- United States

- /

- Metals and Mining

- /

- NasdaqGM:ACNT

Shareholders in Ascent Industries (NASDAQ:ACNT) have lost 48%, as stock drops 10% this past week

For many, the main point of investing is to generate higher returns than the overall market. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Ascent Industries Co. (NASDAQ:ACNT), since the last five years saw the share price fall 48%. More recently, the share price has dropped a further 17% in a month.

After losing 10% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Ascent Industries

Ascent Industries isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years Ascent Industries saw its revenue shrink by 8.4% per year. That's not what investors generally want to see. The stock hasn't done well for shareholders in the last five years, falling 8%, annualized. But it doesn't surprise given the falling revenue. Without profits, its hard to see how shareholders win if the revenue keeps falling.

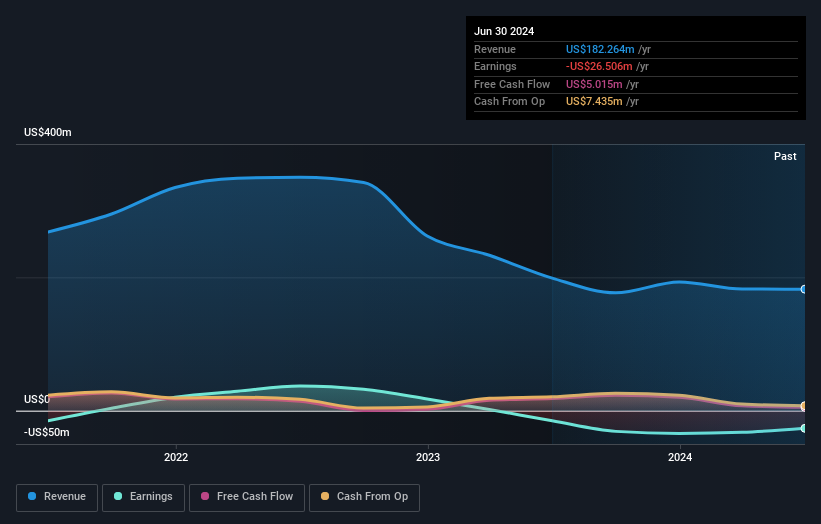

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of Ascent Industries' earnings, revenue and cash flow.

A Different Perspective

Ascent Industries shareholders are down 5.5% for the year, but the market itself is up 33%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 8% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Ascent Industries is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

Ascent Industries is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ACNT

Ascent Industries

An industrials company, produces and distributes stainless steel pipe and tube and specialty chemicals in the United States and internationally.

Flawless balance sheet and slightly overvalued.