- United States

- /

- Insurance

- /

- OTCPK:AFIP.A

AMFI (OTCPK:AFIP.A): Assessing Valuation After Sustained Long-Term Gains and Recent Market Quiet

Reviewed by Kshitija Bhandaru

AMFI (OTCPK:AFIP.A) may not always grab headlines, but its recent moves in the market have investors wondering what the next chapter might hold. There’s no major headline event or explosive news to explain recent activity, and that in itself brings an intriguing question: is the current share price momentum sending a subtle signal, or is it simply business as usual for a company flying under the radar?

Looking at the past few months, AMFI’s share price hasn’t budged—flat over the past week and the past month alike—despite a quiet period with no splashy developments. Yet if you take a step back, a longer-term view shows a dramatic picture. The stock’s total return over the past three years is more than double, up 115%. That kind of steady, sustained performance suggests some quiet confidence building in the background, even if recent weeks have been uneventful on the surface.

So with momentum stalling this year after a long-term climb, is AMFI now trading at a bargain, or is the market already anticipating the company’s next growth phase?

Price-to-Book Ratio: Is it justified?

Based on available valuation data, there is currently insufficient information to determine if AMFI's price-to-book ratio offers a clear signal of under- or overvaluation compared to peers or the broader industry.

The price-to-book ratio measures how a company’s stock price compares to its book value, an important benchmark for insurers. It helps investors gauge whether the stock is priced attractively relative to its underlying assets. This is especially relevant in asset-heavy industries such as insurance.

With no figures reported for the price-to-book multiple, investors cannot determine if the current market price offers a bargain or if it is simply reflecting fair value for the company’s fundamentals.

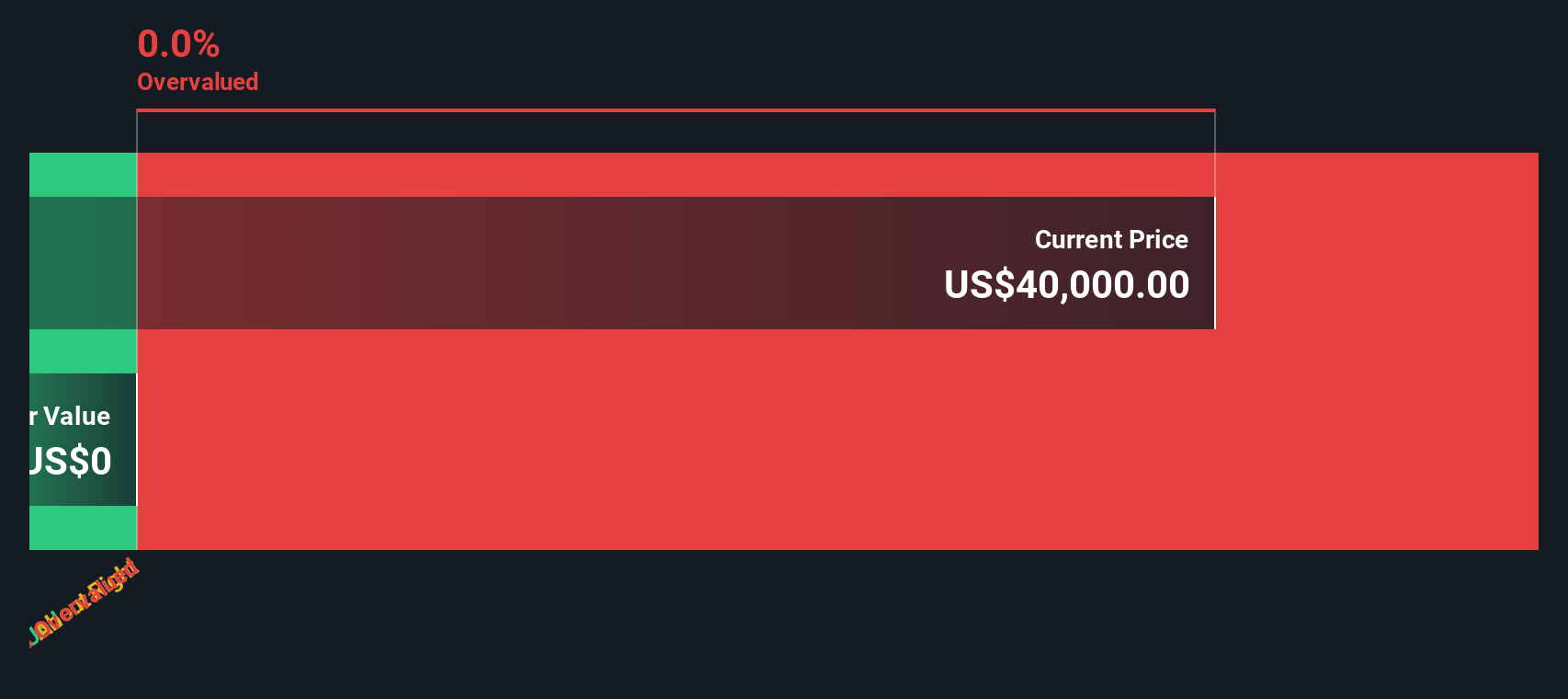

Result: Fair Value of $40,000 (ABOUT RIGHT)

See our latest analysis for AMFI.However, limited financial disclosure and the absence of recent growth figures remain key risks. These factors could quickly alter market sentiment toward AMFI.

Find out about the key risks to this AMFI narrative.Another View: What Does Our DCF Model Say?

Taking a step back from asset-based benchmarks, the SWS DCF model also attempts to value AMFI, but finds the same result due to the absence of available cash flow data. Both methods are left inconclusive. Does this underlying uncertainty hide untapped value, or reinforce market caution?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own AMFI Narrative

If this assessment doesn’t quite fit your view or you’d rather dig through the numbers yourself, you can put together your own outlook in just a few minutes. Do it your way.

A great starting point for your AMFI research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You could be missing out on tomorrow’s winners if you focus on only one stock. Take the next step and discover fresh opportunities with these powerful hand-picked ideas below.

- Grow your income by searching for companies offering stable, attractive payouts when you scan for dividend stocks with yields > 3%.

- Spot emerging breakthroughs in automation, robotics, and smart technology by exploring the world of AI penny stocks.

- Supercharge your portfolio with hidden gems trading below their true worth by looking into undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:AFIP.A

AMFI

AMFI Corp., through its subsidiary, American Fidelity Life Insurance Company, provides life insurance products.

Weak fundamentals or lack of information.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion