- United States

- /

- Insurance

- /

- NYSE:WTM

If You Like EPS Growth Then Check Out White Mountains Insurance Group (NYSE:WTM) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like White Mountains Insurance Group (NYSE:WTM). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for White Mountains Insurance Group

How Fast Is White Mountains Insurance Group Growing Its Earnings Per Share?

In the last three years White Mountains Insurance Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a falcon taking flight, White Mountains Insurance Group's EPS soared from US$68.11 to US$89.68, over the last year. That's a impressive gain of 32%.

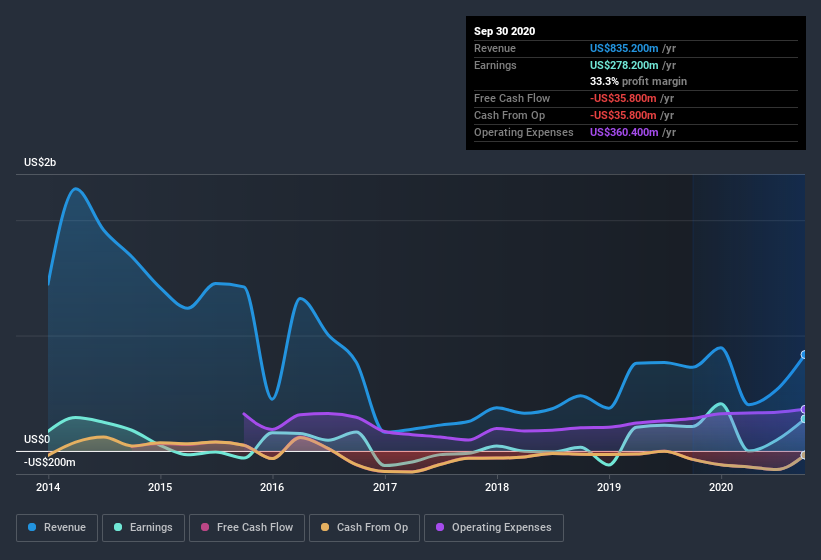

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of White Mountains Insurance Group's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. The good news is that White Mountains Insurance Group is growing revenues, and EBIT margins improved by 13.3 percentage points to 44%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are White Mountains Insurance Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

While we did see insider selling of White Mountains Insurance Group stock in the last year, one single insider spent plenty more buying. Specifically the Independent Non-Executive Chairman, Morgan Davis, spent US$795k, paying about US$758 per share. That certainly pricks my ears up.

The good news, alongside the insider buying, for White Mountains Insurance Group bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a small fortune of shares, currently valued at US$78m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

Is White Mountains Insurance Group Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about White Mountains Insurance Group's strong EPS growth. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if White Mountains Insurance Group is trading on a high P/E or a low P/E, relative to its industry.

As a growth investor I do like to see insider buying. But White Mountains Insurance Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade White Mountains Insurance Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if White Mountains Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:WTM

White Mountains Insurance Group

Through its subsidiaries, provides insurance and other financial services in the United States.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives