- United States

- /

- Insurance

- /

- NYSE:THG

Is Hanover Insurance Group’s Rally Justified After Strong First Quarter Earnings Growth?

Reviewed by Bailey Pemberton

If you’re standing at a crossroads deciding what to do with Hanover Insurance Group stock, you’re not alone. The stock has been showing some serious momentum this year, drawing investors’ attention with a steady climb and sparking plenty of conversation around growth prospects. In the past five years, the stock has more than doubled, returning 115.5%, while 2024 alone has already brought an impressive 20.5% gain. Even in the last month, Hanover added 3.6%, suggesting that recent shifts in the insurance sector and ongoing confidence in broader financials are fueling optimism.

But with share prices recently closing at $183.75 and momentum running strong over both the short and long term, the big question is, are investors getting good value here or are things starting to look a little stretched? The company scores a solid 5 out of 6 on our valuation checks, signaling that by most standard measures, Hanover might still be undervalued despite its run-up.

So how do we really know what the right price is? Over the next sections, we will break down the most popular valuation approaches and see where Hanover shines. As a bonus, there is one method many investors leave out that can offer the clearest view of all, so stay tuned for that at the end.

Approach 1: Hanover Insurance Group Excess Returns Analysis

The Excess Returns model evaluates a company's ability to generate profits above the minimum required by its investors, focusing on return on equity compared to the cost of that equity. It is a solid method for financial firms like Hanover Insurance Group, where capital allocation is key.

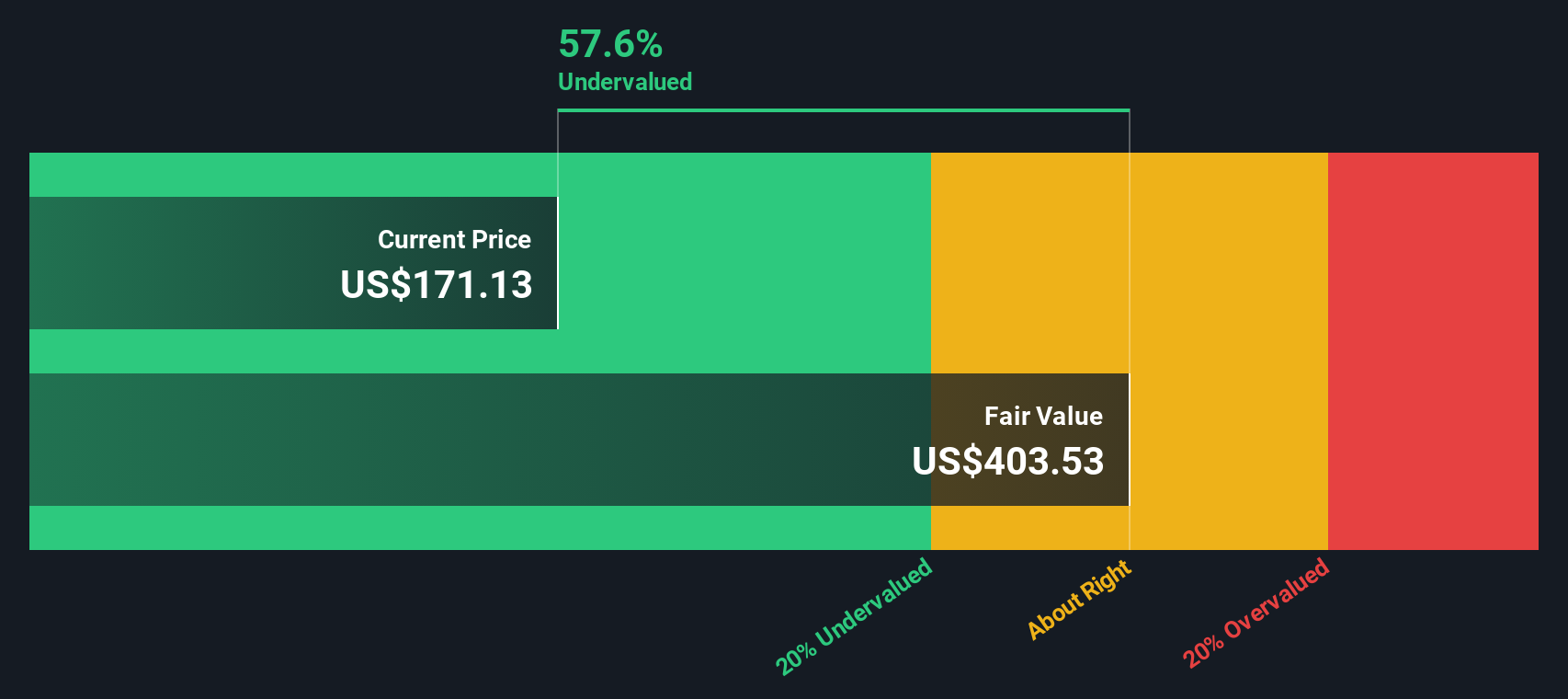

For Hanover Insurance Group, the numbers are striking. The company has a Book Value of $89.59 per share, while its forecasted stable EPS stands at $18.29 per share, based on weighted future Return on Equity estimates from six analysts. Its Cost of Equity is $7.09 per share, giving it an impressive Excess Return of $11.20 per share and reflecting a strong Average Return on Equity of 17.49%. Looking forward, the Stable Book Value is set at $104.56 per share, as projected by five analysts.

According to this model, Hanover's estimated intrinsic value is $407.64 per share. With the current share price at $183.75, this implies the stock is 54.9% undervalued by this approach. The data suggests that Hanover Insurance Group is producing consistently strong returns well above its cost of equity, supporting both near and long-term growth potential.

Result: UNDERVALUED

Our Excess Returns analysis suggests Hanover Insurance Group is undervalued by 54.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Hanover Insurance Group Price vs Earnings

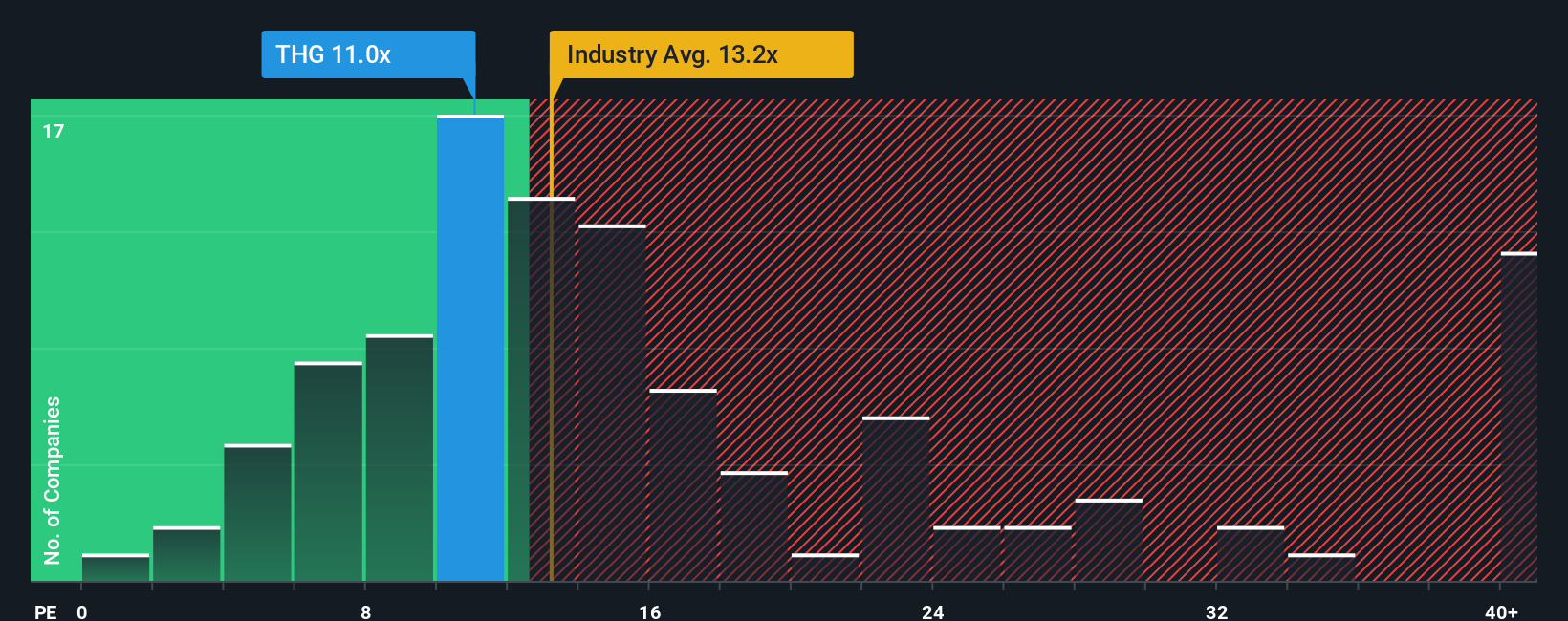

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Hanover Insurance Group. It helps investors understand how much they are paying for each dollar of the company’s earnings, making it especially relevant when those earnings are stable and growing. The PE ratio also reflects market expectations for growth and incorporates perceived risks, with higher growth or lower risk often leading to a higher “fair” PE.

Currently, Hanover Insurance Group trades at a PE ratio of 11.85x. This is well below the industry average of 14.23x and the peer average of 18.79x. This suggests the stock could be undervalued relative to its immediate competitors and the broader insurance sector. However, such direct comparisons can sometimes be misleading, as they do not always consider differences in growth prospects, profit margins, or company-specific risk profiles.

This is where Simply Wall St’s proprietary “Fair Ratio” comes into play. The Fair Ratio for Hanover is 12.35x, calculated using factors such as the company’s earnings growth outlook, profit margins, industry trends, and its overall size and risk exposure. Unlike simple peer or industry comparisons, the Fair Ratio aims to capture the nuances in a company’s fundamentals. Hanover’s current PE ratio of 11.85x is just slightly below its Fair Ratio of 12.35x, indicating the shares are priced about right given their fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hanover Insurance Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative goes beyond the numbers by giving you a story behind your expectations for a company, letting you explain the reasoning, assumptions, and outlook that shape your own view of its fair value, such as your forecasts for future revenue, earnings, and profit margins.

This approach links the company’s story to a financial forecast and then to a fair value, empowering you to make investment decisions that reflect both the data and your own insights. Narratives are practical and accessible on the Simply Wall St platform, where millions of investors use the Community page to discuss, compare, and update their perspectives in real time. They are especially helpful because they show how your fair value stacks up against the current share price, making it easier to decide when to buy or sell.

Best of all, Narratives are dynamic. Whenever key facts change, from new earnings to breaking news, your Narrative can be updated, keeping your fair value estimate relevant and responsive. For Hanover Insurance Group, for example, investors with the most optimistic outlook see a fair value at $197 per share, while more cautious perspectives put it as low as $179.30, showing just how insightfully Narratives capture different investor views.

Do you think there's more to the story for Hanover Insurance Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanover Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THG

Hanover Insurance Group

Through its subsidiaries, provides various property and casualty insurance products and services in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives