- United States

- /

- Construction

- /

- NasdaqGM:BWMN

US Growth Companies With Strong Insider Ownership February 2025

Reviewed by Simply Wall St

As the U.S. stock market grapples with mixed performances and recent declines in major indices, investors are increasingly focused on the economic outlook and policy impacts from Washington. In this environment, growth companies with strong insider ownership can offer potential stability and alignment of interests between management and shareholders, making them an intriguing focus for those navigating today's volatile market landscape.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 27.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Astera Labs (NasdaqGS:ALAB) | 16.1% | 61.1% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Enovix (NasdaqGS:ENVX) | 12.6% | 56.0% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 103.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.2% | 33.6% |

Let's uncover some gems from our specialized screener.

ASP Isotopes (NasdaqCM:ASPI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ASP Isotopes Inc. is a development stage advanced materials company that specializes in the production, distribution, marketing, and sale of isotopes with a market cap of $340.53 million.

Operations: ASP Isotopes Inc. currently does not have any reported revenue segments in its business operations.

Insider Ownership: 23.7%

Revenue Growth Forecast: 41.7% p.a.

ASP Isotopes is navigating a complex landscape with its Silicon-28 enrichment facility in South Africa, which positions it to tap into the semiconductor market. Despite the potential for high revenue growth at 41.7% annually, recent legal challenges over alleged misleading statements about its technology could impact investor confidence. The company has signed supply agreements with U.S.-based customers and expects profitability within three years, but past shareholder dilution and volatile share prices present risks.

- Get an in-depth perspective on ASP Isotopes' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, ASP Isotopes' share price might be too optimistic.

ChromaDex (NasdaqCM:CDXC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ChromaDex Corporation is a bioscience company that develops healthy aging products, with a market cap of approximately $414.90 million.

Operations: The company's revenue is derived from three segments: Ingredients ($16.95 million), Consumer Products ($71.72 million), and Analytical Reference Standards and Services ($3.00 million).

Insider Ownership: 30.4%

Revenue Growth Forecast: 18.1% p.a.

ChromaDex is poised for significant growth, with earnings expected to rise 81.8% annually, outpacing the US market's average. The company recently became profitable and is trading at a 31.2% discount to its estimated fair value. Revenue growth of 18.1% per year is anticipated, though it remains below the threshold for high growth classification. Recent events include presentations at key investor summits and a change in auditors to Crowe LLP for fiscal year 2024.

- Take a closer look at ChromaDex's potential here in our earnings growth report.

- The valuation report we've compiled suggests that ChromaDex's current price could be quite moderate.

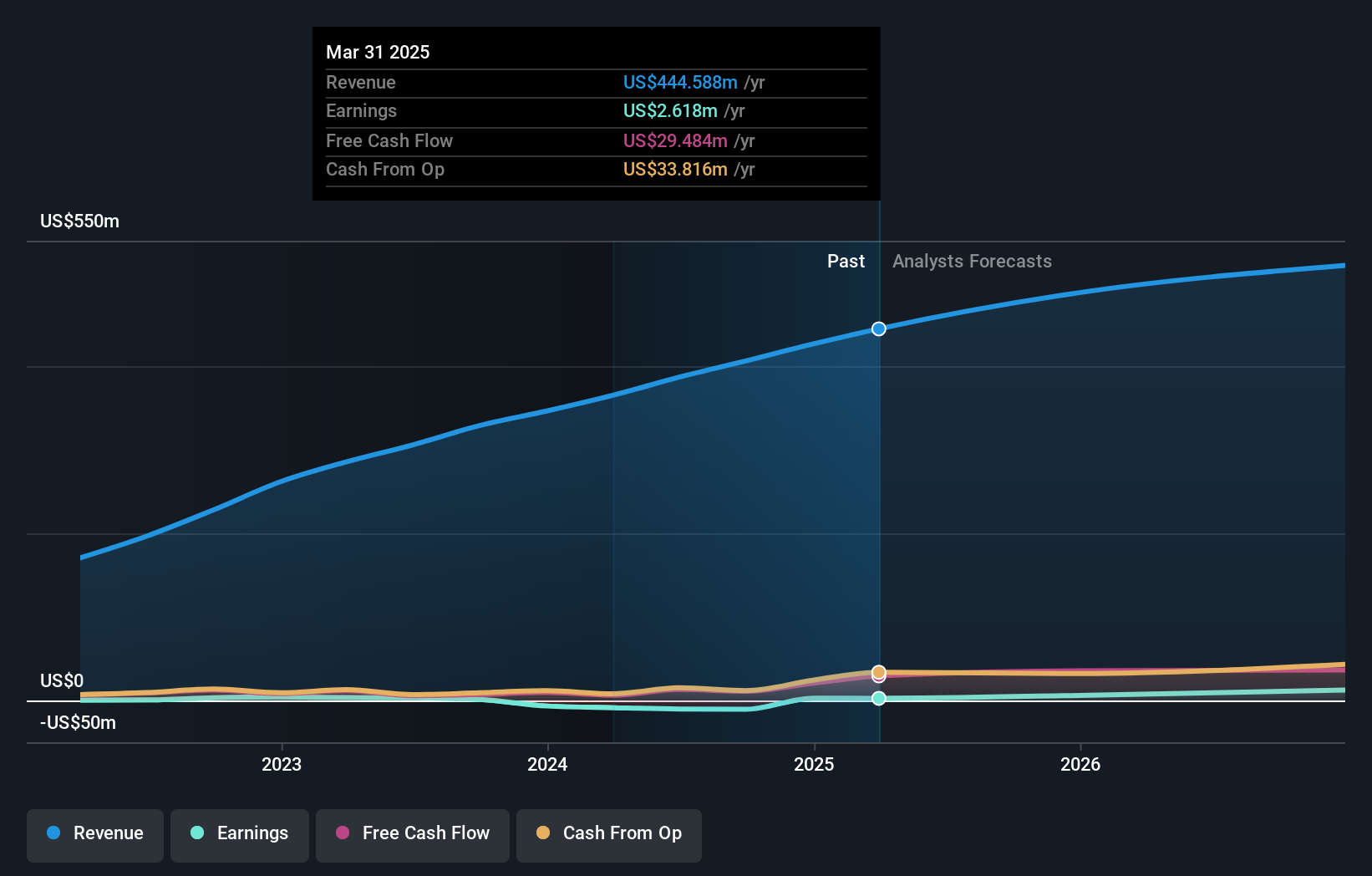

Bowman Consulting Group (NasdaqGM:BWMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bowman Consulting Group Ltd. offers real estate, energy, infrastructure, and environmental management solutions in the United States and has a market cap of approximately $364.27 million.

Operations: The company generates revenue of $406.31 million from providing engineering and related professional services to its customers.

Insider Ownership: 19.3%

Revenue Growth Forecast: 11.4% p.a.

Bowman Consulting Group, with a strong insider ownership profile, is forecasted for significant earnings growth of 128.68% annually and revenue growth of 11.4% per year, surpassing the US market average. Despite past shareholder dilution, it trades at a substantial discount to its fair value and analysts anticipate an 80.2% rise in stock price. Recent contracts include high-profile projects in North Carolina and Oklahoma, enhancing its position in geospatial services and engineering solutions across multiple sectors.

- Click here and access our complete growth analysis report to understand the dynamics of Bowman Consulting Group.

- Insights from our recent valuation report point to the potential undervaluation of Bowman Consulting Group shares in the market.

Where To Now?

- Delve into our full catalog of 197 Fast Growing US Companies With High Insider Ownership here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bowman Consulting Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BWMN

Bowman Consulting Group

Provides engineering, technical, and technology enhanced consulting services in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives