- United States

- /

- Insurance

- /

- NYSE:OSCR

Investors Still Aren't Entirely Convinced By Oscar Health, Inc.'s (NYSE:OSCR) Revenues Despite 30% Price Jump

The Oscar Health, Inc. (NYSE:OSCR) share price has done very well over the last month, posting an excellent gain of 30%. The last month tops off a massive increase of 160% in the last year.

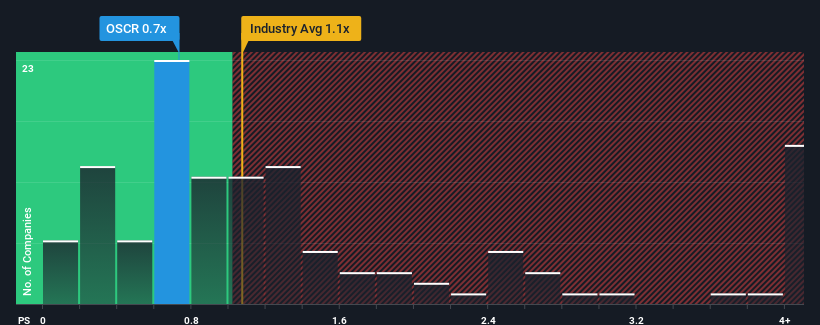

In spite of the firm bounce in price, there still wouldn't be many who think Oscar Health's price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S in the United States' Insurance industry is similar at about 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Oscar Health

How Has Oscar Health Performed Recently?

Recent times have been advantageous for Oscar Health as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Oscar Health will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Oscar Health would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 47% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 26% per year over the next three years. With the industry only predicted to deliver 4.1% each year, the company is positioned for a stronger revenue result.

In light of this, it's curious that Oscar Health's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Oscar Health's P/S

Its shares have lifted substantially and now Oscar Health's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Oscar Health currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 3 warning signs for Oscar Health that we have uncovered.

If you're unsure about the strength of Oscar Health's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OSCR

Reasonable growth potential with mediocre balance sheet.