- United States

- /

- Insurance

- /

- NYSE:UNM

Should Investors Reassess Unum After Five Year Gain and Recent Steady Performance?

Reviewed by Bailey Pemberton

If you're trying to figure out your next move with Unum Group stock, you're not alone. This insurance provider has been catching the attention of both cautious investors and bold opportunists, especially as its price action has sent some interesting signals lately. While Unum Group’s share price closed recently at $75.46, it's the bigger picture that really gets people talking: a stellar 21.4% gain over the past year, a massive 88.4% over three years, and a jaw-dropping 349.8% over five years. Even after all that growth, the company has managed an even performance in the last month, inching up just 0.5%, and staying relatively steady this year with a 3.5% bump. Do these numbers hint at more growth ahead or a period of consolidation?

Much of Unum’s recent moves can be linked to ongoing shifts in the insurance sector, as investors reassess risk and see the value in stable cash flow providers amid changing market winds. What is truly remarkable, though, is that by standard measures, Unum Group still comes out looking like a bargain. On a six-point valuation score, where a point is earned for each sign of undervaluation, Unum Group checks all six boxes, giving it a flawless 6 out of 6. So, is this a signal that the market is overlooking serious value, or is there more beneath the surface?

In the next section, we will break down exactly what goes into those six valuation checks, how each method views Unum Group, and why investors who dig deeper may find an even more nuanced, and potentially rewarding, way to look at valuation than what standard metrics reveal.

Approach 1: Unum Group Excess Returns Analysis

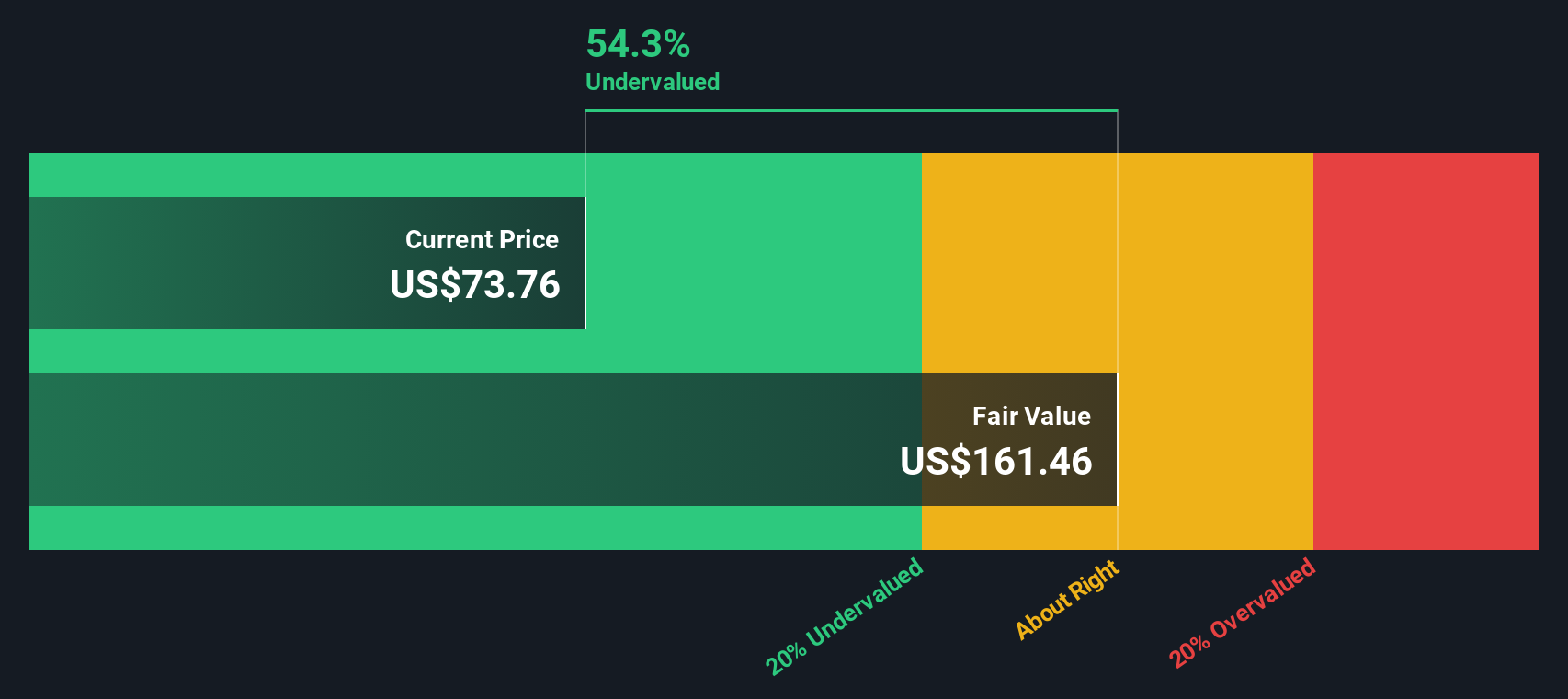

The Excess Returns model takes a close look at how much additional value a company generates for shareholders above its cost of equity, spotlighting both return on invested capital and future growth outlook. In Unum Group’s case, the numbers are impressive. The company’s current Book Value is $65.76 per share, while analysts forecast a Stable Book Value of $74.38 per share. Stable earnings per share (EPS) are estimated at $8.53, based on consensus return on equity projections from four analysts. The average Return on Equity stands at a strong 11.47%.

Against this, Unum's Cost of Equity is $5.10 per share. This means it generates an Excess Return of $3.43 per share, indicating that Unum’s capital is working efficiently. The methodology here compares these generated excess returns to the cost of capital, providing an intrinsic value estimate. The model outputs an intrinsic value of $165.08 per share. With shares currently trading at $75.46, this implies the stock is trading at a remarkable 54.3% discount to its estimated true value. That kind of margin is hard to ignore.

Result: UNDERVALUED

Our Excess Returns analysis suggests Unum Group is undervalued by 54.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Unum Group Price vs Earnings

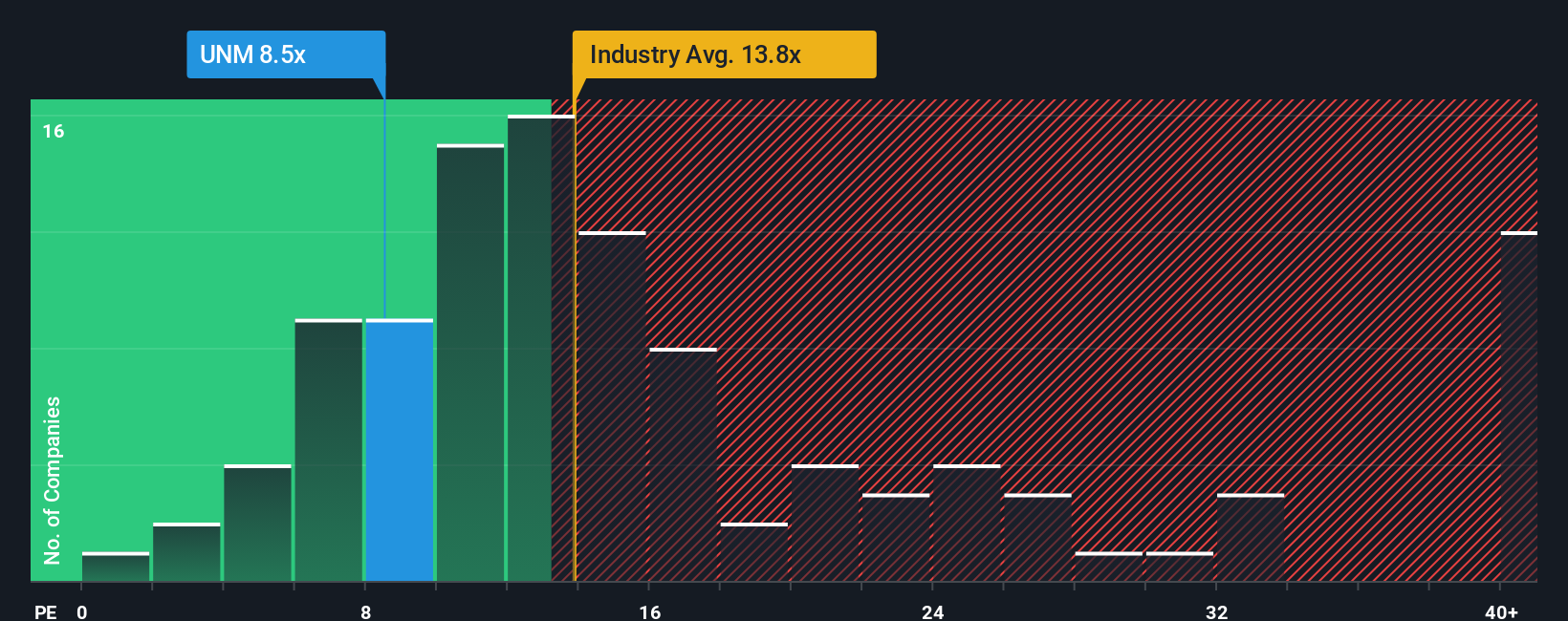

When evaluating profitable companies like Unum Group, the Price-to-Earnings (PE) ratio is often the go-to valuation metric for investors. It offers a clear look at how much investors are willing to pay for each dollar of current earnings. This is particularly meaningful when those earnings are robust and consistent. A company growing steadily with manageable risks will naturally command a higher PE ratio. Those with less certain outlooks or significant challenges typically draw more conservative valuations.

Unum Group currently trades at a PE ratio of 8.5x. This stands out against the Insurance industry average of 13.2x and a peer group average of 13.7x, making Unum look inexpensive on a simple comparison basis. However, headline numbers never tell the whole story. Simply Wall St’s Fair Ratio provides a more nuanced perspective by factoring in elements like Unum’s earnings growth outlook, its profit margins, market cap, and specific risk profile. This delivers a tailored benchmark rather than just an industry snapshot.

For Unum Group, the Fair Ratio is calculated at 12.2x. Since this is notably above the company’s actual PE of 8.5x, it suggests the stock remains undervalued even when accounting for its unique business and risk features, not just its sector. This deeper comparison signals meaningful discount potential for investors willing to look past surface-level metrics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Unum Group Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story about a company. It is how you connect what you believe about Unum Group’s market position, opportunities, and risks to your numbers for future revenue, earnings, and ultimately, fair value.

On Simply Wall St’s Community page, millions of investors are already creating Narratives to link a company’s long-term story to financial forecasts and target prices. Narratives make investing more intuitive, letting you combine the “why” with the “how much,” and helping you decide if Unum Group’s current share price represents an opportunity or caution signal based on your assumptions.

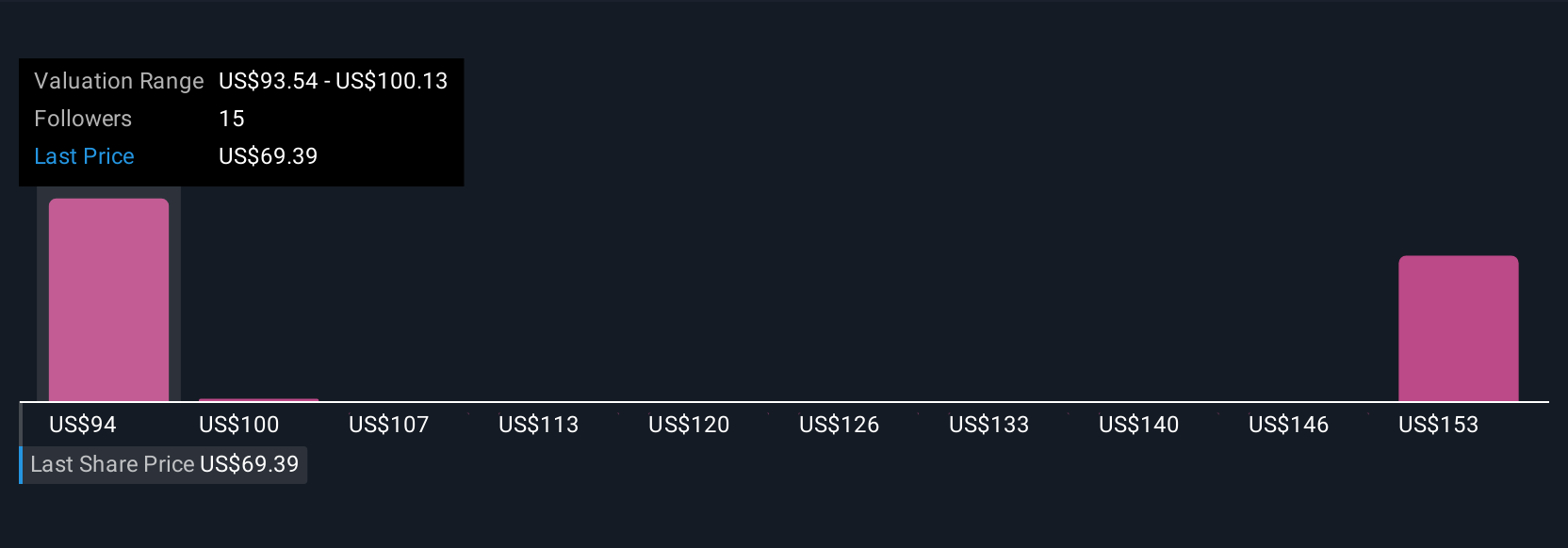

These Narratives update automatically with new developments, whether it is fresh earnings, news, or industry shifts, so your investment view stays relevant and data-driven. For example, the highest fair value for Unum Group among recent Narratives is $108.00 due to optimism around digital expansion and demographic tailwinds, while the lowest is $79.00, reflecting caution around margin pressures and industry competition.

By using Narratives, you can clearly see where your views diverge from the crowd, deepen your research, and decide precisely when Unum Group’s price aligns with your chosen vision for its future.

Do you think there's more to the story for Unum Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNM

Unum Group

Provides financial protection benefit solutions in the United States, the United Kingdom, and Poland.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives