- United States

- /

- Insurance

- /

- NYSE:RLI

RLI (RLI) Profit Margin Decline Reinforces Cautious Investor Narrative This Earnings Season

Reviewed by Simply Wall St

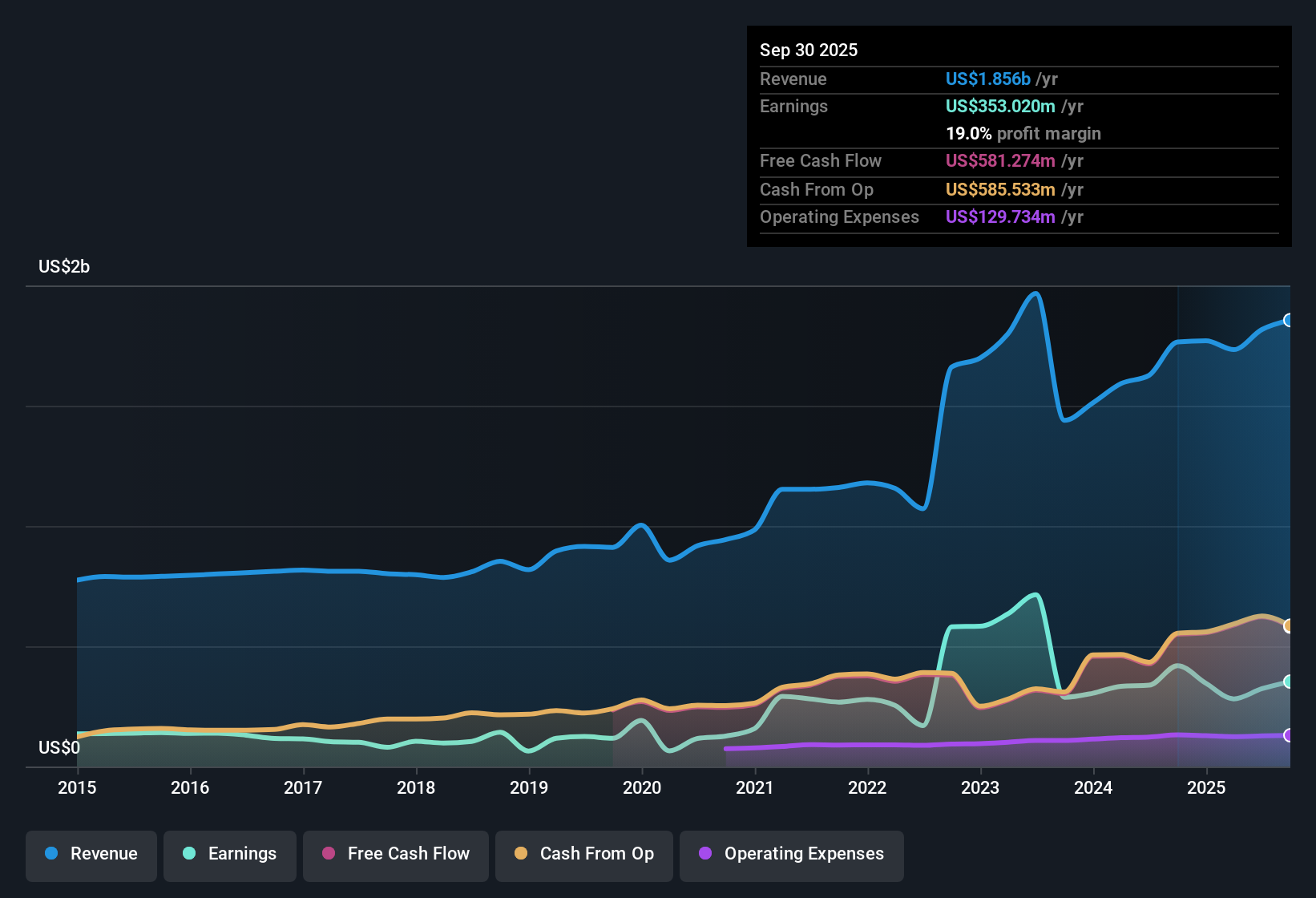

RLI (RLI) reported net profit margins of 19% for the current period, down from 23.8% a year earlier, highlighting a year-over-year drop in profitability. Earnings have grown at an average of 8.3% annually over the past five years, but the company just logged negative earnings growth and projects a further annual decline of 7.1% over the next three years. With revenue expected to inch up by only 0.8% per year, trailing far behind the broader US market’s 10.1% forecast, investors face an environment where profitability pressures look likely to persist.

See our full analysis for RLI.Now, let’s see how these results stack up against the narratives shaping investor expectations. Some assumptions may hold, but others could face a reality check.

See what the community is saying about RLI

Profit Margins Projected to Shrink Further

- Consensus narrative highlights a squeeze on profitability, with profit margins forecast to contract from 17.8% today to 15.7% over the next three years.

- This shrinking margin trend amplifies worries about the impact of fierce competition, regulatory pressure, and higher catastrophe payouts eating into future profits.

- At the same time, analysts flag that RLI’s current strategy of maintaining underwriting discipline much tighter than most peers might be the buffer that keeps margins from falling further.

- Despite these pressures, analysts also point to robust investment income, up 16% year-to-date, as a modest offset, even if it cannot fully counteract rising claims and subdued top-line growth.

- If catastrophe losses increase or tech investments fail to boost efficiency, net margins may face even steeper declines than consensus expects.

- Still, the company’s combined ratios, such as 62% in Property, are well below industry averages, offering margin support not often seen in direct competitors.

- For investors weighing these risks, the outcome will hinge on whether RLI’s operational strengths can keep the margin squeeze manageable as industry storms gather.

Consensus narrative urges caution, as directionally lower margins make RLI more vulnerable if catastrophe claims spike or price competition worsens. For the full range of arguments from both sides, go deeper with the balanced case for RLI. 📊 Read the full RLI Consensus Narrative.

Valuation Gap Creates Dilemma

- RLI trades at a Price-To-Earnings ratio of 15.9x, compared to the insurance peer group’s 10.4x and industry average of 13.9x, signaling a premium despite profit contraction.

- Analysts’ consensus sets a fair value estimate (DCF) at $70.76, which is above both the current share price of $61.30 and the analyst price target of $69.25, suggesting shares may be undervalued on forward-looking profit but expensive relative to insurance peers.

- This tension makes valuation a balancing act, since future earnings are under threat but the current price implies modest upside if consensus targets and margin forecasts are achieved.

- Bulls see further support in analyst expectations: earnings are projected to reach $297.9 million by 2028, but would demand a lofty 27.9x PE to align with consensus price targets, much higher than today’s multiples across the sector.

- This means any upside depends on RLI outperforming its already rich expectations, which could prove difficult if margins do not stabilize or revenue growth remains tepid.

- With shares sitting below DCF fair value, investors are forced to decide how much faith they place in the company’s long-term resilience versus shorter-term margin headwinds.

Dividend Durability Under Scrutiny

- Risks and rewards analysis flags the dividend as a potential weak spot, with questions about its sustainability surfacing as profit growth is now negative and margins narrow.

- Bears highlight that rising acquisition and reinsurance costs could limit RLI’s ability to maintain its dividend if profit declines continue, especially as regulatory and claim costs remain elevated.

- This skepticism grows when comparing RLI’s payout prospects to industry peers, many of whom have lower expense ratios and steadier profit trajectories.

- Supporters counter that RLI’s conservative capital management, evident in its reserve strength and high-quality investment portfolio, might provide enough cushion to defend payouts even in a tougher environment.

- Still, investors will need to watch for signs that tech investments translate into cost savings soon, as this is crucial to keep dividend sustainability from slipping further in the face of flattening revenue and shrinking margins.

- Consensus view is that dividend safety will remain an open debate unless RLI can successfully reverse its negative earnings trend.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for RLI on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures with your own take? Share your distinct insight and shape a unique outlook in just minutes. Do it your way

A great starting point for your RLI research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

RLI faces margin pressure, slowing top-line growth, and questions about dividend sustainability. This makes its future returns less predictable than industry peers.

If you want reliable payouts and lower payout risk, discover these 2009 dividend stocks with yields > 3% offering stronger dividend track records and steadier financial fundamentals than companies navigating profit and margin uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RLI

RLI

An insurance holding company, provides property, casualty, and surety insurance products.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives