- United States

- /

- Insurance

- /

- NYSE:PRI

A Fresh Look at Primerica (PRI) Valuation After Recent Share Price Fluctuations

Reviewed by Kshitija Bhandaru

See our latest analysis for Primerica.

Primerica’s share price is currently at $264.08, and while it has slipped by 2.8% since the start of the year, the long view reveals resilience. Its 1-year total shareholder return is down just 4%, but the story changes over the longer horizon, with a three-year total shareholder return above 100%. Recent movement hints that momentum has cooled after a strong multi-year run, as investors weigh the company’s fundamentals and growth outlook heading into the rest of the year.

If you’re open to broadening your search, now’s a smart time to discover fast growing stocks with high insider ownership.

With Primerica’s recent dip and a healthy gap to analyst price targets, the real question now is whether the market has undervalued the stock or if expectations for future growth are already baked in. Could this be the next buying opportunity?

Most Popular Narrative: 15.5% Undervalued

With Primerica’s most followed valuation narrative assigning a fair value of $312.43, the latest close at $264.08 suggests a solid gap to the upside. The story is driven not by short-term sentiment, but by structural shifts that the narrative claims are now supporting multi-year growth for the firm.

Strong demographic drivers, especially the large cohort of Baby Boomers and Gen X approaching retirement, are fueling sustained demand for retirement planning products, annuities, and investment solutions. This provides a multi-year tailwind for Primerica's ISP segment and supports double-digit sales growth, which could boost top-line revenue and client assets.

Want to know what's fueling this eye-catching fair value? This narrative depends on bold sales projections, shrinking margins, and a future profit multiple that suggests Primerica could join the blue-chip elite. The calculations behind the price target might surprise you. Curious about the figures driving these expectations? Read on to uncover which numbers could move the share price next.

Result: Fair Value of $312.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost-of-living pressures and declining policy sales could quickly challenge this bullish outlook, putting renewed pressure on future earnings growth.

Find out about the key risks to this Primerica narrative.

Another View: Our DCF Model Paints a Different Picture

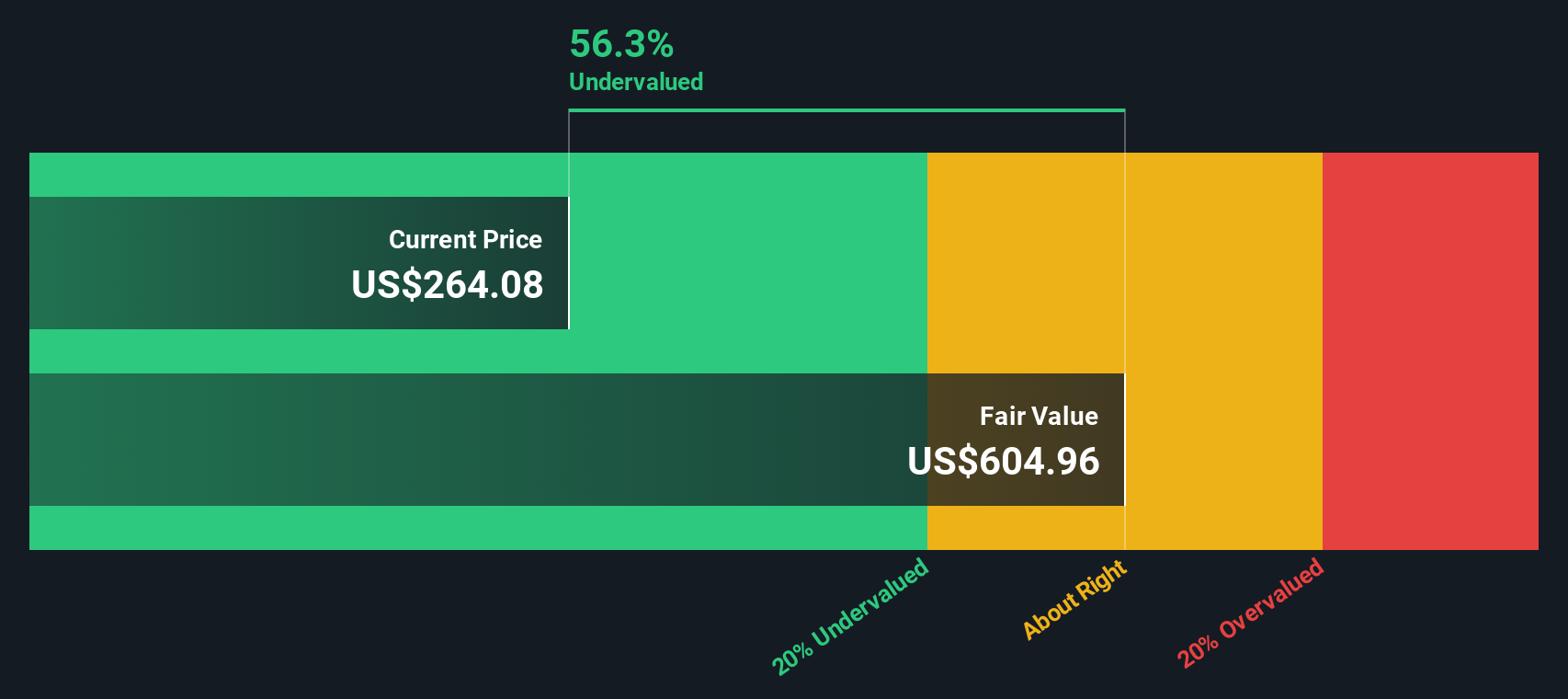

Looking at Primerica through the lens of our SWS DCF model, the shares appear even more undervalued than the narrative suggests. With a fair value estimate of $604.96, the current price is just over 56% below what the DCF model calculates. Does this deeper discount signal an opportunity the market is missing, or is it a sign of caution around future growth?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Primerica Narrative

If this perspective does not quite fit your outlook, why not dig into the numbers and shape your own view in just a few minutes? Do it your way

A great starting point for your Primerica research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Ready to make your next smart move? Use the Simply Wall Street Screener to uncover powerful stock opportunities that others might overlook. Act now and position your portfolio ahead of the curve with expertly crafted screens.

- Tap into fast-growing markets by pinpointing these 24 AI penny stocks that power artificial intelligence breakthroughs in automation and data-driven solutions.

- Strengthen your income strategy by finding these 18 dividend stocks with yields > 3% that consistently reward shareholders with reliable, high-yield payments.

- Ride the next wave of financial innovation as you spot these 79 cryptocurrency and blockchain stocks that are transforming payment systems and digital asset adoption worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRI

Primerica

Provides financial products and services to middle-income households in the United States and Canada.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives