- United States

- /

- Insurance

- /

- NYSE:PRU

Prudential (PRU) Valuation Review Following CIO Transition, Advisor Expansion and New AI-Driven Initiatives

Reviewed by Simply Wall St

The recent pop in Prudential Financial (PRU) appears tied less to a single headline and more to a cluster of signals, including a planned CIO transition and visible momentum inside its Prudential Advisors unit.

See our latest analysis for Prudential Financial.

Those moves come at a time when Prudential Financial’s share price, now around $109.57, has delivered a solid five year total shareholder return of 73.84%. This has occurred even as this year’s share price return is still in negative territory, suggesting that longer term momentum outweighs recent volatility.

If you like the combination of durable franchises and quietly compounding returns, it is also worth exploring fast growing stocks with high insider ownership as a way to spot the next wave of leadership stories early.

With shares trading modestly below analyst targets but boasting a hefty estimated intrinsic discount, is Prudential a quietly undervalued compounding machine, or has the market already priced in the next leg of earnings growth?

Most Popular Narrative Narrative: 5.3% Undervalued

With Prudential Financial last closing at $109.57 against a narrative fair value near $115.71, the spread hints at modest upside from disciplined execution.

The company's continued investment in digital transformation (including AI-powered underwriting, automation, and customer self-service capabilities) is expected to lower operating costs and improve net margins over time as technology adoption further enhances scale and efficiency.

Curious how slow and steady revenue growth, rising margins, and a lower future earnings multiple can still support a higher value than today? The full narrative unpacks the math, the milestones, and the profit trajectory behind that call.

Result: Fair Value of $115.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition in retirement products and execution risk around Prudential’s digital transformation could compress margins and derail the current undervaluation thesis.

Find out about the key risks to this Prudential Financial narrative.

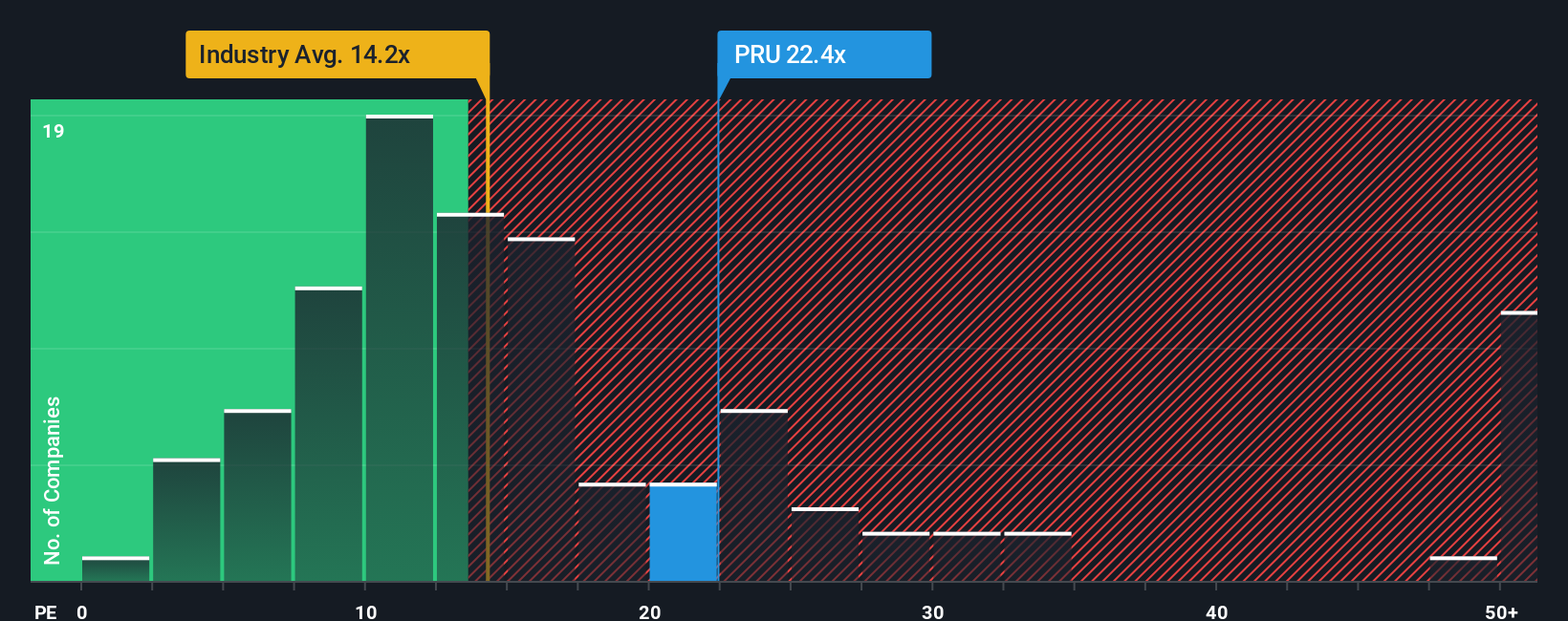

Another View, Market Multiple Sends a Different Signal

While narrative fair value sees modest upside, Prudential’s current price to earnings ratio of 14.8 times sits above both peers at 13.3 times and the US insurance industry at 13.1 times, yet still below its 16.1 times fair ratio. This leaves investors to weigh the near term premium against the longer term rerating potential.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prudential Financial Narrative

If you see things differently or simply prefer to test the numbers yourself, you can build a complete narrative in just minutes: Do it your way.

A great starting point for your Prudential Financial research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want a stronger watchlist and sharper conviction, use the Simply Wall Street Screener now so you do not miss tomorrow’s strongest performers.

- Explore potential income streams by targeting dependable payers through these 14 dividend stocks with yields > 3% that can support a long term, yield focused approach.

- Position your portfolio to participate in developments in AI by filtering for scalable opportunities using these 25 AI penny stocks before they become widely followed.

- Look for potential mispricings in quality businesses with these 921 undervalued stocks based on cash flows and consider opportunities to buy strength when it still appears reasonably priced.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRU

Prudential Financial

Provides insurance, investment management, and other financial products and services in the United States, Japan and internationally.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026