- United States

- /

- Insurance

- /

- NYSE:RGA

Reinsurance Group of America (RGA): Is the Stock Undervalued After Recent Share Price Swings?

Reviewed by Kshitija Bhandaru

Reinsurance Group of America (RGA) continues to draw investor attention as its shares have seen some swings over the past week. With a year-to-date return in the red, many are watching for any signs of a turnaround or catalysts that could shift market sentiment.

See our latest analysis for Reinsurance Group of America.

RGA’s share price has slipped since the start of the year, but the longer-term picture remains far brighter given its strong three- and five-year total shareholder returns. Recent movements suggest momentum is taking a breather, even as the company’s underlying performance points to resilience and potential for renewed growth ahead.

If you want to see what other compelling opportunities are out there, this could be the perfect time to broaden your outlook and discover fast growing stocks with high insider ownership

With the shares trading well below analyst targets while also boasting impressive multi-year gains, the key question is whether RGA is undervalued now, or if its potential is already reflected in today’s price.

Most Popular Narrative: 18.2% Undervalued

Compared to the most widely followed narrative, Reinsurance Group of America’s $193.87 closing price still has ground to make up before reaching the $236.89 target considered fair value. This gap shines a light on the assumptions fueling optimism about future growth and profitability.

The company's leadership in digital underwriting solutions and customized reinsurance products, supported by data analytics and exclusive arrangements, enhances efficiency and pricing power. These advantages could improve net margins and generate higher earnings as tech-enabled capabilities are scaled.

What secret lies behind these bullish numbers? The narrative rests on a mix of cutting-edge technology, aggressive geographic expansion, and profit margins that may outpace competitors. Dive deeper to discover which surprising financial projections shape this bullish valuation.

Result: Fair Value of $236.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing volatility in U.S. life claims and rising medical costs could challenge RGA’s margins and make the outlook for sustained earnings growth uncertain.

Find out about the key risks to this Reinsurance Group of America narrative.

Another View: What Do Ratios Say?

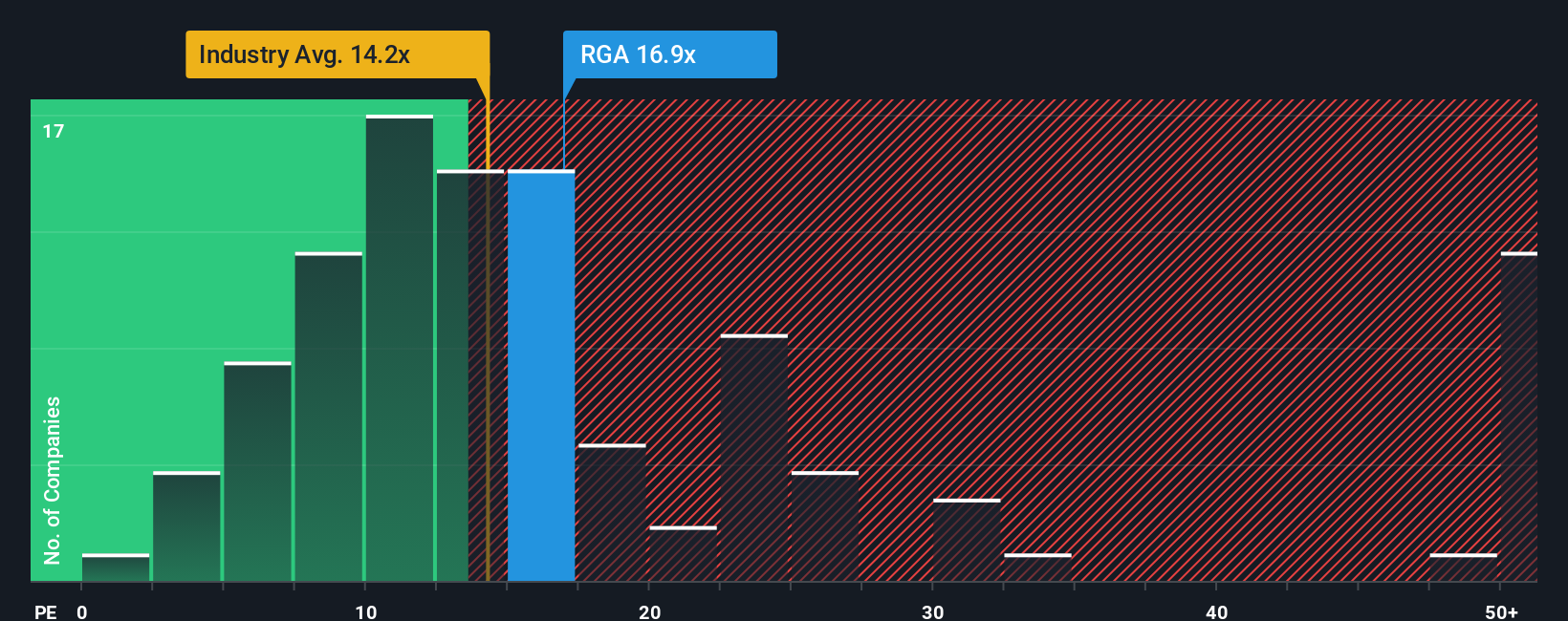

Taking a closer look at traditional valuation ratios, RGA appears expensive, trading at 16.6 times earnings compared to the US Insurance industry’s 13.7 times and peer average of 14 times. However, the fair ratio analysis suggests that 20.9 times earnings could be justified if the market shifts. Does this premium reflect hidden strengths, or signs of overexuberance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Reinsurance Group of America Narrative

If you have a unique perspective or want to dig deeper on your own, it only takes a few minutes to craft your personal view: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Reinsurance Group of America.

Looking for more investment ideas?

Don’t let opportunity pass you by. Expand your investing toolkit and spot your next potential win by using the Simply Wall Street Screener today.

- Tap into the explosive potential of AI by uncovering companies making waves in artificial intelligence with these 24 AI penny stocks.

- Secure steady income streams for your portfolio by checking out these 19 dividend stocks with yields > 3% offering yields above 3%.

- Get ahead of the curve with innovation in finance by searching for crypto and blockchain pioneers through these 78 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RGA

Reinsurance Group of America

Provides reinsurance and financial solutions.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives