- United States

- /

- Insurance

- /

- NYSE:MKL

Is Now the Right Moment to Reassess Markel Group Shares After Strong 25% Annual Rally?

Reviewed by Bailey Pemberton

Thinking about what to do with your Markel Group shares, or wondering whether now is the time to jump in? You are definitely not alone. The stock has been on an impressive run, up 25.0% over the past year and an eye-catching 97.6% over five years. Even in just the last week, Markel gained 3.7%. While that kind of growth hints at a dynamic business, some of this momentum also reflects changes in how investors are viewing Markel's risk and overall market environment. Broader financial sector optimism has also helped to push the price higher.

Given such strong performance, the big question is: does Markel still offer value for today’s investor, or are you late to the party? On a valuation basis, Markel scores 3 out of 6, meaning it passes half the commonly used undervaluation checks. That in-between result might sound inconclusive, but there are some key details beneath the surface that can point you to a smarter decision, depending on your own investing lens.

To help you get off the fence, let’s break down the valuation frameworks most investors use, with a few twists Markel brings to the table. Stay tuned, as there’s one approach that could shine an even brighter light on what’s really happening here.

Approach 1: Markel Group Excess Returns Analysis

The Excess Returns model evaluates how efficiently a company invests money to generate profits beyond the minimum expected by its investors. For Markel Group, this means looking at how much value the business creates on top of its cost of capital, based on tangible measures like book value, earnings power, and projected returns.

According to analyst estimates, Markel’s per-share Book Value stands at $1,368.57, with a Stable Book Value forecast to rise to $1,519.30. The company’s Stable EPS is $110.28 per share, derived from a weighted estimate of future Return on Equity by four analysts. Markel’s Cost of Equity is set at $102.95 per share. This means the business generates an Excess Return of $7.33 per share, indicating value creation, but at a modest spread. The historical average Return on Equity for Markel is 7.26%, in line with insurance sector norms but not at the very top of the industry.

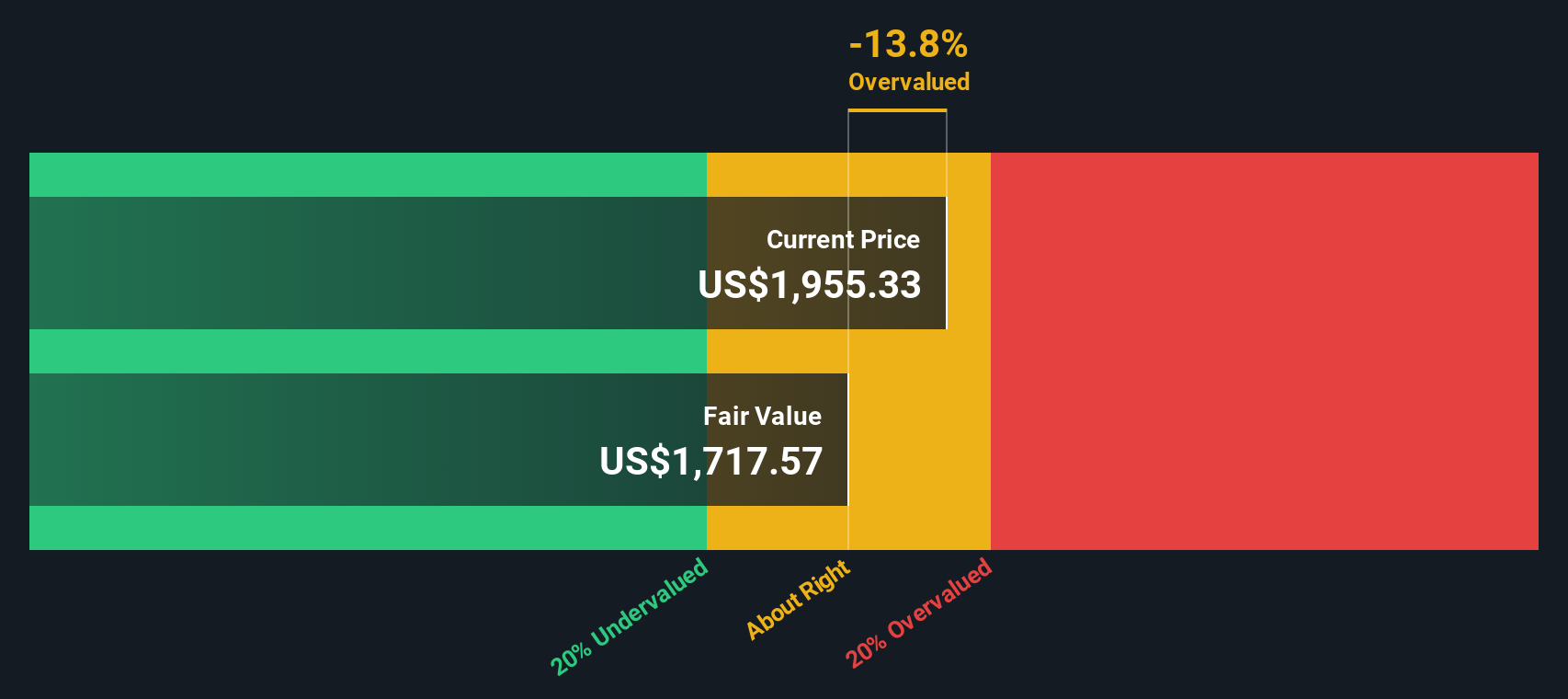

Putting all these factors together, the Excess Returns model estimates Markel’s intrinsic value at $1,717.57 per share. At current trading levels, the stock is considered 13.8% overvalued based on this approach. For investors, this signals that the market is currently pricing in more growth or safety than the model justifies.

Result: OVERVALUED

Our Excess Returns analysis suggests Markel Group may be overvalued by 13.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Markel Group Price vs Earnings

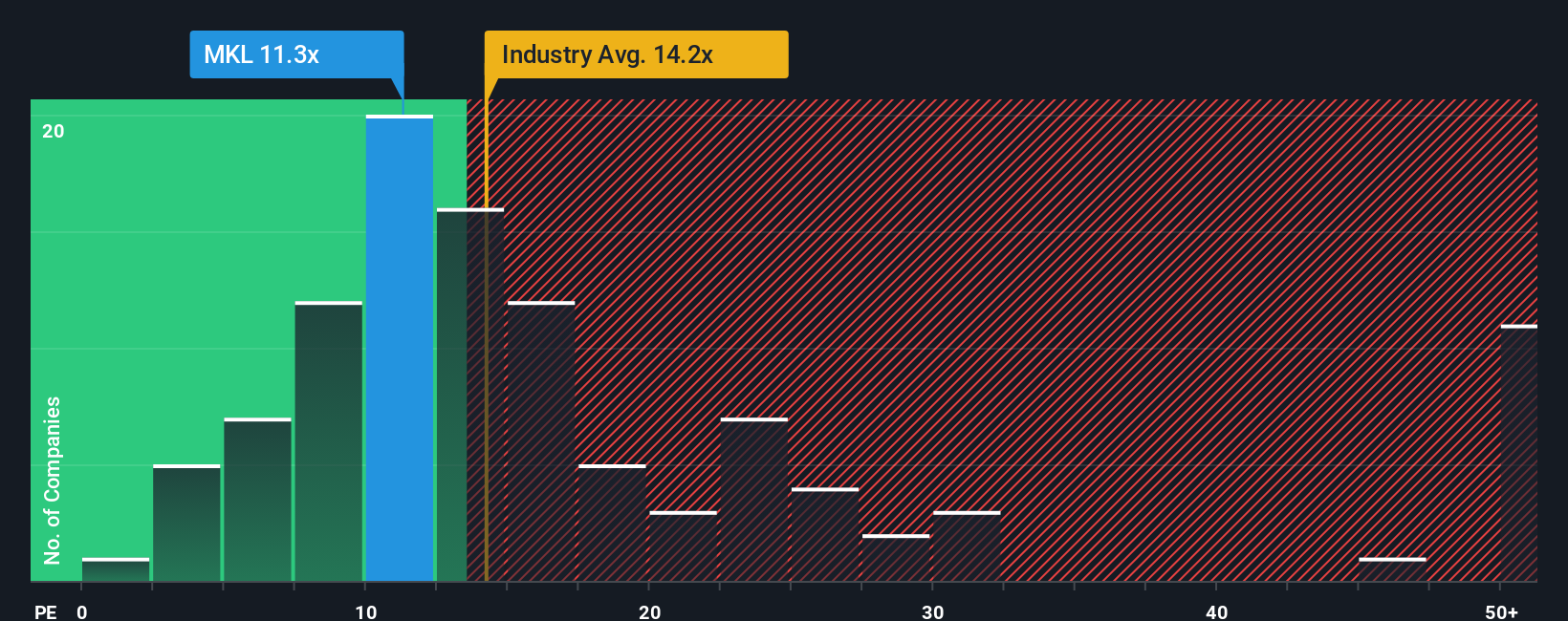

The Price-to-Earnings (PE) ratio is widely recognized as a reliable measure for valuing established, profitable companies like Markel Group because it connects a company’s share price to its actual earning power. A PE ratio gauges how much investors are willing to pay for each dollar of earnings, with growth prospects and risk appetite both playing a large role. If investors expect faster growth or lower risk, it is normal to see higher multiples. The reverse is true for slower-growth or riskier firms.

Currently, Markel Group trades at a PE ratio of 11.5x, which is noticeably lower than the insurance industry average of 14.3x and well below the peer average of 18.6x. However, simply comparing to these benchmarks does not tell the whole story. That is where the Simply Wall St “Fair Ratio” comes in. It is calculated at 11.5x for Markel. This proprietary metric considers not just what competitors are trading at, but also factors in Markel’s unique mix of earnings growth, risks, profit margins, market cap, and how it stacks up in the broader industry.

Unlike basic peer or industry comparisons, the Fair Ratio gives a more tailored and forward-looking view of what a reasonably priced multiple should be for Markel. Since both Markel’s current PE and its Fair Ratio are virtually identical, the shares appear fairly priced relative to what would be justified by its fundamentals and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Markel Group Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative combines your view of Markel Group’s future, how you expect its revenue, earnings, and profit margins to change, with your assumptions about fair value, wrapping the numbers inside a story that explains why you believe what you do.

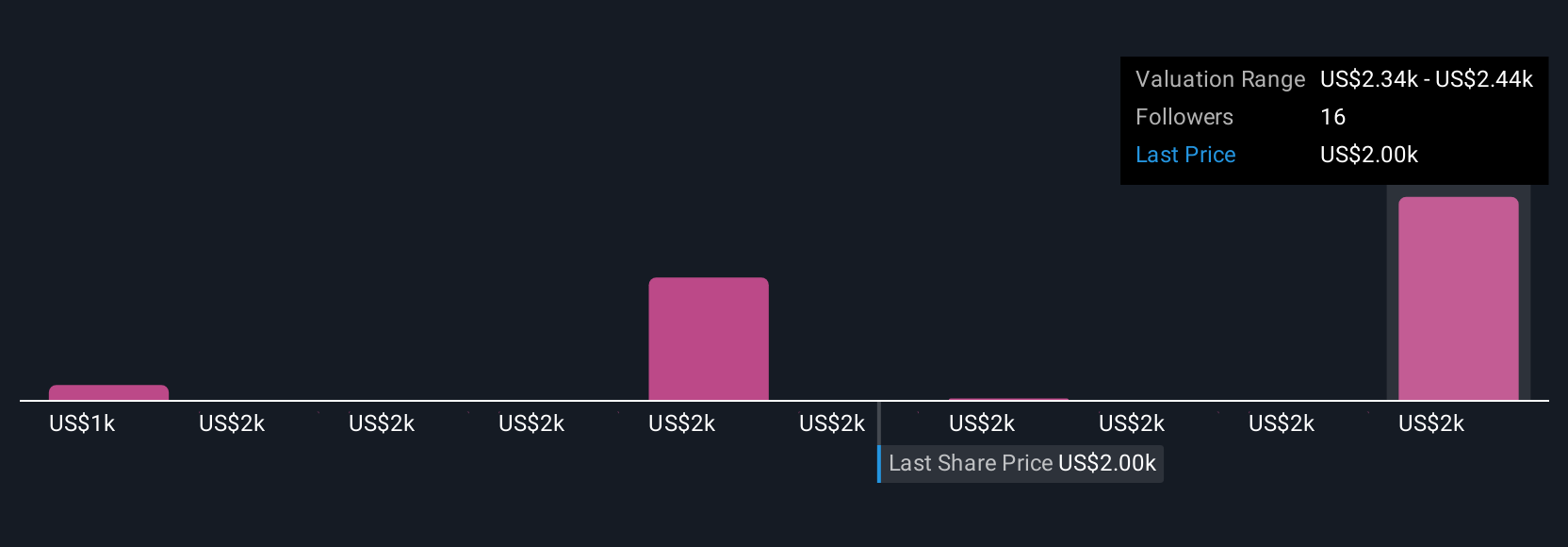

Narratives act as a bridge between the company’s business drivers and a personalized financial forecast. This approach ultimately points you to a fair value estimation that reflects your own perspective. Best of all, Simply Wall St makes this tool easy and accessible. On the Markel Group Community page, millions of investors share and update their Narratives with just a few clicks.

You can compare your Fair Value estimate to the current market price directly, helping you decide if now is the right time to buy, hold, or sell. The real power of Narratives is that they update automatically whenever new facts, like headlines or earnings releases, change the outlook. This ensures you always have a dynamic, forward-looking view.

For example, one Narrative for Markel Group sees its decentralized operations and digital transformation lifting future earnings, leading to a bullish fair value of $1,985 per share. Another Narrative highlights persistent industry challenges and projects a more modest target, demonstrating how different perspectives can coexist and guide smarter decisions.

Do you think there's more to the story for Markel Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MKL

Markel Group

Through its subsidiaries, engages in the insurance business in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives