- United States

- /

- Insurance

- /

- NYSE:OSCR

Oscar Health (OSCR): Assessing Valuation Following Major Insider Sale and Convertible Debt Announcement

Reviewed by Kshitija Bhandaru

Oscar Health (NYSE:OSCR) found itself in the investor spotlight after an eventful week that is hard to ignore. When a top executive like the President of Technology & CTO, Mario Schlosser, sells nearly 400,000 shares, it naturally raises questions about insider confidence. Adding to this, the recent $355 million convertible senior notes offering is understandable cause for some shareholders to reassess their positions, especially with talk of possible dilution coming soon and the planned termination of a revolving credit facility connecting the dots for market watchers.

These moves seem to have weighed on Oscar Health’s momentum lately. After delivering strong gains earlier in the year, the stock lost 3.7% in a single recent session as negative sentiment took hold. Over the past year, the stock is down 12%, even though it has surged almost 36% year-to-date. The mixed bag of performance, paired with other headlines like the launch of a new leveraged ETF tied to its shares, keeps the narrative shifting by the week.

With all these cross-currents, the real question is whether Oscar Health is now priced low enough to be compelling, or if the market is already baking in every ounce of its future growth prospects.

Most Popular Narrative: 65% Overvalued

According to the most widely followed narrative, Oscar Health's current market valuation is seen as significantly overvalued compared to its estimated fair value. This assessment is based on a discount rate of 6.8% applied to future cash flows and earnings projections.

"Robust digital adoption and AI-driven efficiencies in healthcare are driving Oscar Health's operating cost reductions, such as a $60 million planned administrative cost cut in 2026. These steps can lead to improved net margins and set the stage for operating profitability."

What is fueling this bold narrative? Find out how a unique blend of growth forecasts, margin expansion, and ambitious efficiency targets are shaping a much lower fair value than the share price suggests. Can Oscar Health deliver on these projections or is the market getting too far ahead of itself?

Result: Fair Value of $11.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, robust digital adoption and strategic expansion could quickly improve Oscar Health's profitability and challenge the view that the market is overly optimistic.

Find out about the key risks to this Oscar Health narrative.Another View: Multiple Says Cheap, But Is It?

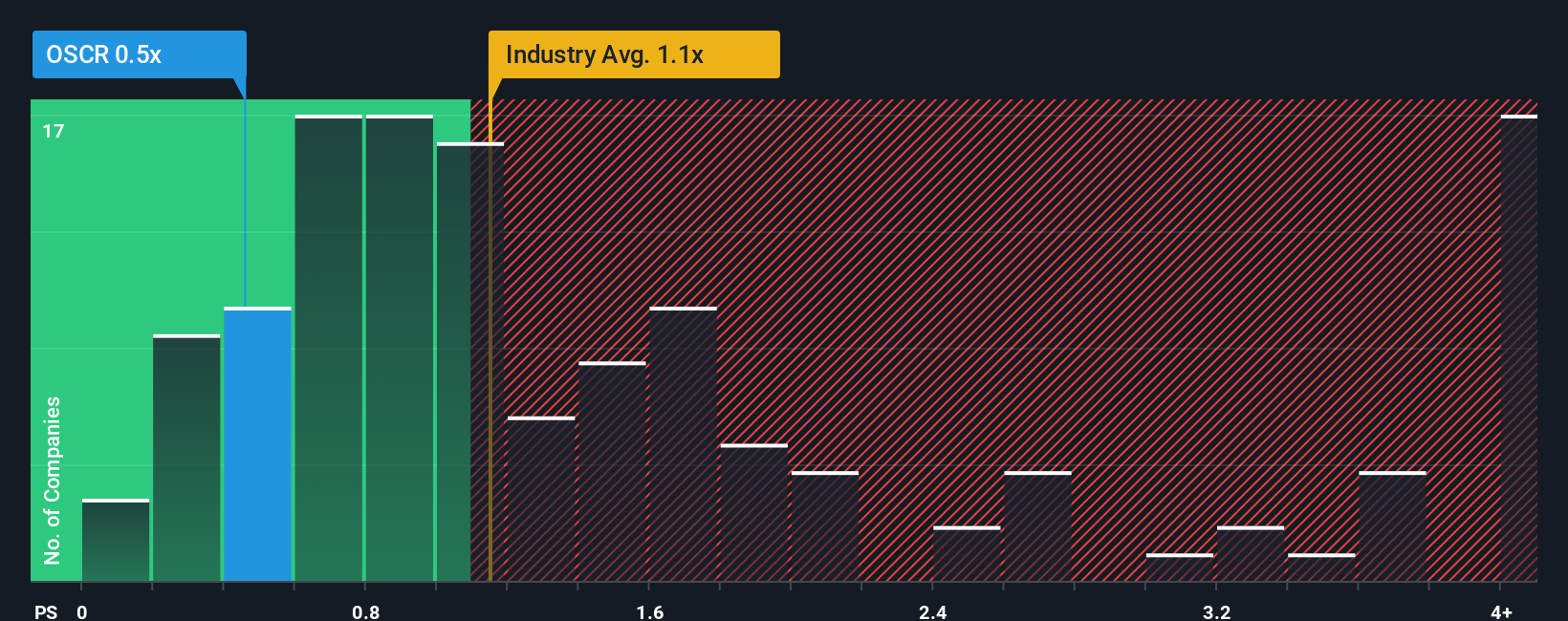

On the other hand, a look at one common valuation tool paints a more optimistic picture. Oscar Health appears attractively valued for its revenue compared to the industry. However, does this low price signal real opportunity or lingering doubts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Oscar Health Narrative

If this doesn’t quite match your perspective or you’d rather dig into the numbers yourself, there’s nothing stopping you from shaping your own narrative in just a few minutes. Do it your way.

A great starting point for your Oscar Health research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great investment opportunities slip by while you focus on just one stock. Expand your research with these smart ways to uncover promising companies, and be the first among your friends to spot the next big trend:

- Tap into emerging tech by scanning AI penny stocks for companies at the cutting edge of artificial intelligence innovation and growth.

- Boost your portfolio’s reliability and seek steady income streams by reviewing dividend stocks with yields > 3%, which spotlights stocks offering dividend yields above 3%.

- Seize undervalued gems with strong fundamentals by searching undervalued stocks based on cash flows, where potential bargains based on future cash flows are waiting to be found.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSCR

Oscar Health

Operates as a healthcare technology company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives