- United States

- /

- Insurance

- /

- NYSE:MKL

Will Chelsea Jiang’s Greater China Appointment Change Markel Group’s (MKL) Narrative?

Reviewed by Simply Wall St

- Earlier this month, Markel Insurance appointed Chelsea Jiang as Managing Director Greater China, where she will oversee the company’s operations in both Hong Kong and Shanghai, bringing leadership experience from AXA.

- This move highlights Markel’s focus on strengthening its footprint and advancing growth in Asia by leveraging Jiang’s market expertise and established local relationships.

- We will explore how Chelsea Jiang’s leadership appointment in Greater China could influence Markel Group’s focus and future investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Markel Group Investment Narrative Recap

To own shares in Markel Group, investors typically need confidence in its ability to drive sustainable insurance profitability through operational streamlining and expansion into key markets like Asia. The recent appointment of Chelsea Jiang can enhance Markel’s execution in Greater China, but is not expected to materially shift the most immediate catalysts such as ongoing margin improvements or address the primary risk of income volatility from unrealized investment gains.

Among recent announcements, the company’s leadership restructuring within its US Wholesale and Specialty division is particularly relevant. Like the Greater China leadership move, these appointments reflect Markel’s broader focus on efficiency and simplification, which aligns directly with the catalyst of boosting net margins, though short-term earnings may still be sensitive to investment performance and catastrophe exposures.

Yet, while management seeks efficiency, investors should be aware that persistent volatility in unrealized equity gains remains a risk if...

Read the full narrative on Markel Group (it's free!)

Markel Group's outlook anticipates $17.6 billion in revenue and $2.0 billion in earnings by 2028. This forecast reflects a 4.2% annual revenue growth rate and a $0.2 billion increase in earnings from the current $1.8 billion.

Uncover how Markel Group's forecasts yield a $1895 fair value, a 6% downside to its current price.

Exploring Other Perspectives

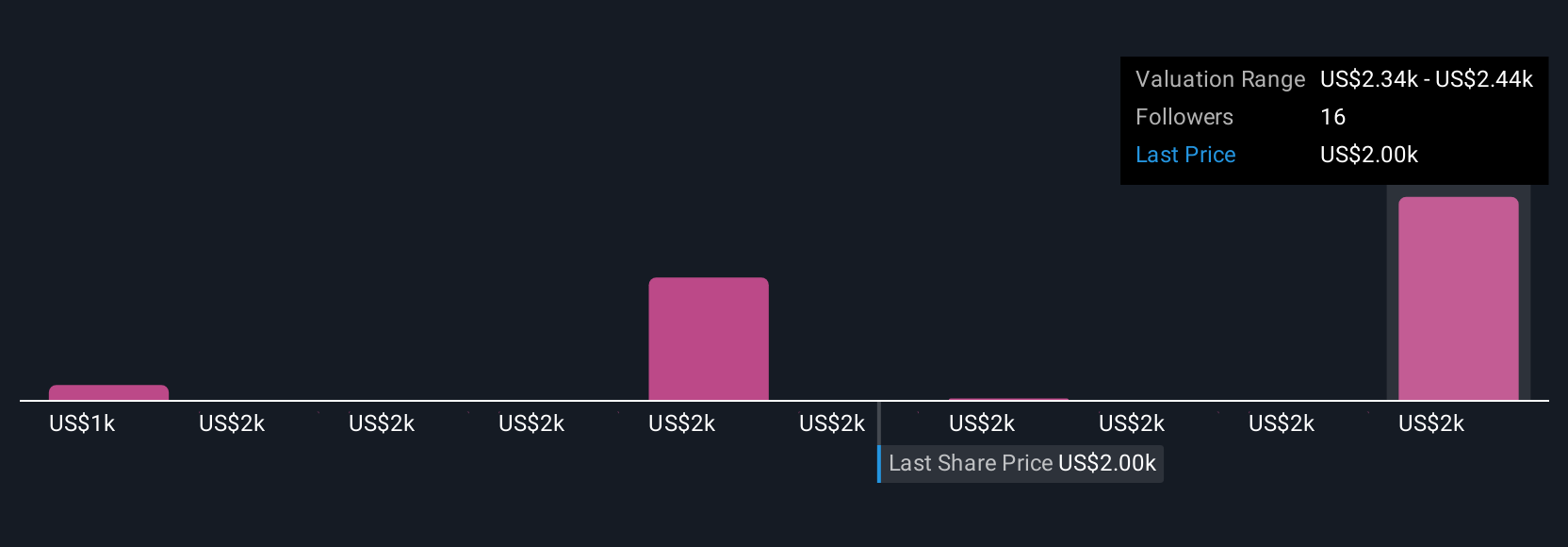

Six community members on Simply Wall St have shared fair value targets for Markel Group, ranging from US$1,449.63 to US$2,435.99 per share. While management changes target key growth areas, income volatility tied to equity markets continues to influence sentiment and financial outcomes, inviting you to explore these differing forecasts and perspectives further.

Build Your Own Markel Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Markel Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Markel Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Markel Group's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MKL

Markel Group

Through its subsidiaries, engages in the insurance business in the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives