- United States

- /

- Insurance

- /

- NYSE:STC

Undiscovered Gems in the US Market for July 2025

Reviewed by Simply Wall St

The United States market has shown robust performance, rising 1.8% over the last week and climbing 14% in the past year, with earnings projected to grow by 15% annually. In this thriving environment, identifying lesser-known stocks that exhibit strong fundamentals and potential for growth can offer unique opportunities for investors seeking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Andersons (ANDE)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Andersons, Inc. operates in trade, renewables, and nutrient and industrial sectors across various countries including the United States, Canada, Mexico, Egypt, and Switzerland with a market cap of approximately $1.30 billion.

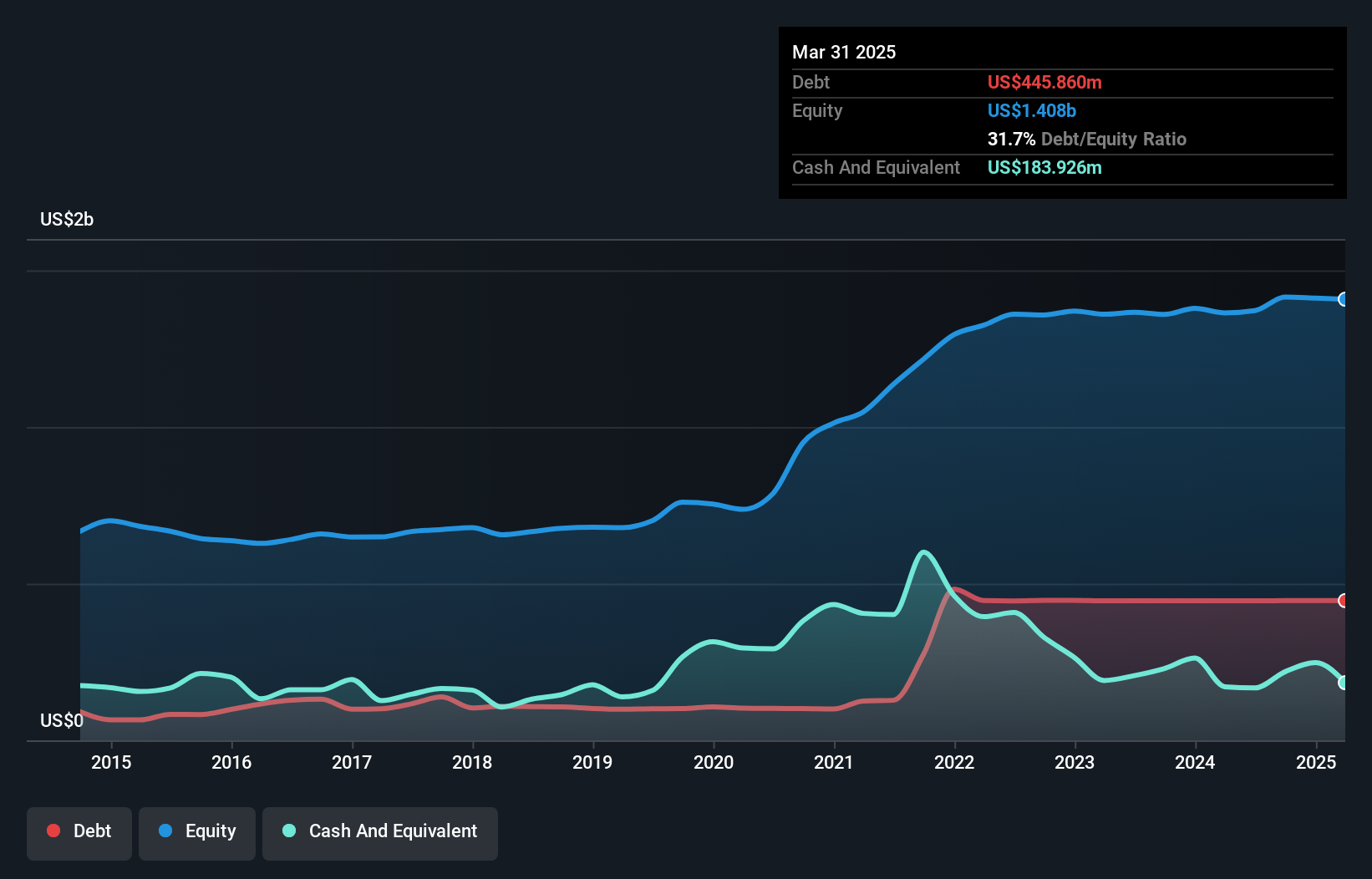

Operations: The company generates significant revenue from its renewables segment, amounting to $2.81 billion.

Andersons, a smaller player in the agricultural supply chain, is making strategic moves with its Skyland Grain expansion and renewable investments to strengthen its North American presence. Despite a high net debt to equity ratio of 40.7%, the company has managed to reduce this from 134.1% over five years, showcasing financial discipline. The interest payments are well covered by EBIT at 9.6 times, reflecting solid operational performance amidst challenges like fluctuating grain prices and regulatory hurdles. Recently dropped from several Russell indices, Andersons still offers value with a price-to-earnings ratio of 12x against the US market's 18.8x average.

Build-A-Bear Workshop (BBW)

Simply Wall St Value Rating: ★★★★★★

Overview: Build-A-Bear Workshop, Inc. is a multi-channel retailer specializing in plush animals and related products with operations in the United States, Canada, the United Kingdom, Ireland, and internationally; it has a market cap of $701.62 million.

Operations: Revenue is primarily derived from the Direct-To-Consumer segment at $472.05 million, followed by Commercial at $33.03 million, and International Franchising contributing $5 million.

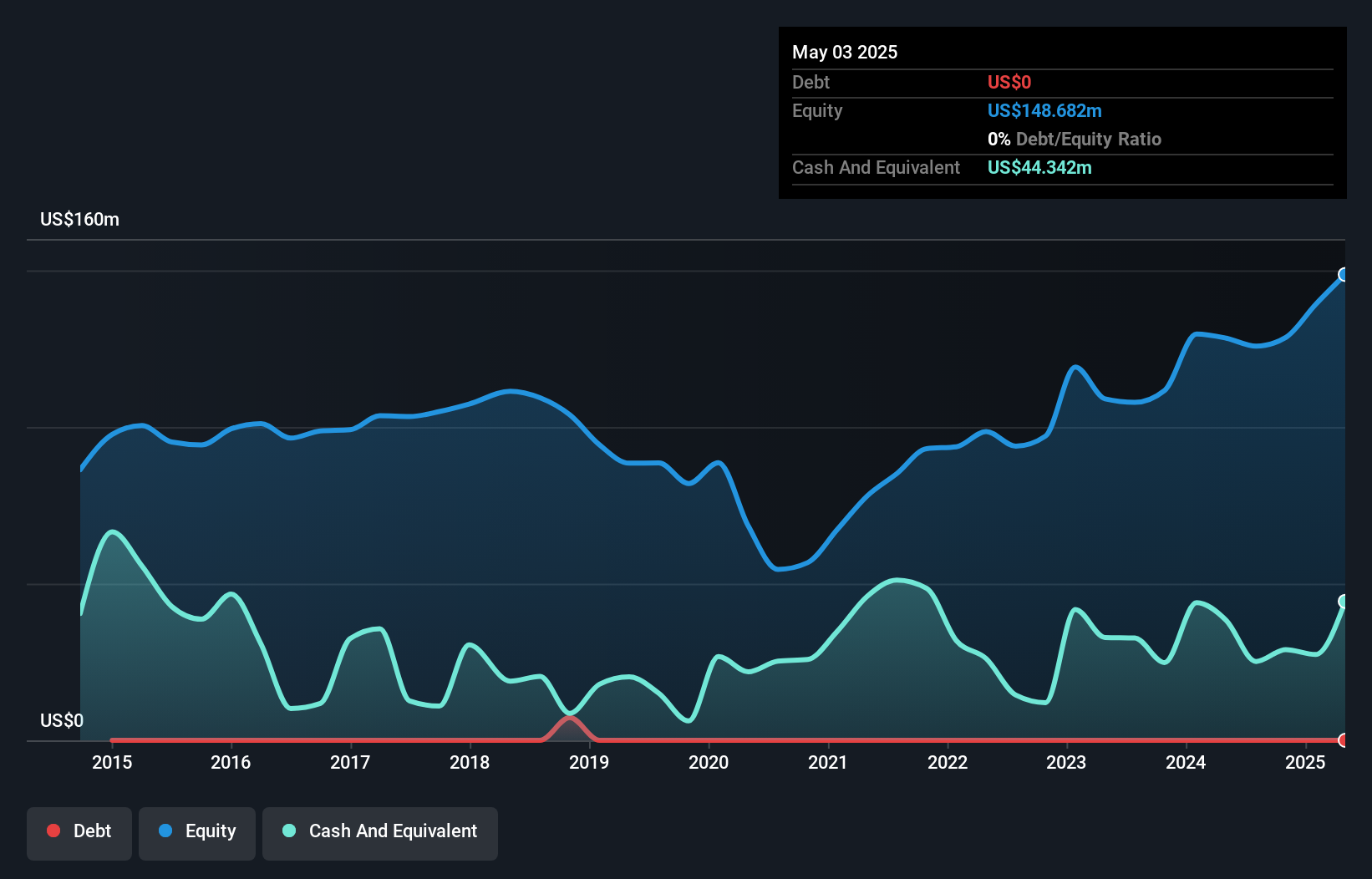

Build-A-Bear Workshop is making waves with its strategic focus on international expansion and digital transformation, aiming to open at least 50 new partner-operated stores this year. The company's earnings grew by 12% over the past year, outpacing the Specialty Retail industry. Trading at US$34.91, it is considered undervalued by 22.6% compared to its estimated fair value. Despite significant insider selling in recent months, Build-A-Bear remains debt-free and generates positive free cash flow of US$46 million as of early February 2024. Recent share repurchases amounted to 2.83%, reflecting confidence in future prospects despite inflationary challenges ahead.

Stewart Information Services (STC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Stewart Information Services Corporation operates through its subsidiaries to offer title insurance and real estate transaction-related services both in the United States and internationally, with a market capitalization of approximately $1.87 billion.

Operations: Stewart Information Services generates revenue primarily from its Title segment, including mortgage services, which accounts for $2.18 billion, and Real Estate Solutions, contributing $372.74 million. The company's financial performance is influenced by these revenue streams and associated costs.

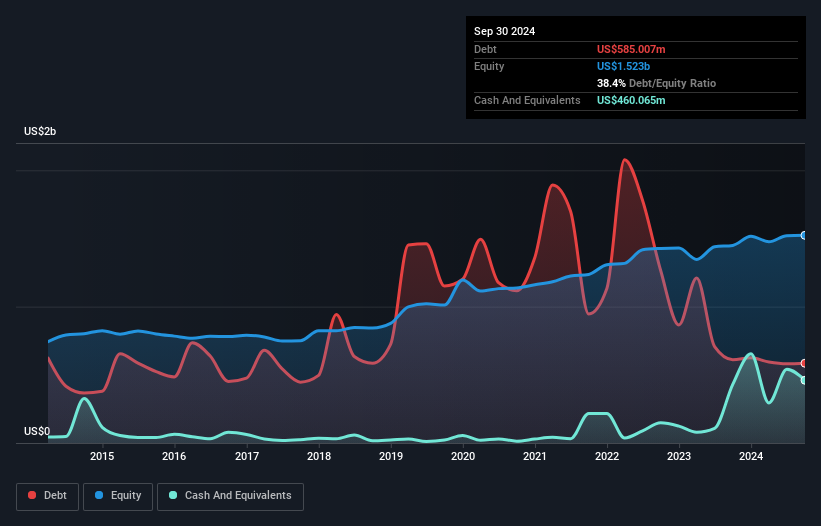

Stewart Information Services, a relatively smaller player in the insurance industry, has shown impressive growth with earnings surging 75% last year, outpacing the industry average of 7%. The company maintains a satisfactory net debt to equity ratio at 18.6%, indicating solid financial health. With EBIT covering interest payments by 6.7 times, Stewart's financial stability is evident. Recent news highlights their focus on acquisitions to bolster growth in targeted MSAs and agency services expansion. A quarterly dividend of $0.50 per share was affirmed recently, reflecting confidence in its cash flow generation capabilities amidst market uncertainties.

Taking Advantage

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 279 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STC

Stewart Information Services

Through its subsidiaries, provides title insurance and real estate transaction related services in the United States and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives