- United States

- /

- Insurance

- /

- NYSE:WRB

W. R. Berkley (WRB): Valuation Insight After Surge in Premium Growth and Capital Actions

Reviewed by Kshitija Bhandaru

If you’re holding or eyeing W. R. Berkley (WRB), this latest round of upbeat headlines probably has you weighing your next move. The company’s recent surge in premium growth and decisive capital moves, such as share buybacks, are in sharp focus, especially as the insurance sector enjoys tailwinds from better pricing and underwriting discipline. With profitability and book value expected to accelerate on the back of these factors, there is a sense in the air that W. R. Berkley’s management is steering ahead of competitors, and investors are starting to notice.

The stock has tracked upward momentum, with a 37% gain over the past year and more than doubling over the last five years. While industry optimism has supported insurance shares overall, W. R. Berkley’s focus on market share gains and operational improvement has set it apart. The company’s rally this year suggests that the market is factoring in those premium growth rates and forecasts for even stronger financials ahead, but it is not clear if further upside is already built into today’s price.

So, with all this in mind, is W. R. Berkley now trading at an attractive entry point, or have investors already priced in years of future growth?

Most Popular Narrative: 4.3% Overvalued

According to the most closely followed narrative, W. R. Berkley is considered slightly overvalued, with a fair value estimate coming in just below the current share price. Market optimism has pushed valuations upward, but the consensus suggests that the stock price now exceeds the average projected fair value.

"Digital transformation and the rise of technology-driven exposures (e.g., cyber, tech E&O) are prompting clients to seek innovative products, providing high-margin growth opportunities that W. R. Berkley, with its specialty focus and decentralized, agile underwriting model, is well-positioned to capture. This supports future earnings."

What’s the real story behind W. R. Berkley’s lofty price? Analysts are relying on a surprisingly bold set of profit forecasts and future multiples to justify that target. Want to know the underlying earnings momentum and the valuation logic that could keep the stock riding high or send it lower? The key calculation could upend how you see this specialty insurer’s growth potential.

Result: Fair Value of $72.73 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, increased competition or persistent inflation could put pressure on underwriting profitability and challenge W. R. Berkley’s ability to meet optimistic growth expectations.

Find out about the key risks to this W. R. Berkley narrative.Another View: The SWS DCF Model Sees it Differently

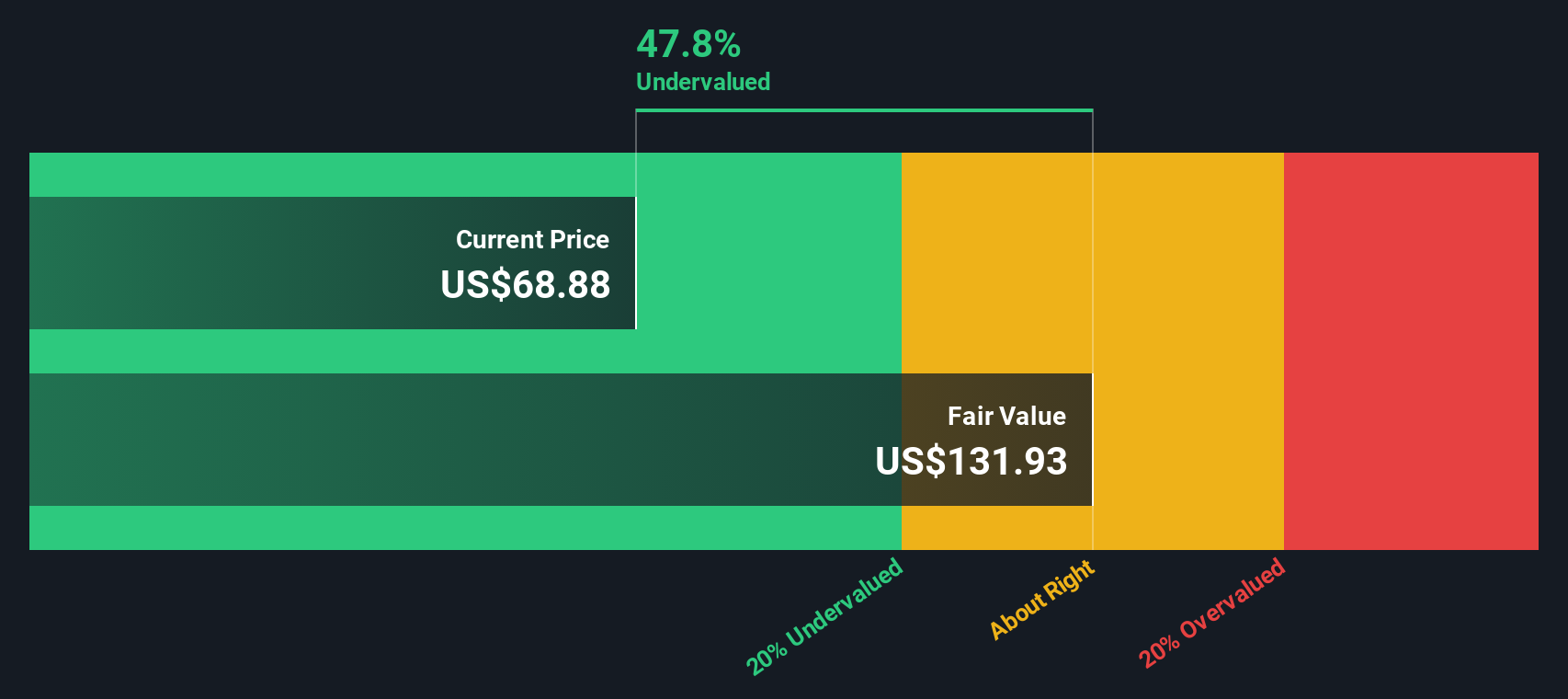

While the analyst consensus suggests W. R. Berkley may be trading above its fair value, our SWS DCF model takes a more optimistic stance and flags the stock as undervalued. Can a cash flow-based view reveal something that multiples might miss?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own W. R. Berkley Narrative

If you see things differently or want to dig into the data yourself, you can quickly analyze and shape your own view in just a few minutes, and Do it your way.

A great starting point for your W. R. Berkley research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their options open. Don’t let the momentum pass you by. There are other unique opportunities you can act on right now with the Simply Wall Street Screener:

- Start earning reliable income by locking in dividend stocks with yields over 3% through dividend stocks with yields > 3%.

- Tap into the AI revolution before others catch on by targeting AI-driven companies blazing a trail in innovation via AI penny stocks.

- Seize your next bargain by finding stocks that look undervalued based on real cash flows using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W. R. Berkley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRB

W. R. Berkley

An insurance holding company, operates as a commercial line writer worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives