- United States

- /

- Insurance

- /

- NYSE:MKL

Evaluating Markel Group (MKL) Valuation After Strong Earnings Growth and Improved Margins

Reviewed by Kshitija Bhandaru

Most Popular Narrative: Fairly Valued

The most widely followed narrative currently sees Markel Group as fairly valued, with just a minor gap between the market price and consensus fair value. Analysts believe the share price is close to justified based on expected future financial performance.

The restructuring and re-segmentation of Markel's insurance operations, including decentralizing decision-making and aligning accountability with clear P&L ownership, is expected to drive expense efficiency and strengthen underwriting performance. This will likely improve overall net margins and earnings as operational improvements take hold.

Want to know what is behind this "just right" valuation call? A mix of bold company changes, evolving business mix, and projections that rest on several critical financial levers set the stage. Is this the classic, steady compounding story or a more dramatic pivot in the works? Dive deeper to uncover the driving forces and the unique future estimates shaping this price target.

Result: Fair Value of $1,931.20 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing reserve risks in discontinued lines and challenges from organizational changes could still unsettle the otherwise steady growth narrative for Markel Group.

Find out about the key risks to this Markel Group narrative.Another View: What Does Our DCF Model Say?

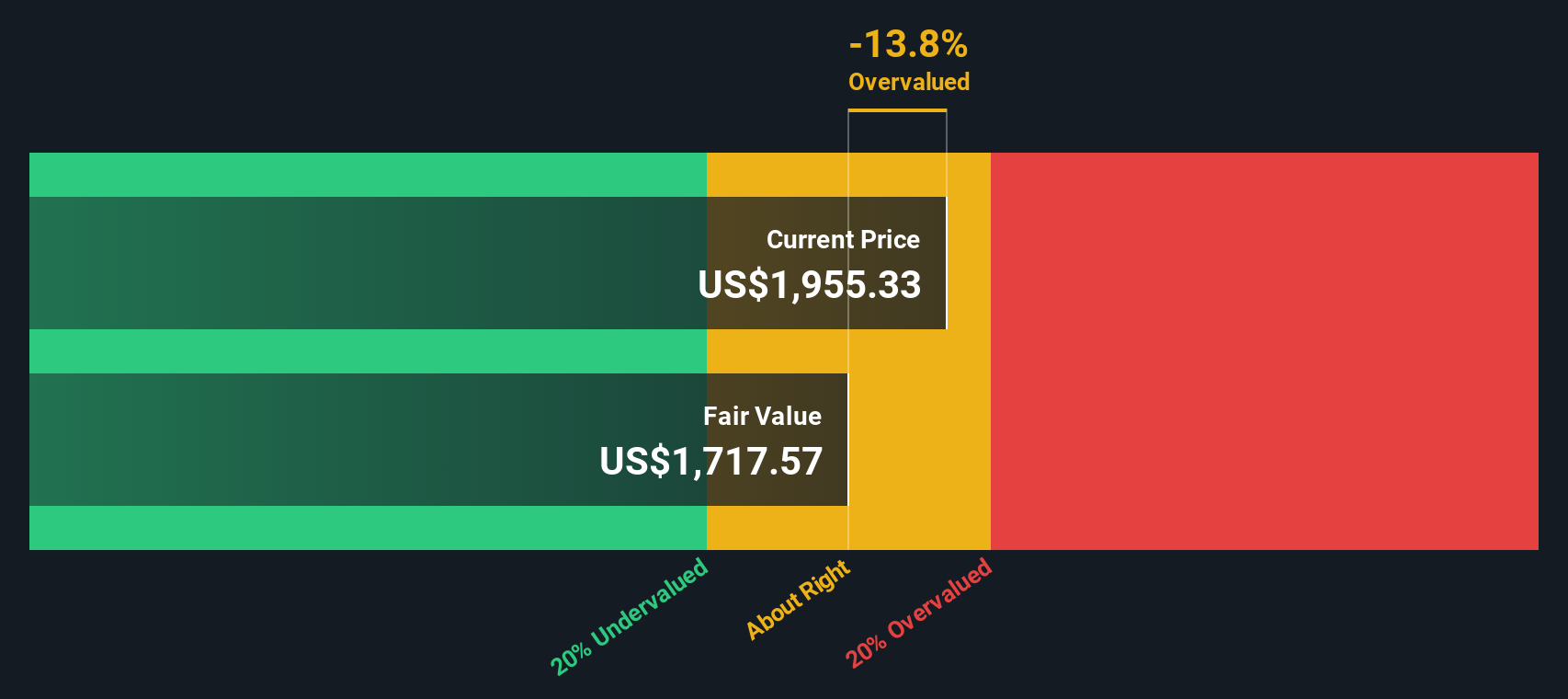

Looking at Markel Group from another angle, the SWS DCF model suggests the shares may be trading above their estimated intrinsic value. This raises the question of whether analysts are being optimistic, or if the market is overlooking hidden risks.

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Markel Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Markel Group Narrative

If you have different viewpoints or enjoy uncovering your own investment insights, you can build a custom narrative in just a few minutes. Do it your way.

A great starting point for your Markel Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More High-Potential Investment Ideas?

Don’t settle for the ordinary when you can tap into tomorrow’s winners right now. Get ahead with focused insights that reveal where smart capital is moving next.

- Unlock fresh growth stories by zeroing in on market gems. Unearth undervalued stocks based on cash flows poised for a powerful turnaround based on strong cash flows.

- Ride the technology wave and target rapid advancements with the latest breakthroughs in artificial intelligence. Seek out AI penny stocks set to shape the future.

- Supercharge your income strategy by finding resilient payouts and consistent returns with dividend stocks with yields > 3% offering yields above 3% for smarter cash flow management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MKL

Markel Group

Through its subsidiaries, engages in the insurance business in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives