- United States

- /

- Metals and Mining

- /

- NasdaqGM:ASTL

A Fresh Look at Algoma Steel Group (NasdaqGM:ASTL) Valuation After Strategic Infrastructure Collaboration and Transformation Moves

Reviewed by Kshitija Bhandaru

Algoma Steel Group (NasdaqGM:ASTL) has drawn renewed attention after announcing a strategic collaboration with TransPod and Supreme Steel on a sustainable, high-speed infrastructure project in Canada. This move highlights Algoma's ongoing business transformation and its role within the industry.

See our latest analysis for Algoma Steel Group.

Recent months have brought a steady flow of news for Algoma Steel Group. The company has secured substantial government-backed loan facilities, delivered the first arc from its new electric arc furnace, and provided updated shipment guidance. However, despite these transformative efforts, the share price return over the past year remains negative, and the one-year total shareholder return stands at -0.66%. This signals that momentum is still subdued as the company navigates operational headwinds and industry pressures.

If you’re keeping an eye on companies making bold moves amid changing market dynamics, now’s a great moment to discover fast growing stocks with high insider ownership

With Algoma’s shares still trading near recent lows despite meaningful transformation initiatives and new growth opportunities, investors may wonder whether the market is overlooking latent value or whether it is fairly factoring in the company’s prospects for recovery and expansion.

Price-to-Sales of 0.2x: Is it justified?

Algoma Steel Group is trading with a price-to-sales ratio of just 0.2x, which is significantly below both its industry peers and the broader market. The last close price of $3.31 reflects this low multiple.

The price-to-sales ratio compares a company's market capitalization to its total revenue, giving investors a sense of how much they are paying for every dollar of sales generated. This metric is especially meaningful for companies in cyclical and capital-intensive sectors like metals and mining, where profitability may swing widely from year to year.

At 0.2x, Algoma's multiple is substantially lower than the US Metals and Mining industry average of 2.9x and its peer average of 5.8x. This suggests that investors may be underpricing the company’s revenue potential. This deep discount also stands in contrast to the estimated fair price-to-sales ratio of 0.3x. This implies that some upward re-rating could occur if market sentiment improves or operations stabilize.

Explore the SWS fair ratio for Algoma Steel Group

Result: Price-to-Sales Ratio of 0.2x (UNDERVALUED)

However, persistent net losses and ongoing share price weakness could challenge the story of recovery and dampen investor enthusiasm in the near term.

Find out about the key risks to this Algoma Steel Group narrative.

Another View: Discounted Cash Flow Perspective

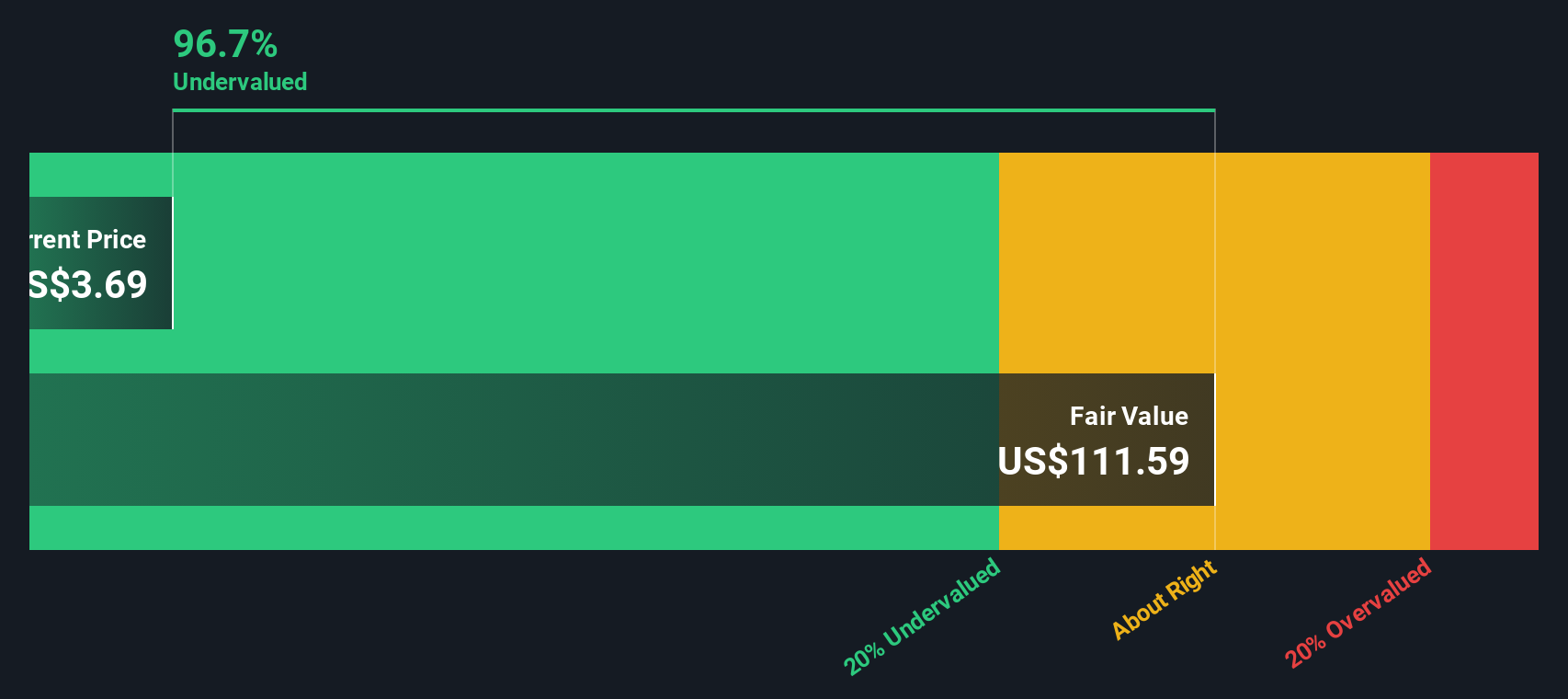

Looking at Algoma Steel Group through the lens of our DCF model provides a strikingly different perspective. The SWS DCF approach estimates a fair value of $101.92 per share, suggesting shares could be drastically undervalued at current levels. Does this disconnect reflect genuine market caution, or is there a major opportunity hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Algoma Steel Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Algoma Steel Group Narrative

If you see the data differently, or want to dig deeper and draw your own conclusions, it only takes a few minutes to build a custom view of Algoma’s outlook. Do it your way.

A great starting point for your Algoma Steel Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip by when you could be ahead of the crowd. Use these powerful tools to pinpoint stocks with standout potential right now:

- Maximize income with attractive yields by targeting these 19 dividend stocks with yields > 3% offering the consistency and reliability savvy investors seek.

- Jump on breakthrough trends at the intersection of healthcare and technology by screening for these 32 healthcare AI stocks, where innovation meets real-world impact.

- Uncover overlooked value by comparing market prices to fundamentals with these 896 undervalued stocks based on cash flows before everyone else catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ASTL

Algoma Steel Group

Produces and sells steel products in Canada, the United States, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives