Last Update 05 Nov 25

Fair value Decreased 1.81%MMC: Earnings Resilience Will Outperform Despite Sector Headwinds And Ongoing Deal Activity

Marsh & McLennan Companies' analyst price target saw a modest reduction of nearly $4 to $214, as analysts cite softer than expected revenue growth and concerns about valuation amidst shifting market dynamics.

Analyst Commentary

Recent Street research offers a nuanced view of Marsh & McLennan Companies, as analysts weigh market conditions, revenue trends, and valuation pressures. Their commentary highlights both the appealing and challenging facets of the company in the current environment.

Bullish Takeaways- Bullish analysts note that catastrophe losses were lighter than expected in the most recent quarter. This supports higher earnings estimates and boosts confidence in the company's earnings resilience.

- Despite a backdrop of macro uncertainty, underlying earnings performance has thus far remained relatively stable. This suggests sound risk management and limited adverse impact from market volatility.

- The company is viewed favorably within its sector when compared to peers, particularly in the insurance brokerage space. Organic growth prospects remain solid despite sector headwinds.

- Certain analysts have raised price targets to reflect updated outlooks for U.S. insurance companies. This indicates optimism about future growth potential and Marsh & McLennan's ability to navigate industry challenges.

- Bearish analysts are concerned about softer revenue growth and cite underperformance versus organic growth targets as a key area of caution for the company.

- Questions surrounding valuation have emerged, with the stock now screening as potentially not inexpensive amid a challenging pricing and macroeconomic environment.

- Some analysts believe the shares may not outperform unless Marsh & McLennan can articulate a more robust growth profile, particularly in the face of commercial property and casualty growth headwinds.

- There is also caution about the lagging effect of a prolonged soft market in property and casualty, which could pressure margins and limit upside in the near term.

What's in the News

- Announced a strategic knowledge partnership with Bloomberg Media to develop and distribute thought leadership at major events globally. This marks the first media partnership featuring the new Marsh brand, which is set to launch next year (Client Announcements).

- Actively seeking acquisitions, with leadership indicating a continued focus on smaller to midsized deals that fit culturally and enhance presence in underpenetrated markets. This follows a quiet third quarter but ongoing deal activity (Seeking Acquisitions/Investments).

- Repurchased 1,955,473 shares for $400 million in Q3 2025, completing a total buyback of 148,758,211 shares valued at over $12.4 billion under the long-term repurchase program (Buyback Tranche Update).

Valuation Changes

- Consensus Analyst Price Target has decreased modestly, moving from $218.21 to $214.26.

- Discount Rate remains unchanged at 6.78%.

- Revenue Growth assumption has edged down slightly, from 5.37% to 5.35%.

- Net Profit Margin has declined marginally, shifting from 17.68% to 17.64%.

- Future P/E ratio is slightly lower, falling from 23.60x to 23.23x.

Key Takeaways

- Growing risk complexity and regulatory demands are fueling long-term global demand for the company's advisory, insurance, and consulting services.

- Strategic digital investments and acquisitions are driving operational efficiency, service breadth, and market expansion, supporting sustained earnings growth.

- Ongoing pricing declines, consulting demand uncertainty, acquisition challenges, liability cost pressures, and tech disruption risk threaten long-term revenue stability and profit growth.

Catalysts

About Marsh & McLennan Companies- A professional services company, provides advisory services and insurance solutions to clients in the areas of risk, strategy, and people worldwide.

- Rising global risk complexity-including increased litigation, extreme weather, catastrophic events, cyber threats, and evolving AI risks-is expected to drive higher demand for Marsh & McLennan's specialized risk advisory and brokerage services, supporting long-term fee revenue and new client growth.

- Expansion of the global middle class, particularly in emerging markets like Latin America, Asia, and EMEA, is fueling robust demand for insurance and risk management solutions, as reflected in continued high single-digit international revenue growth, which should expand the company's addressable market and underpin top-line growth.

- Ongoing regulatory tightening and evolving compliance requirements worldwide are increasing the need for consulting, actuarial, and risk management advisory expertise, creating resilient demand and supporting stable revenues for the firm's consulting divisions.

- Strategic investments in digital transformation, advanced analytics, and AI (e.g., proprietary data tools for risk modeling, agentic interfaces) are expected to enhance operational efficiency and improve product/service offerings, enabling margin expansion and net earnings growth through improved client retention and lower cost to serve.

- Acquisition-driven growth, demonstrated by recent transactions like McGriff and successful integration of wealth management businesses, is broadening Marsh & McLennan's service portfolio and geographic footprint, enabling scale advantages and contributing to higher consolidated earnings over time.

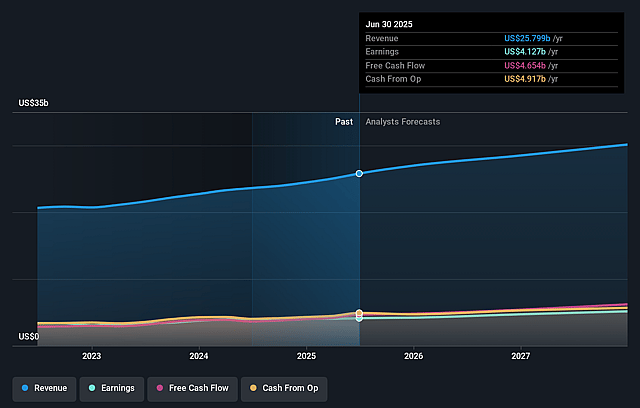

Marsh & McLennan Companies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Marsh & McLennan Companies's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.0% today to 17.4% in 3 years time.

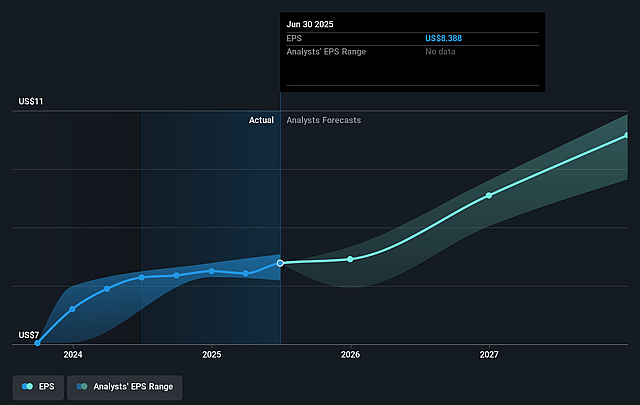

- Analysts expect earnings to reach $5.3 billion (and earnings per share of $11.3) by about September 2028, up from $4.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $4.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.1x on those 2028 earnings, up from 24.0x today. This future PE is greater than the current PE for the GB Insurance industry at 14.3x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Marsh & McLennan Companies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The persistent decline in property and reinsurance pricing, as highlighted by several consecutive quarters of price decreases and ongoing soft market conditions, threatens Marsh & McLennan's revenue growth and commission income, which may impact both top-line revenue and profitability over the long term.

- Structural decline and slowing demand in discretionary and project-based consulting services (notably in Mercer's Career segment and in project-based pension consulting) expose the company to greater revenue volatility and earnings risk, especially during periods of economic or labor market uncertainty that shrink client spend.

- The company faces elevated operational risk and margin pressure from integrating large acquisitions such as McGriff, further exacerbated by increased debt levels and significant acquisition-related charges, which could hinder net margin expansion and earnings growth if synergies fail to materialize as planned.

- Growing exposure to litigation-driven increases in U.S. liability insurance costs and the prevalence of "nuclear verdicts" create client hesitancy, higher insurance costs, and potential reductions in insurance demand, which may dampen both revenue and client retention rates in key U.S. markets.

- Rapid adoption of advanced analytics, AI, and insurtech across the industry poses a long-term risk of traditional service disintermediation; if Marsh & McLennan fails to keep pace with faster, more nimble digital-first competitors, its margins and fee-based revenues could be eroded by shrinking pricing power and client migration to tech-enabled alternatives.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $232.421 for Marsh & McLennan Companies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $258.0, and the most bearish reporting a price target of just $197.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $30.7 billion, earnings will come to $5.3 billion, and it would be trading on a PE ratio of 26.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of $201.88, the analyst price target of $232.42 is 13.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.