- United States

- /

- Insurance

- /

- NYSE:MMC

How Investors May Respond To Marsh & McLennan (MMC) Q2 Results and Share Buyback Announcement

Reviewed by Simply Wall St

- Marsh & McLennan Companies recently reported second quarter 2025 results, with sales increasing to US$6.97 billion and net income reaching US$1.21 billion, both higher than the previous year.

- The company also completed a buyback tranche during the same quarter, repurchasing over 1.33 million shares for US$300 million, signaling ongoing confidence in its financial position and capital allocation strategy.

- We'll assess how Marsh & McLennan's solid quarterly performance and share buyback activity influence its long-term investment outlook.

Marsh & McLennan Companies Investment Narrative Recap

To be a shareholder in Marsh & McLennan Companies, you need to believe in a world where growing global risk and compliance needs continue to drive sustained demand for specialized risk management, insurance brokerage, and consulting services. The latest earnings beat and sizable buyback do reinforce the company’s strengths but do not materially shift the biggest short-term catalyst, rising global demand for risk advisory, nor the major risk, which is sustained pressure on property and reinsurance pricing that could hold back revenue and margins if prolonged.

The most relevant recent announcement for investors here is the second quarter earnings report, which showed continued sales and earnings growth year-on-year. These results reflect the ongoing ability of Marsh & McLennan to expand revenues against a backdrop of complex risk environments and suggest its core risk advisory and brokerage segments are maintaining resilience, even as pricing headwinds in insurance markets remain a prominent concern for the future.

By contrast, investors should be aware that if declining property and reinsurance pricing persists, the company’s revenue outlook may...

Read the full narrative on Marsh & McLennan Companies (it's free!)

Marsh & McLennan Companies' narrative projects $30.7 billion revenue and $5.4 billion earnings by 2028. This requires 6.0% yearly revenue growth and a $1.3 billion increase in earnings from the current $4.1 billion.

Exploring Other Perspectives

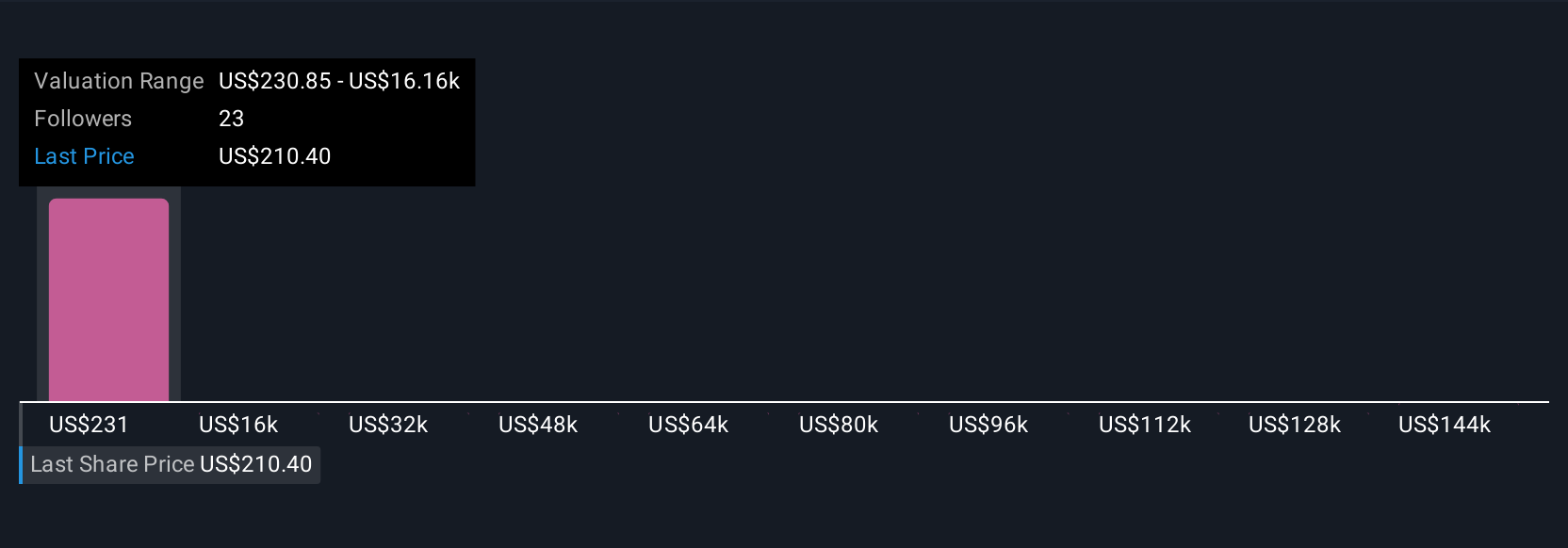

Three individual fair value estimates from the Simply Wall St Community range from US$230.85 to an extreme US$159,561.02. While many see ongoing demand for global risk advisory supporting results, you can explore a range of alternative viewpoints that reflect sharply different expectations for Marsh & McLennan’s future.

Build Your Own Marsh & McLennan Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marsh & McLennan Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Marsh & McLennan Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marsh & McLennan Companies' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMC

Marsh & McLennan Companies

A professional services company, provides advisory services and insurance solutions to clients in the areas of risk, strategy, and people worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives