- United States

- /

- IT

- /

- NasdaqGS:APLD

3 Growth Companies With High Insider Ownership And Up To 37% Revenue Growth

Reviewed by Simply Wall St

The market has climbed by 2.0% over the past week, with every sector up, contributing to a 12% increase over the last 12 months. In this context of overall growth and an optimistic forecast for earnings to grow by 14% annually, companies that exhibit both substantial revenue growth and high insider ownership can be particularly appealing for investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 22.7% | 24.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 16.2% | 39.1% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| FTC Solar (NasdaqCM:FTCI) | 27.9% | 62.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.1% | 44.4% |

| Enovix (NasdaqGS:ENVX) | 12.1% | 58.4% |

| BBB Foods (NYSE:TBBB) | 12.9% | 30.2% |

| OS Therapies (NYSEAM:OSTX) | 23.2% | 67.2% |

| Zapp Electric Vehicles Group (OTCPK:ZAPP.F) | 16.1% | 120.2% |

Here's a peek at a few of the choices from the screener.

Applied Digital (NasdaqGS:APLD)

Simply Wall St Growth Rating: ★★★★★☆

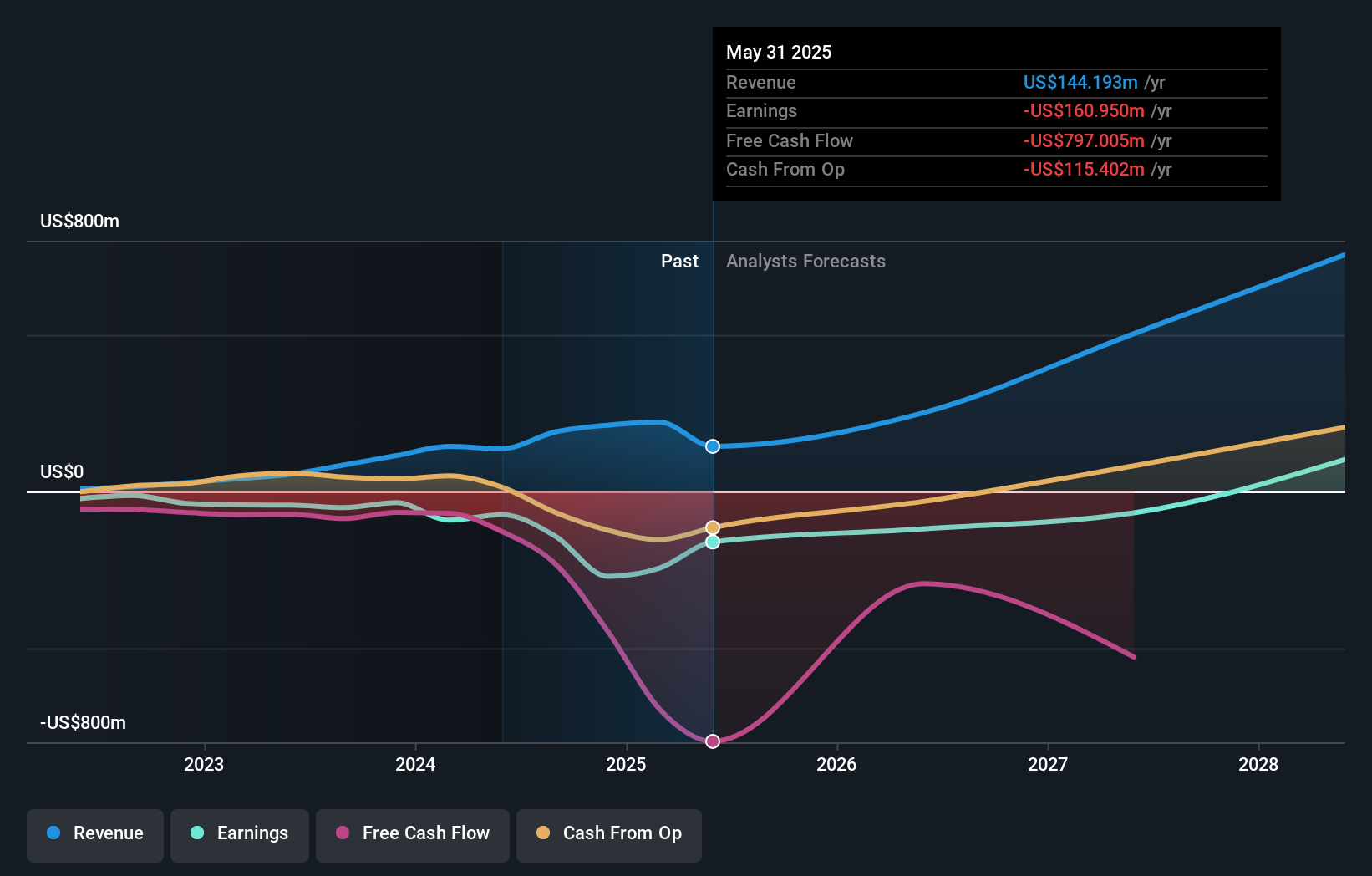

Overview: Applied Digital Corporation designs, develops, and operates digital infrastructure solutions and cloud services for high-performance computing and artificial intelligence industries in North America, with a market cap of approximately $1.53 billion.

Operations: The company's revenue is derived from two main segments: Cloud Services, contributing $88.11 million, and Datacenter Hosting, generating $133.08 million.

Insider Ownership: 10%

Revenue Growth Forecast: 37.4% p.a.

Applied Digital is poised for significant growth with its revenue forecast to increase by 37.4% annually, outpacing the US market. The company recently secured two 15-year lease agreements with CoreWeave, projected to generate approximately US$7 billion in revenue. Despite past shareholder dilution and a volatile share price, Applied Digital's strategic positioning in AI and HPC infrastructure development at its Ellendale campus highlights its potential as an emerging leader in the data center ecosystem.

- Click here and access our complete growth analysis report to understand the dynamics of Applied Digital.

- The valuation report we've compiled suggests that Applied Digital's current price could be inflated.

Super Micro Computer (NasdaqGS:SMCI)

Simply Wall St Growth Rating: ★★★★★★

Overview: Super Micro Computer, Inc. develops and sells high-performance server and storage solutions based on modular and open architecture across the United States, Europe, Asia, and internationally, with a market cap of approximately $23.88 billion.

Operations: The company generates revenue of $21.57 billion from developing and providing high-performance server solutions based on modular and open architecture across various regions including the United States, Europe, and Asia.

Insider Ownership: 16.2%

Revenue Growth Forecast: 26.4% p.a.

Super Micro Computer is positioned for robust growth, with earnings expected to rise significantly at 39.1% annually, surpassing the US market's average. Recent strategic partnerships, including collaborations with Digi Power X and DataVolt, highlight its expansion in AI and data center solutions. Despite a volatile share price and reduced profit margins compared to last year, Supermicro's revenue is forecast to grow rapidly at 26.4% per year, reflecting its strong market potential in high-performance computing infrastructure.

- Navigate through the intricacies of Super Micro Computer with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Super Micro Computer's share price might be on the cheaper side.

Ryan Specialty Holdings (NYSE:RYAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ryan Specialty Holdings, Inc. provides specialty products and solutions for insurance brokers, agents, and carriers across multiple regions including the United States, Canada, the United Kingdom, Europe, India, and Singapore with a market cap of $18.78 billion.

Operations: Ryan Specialty Holdings generates $2.59 billion in revenue from its insurance brokers segment.

Insider Ownership: 15.5%

Revenue Growth Forecast: 16.7% p.a.

Ryan Specialty Holdings is poised for substantial growth, with earnings projected to increase significantly at 91% annually, outpacing the US market. Despite a recent net loss of US$4.39 million in Q1 2025, revenue grew to US$690.17 million from the previous year. The company maintains its organic revenue growth outlook between 11-13% for 2025 and continues exploring M&A opportunities despite high leverage levels, supported by strong free cash flow and balance sheet flexibility.

- Get an in-depth perspective on Ryan Specialty Holdings' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Ryan Specialty Holdings implies its share price may be too high.

Summing It All Up

- Discover the full array of 191 Fast Growing US Companies With High Insider Ownership right here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APLD

Applied Digital

Designs, develops, and operates digital infrastructure solutions to high-performance computing (HPC) and artificial intelligence industries in North America.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives