- United States

- /

- Insurance

- /

- NYSE:TRV

It's A Story Of Risk Vs Reward With The Travelers Companies, Inc. (NYSE:TRV)

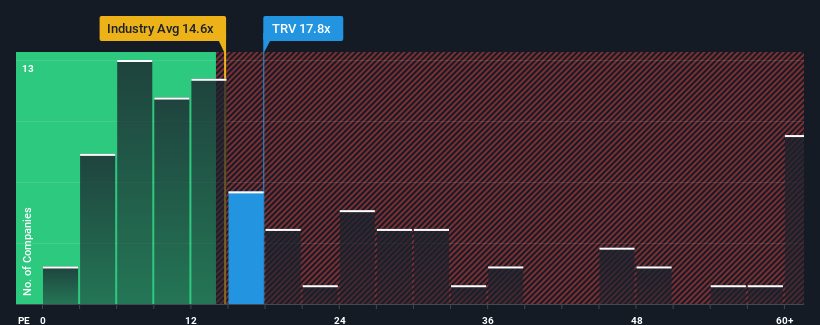

It's not a stretch to say that The Travelers Companies, Inc.'s (NYSE:TRV) price-to-earnings (or "P/E") ratio of 17.8x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Travelers Companies has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Travelers Companies

How Is Travelers Companies' Growth Trending?

In order to justify its P/E ratio, Travelers Companies would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a worthy increase of 8.6%. EPS has also lifted 23% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 22% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 10% per annum, which is noticeably less attractive.

In light of this, it's curious that Travelers Companies' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Travelers Companies' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Travelers Companies' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Travelers Companies that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Travelers Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TRV

Travelers Companies

Through its subsidiaries, provides a range of commercial and personal property, and casualty insurance products and services to businesses, government units, associations, and individuals in the United States and internationally.

Solid track record established dividend payer.