- United States

- /

- Insurance

- /

- NYSE:MET

Does MetLife’s US$10 Billion Annuity Reinsurance Shift Redefine The Bull Case For MET?

Reviewed by Sasha Jovanovic

- MetLife recently completed a US$10.00 billion reinsurance transaction with Talcott Resolution Life Insurance Company, transferring a block of U.S. retail variable annuity and rider reserves to improve capital efficiency and financial flexibility.

- This move, alongside solid third-quarter 2025 results featuring robust investment income and strong Asia sales, highlights MetLife’s push to sharpen its balance sheet while growing fee-oriented retirement and benefits businesses.

- We’ll now examine how this large reinsurance deal could reshape MetLife’s investment narrative, particularly its emphasis on asset-light, fee-based growth.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

MetLife Investment Narrative Recap

To own MetLife, you need to believe it can convert its global insurance and retirement footprint into steadier, capital-light earnings while managing credit and interest rate pressures. The US$10.0 billion variable annuity reinsurance deal fits this story by freeing up capital for fee-oriented lines, but it does not remove the key near term risk around commercial mortgage loan losses and related reserve needs.

Alongside the Talcott transaction, MetLife’s recent US$12.0 billion of new pension risk transfer mandates underline how the company is leaning into asset-light, fee-based retirement solutions as a growth engine. Together, these moves could make earnings less sensitive to spread income and reserve volatility, which matters if investment margins or Asia’s variable investment income stay uneven.

Yet, against this push toward asset-light growth, investors should still be aware of how commercial mortgage loan credit stress could...

Read the full narrative on MetLife (it's free!)

MetLife's narrative projects $83.8 billion revenue and $6.3 billion earnings by 2028. This requires 4.7% yearly revenue growth and a roughly $2.2 billion earnings increase from $4.1 billion today.

Uncover how MetLife's forecasts yield a $93.00 fair value, a 18% upside to its current price.

Exploring Other Perspectives

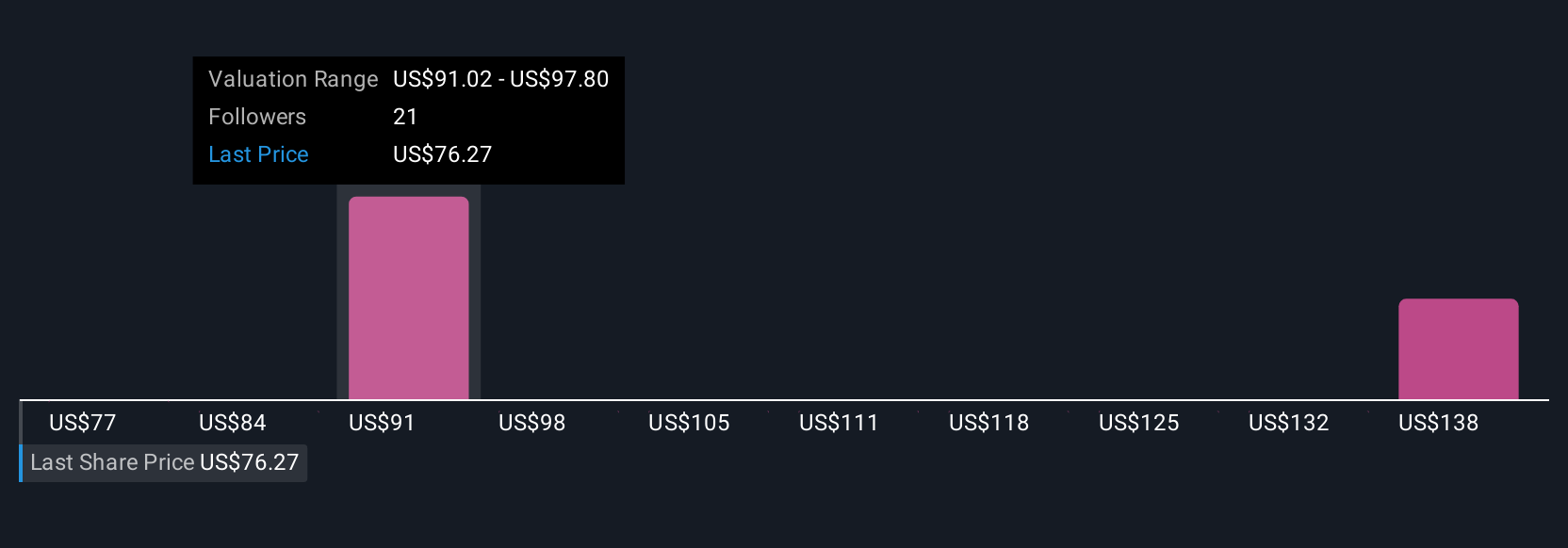

Three members of the Simply Wall St Community currently see MetLife’s fair value between US$91 and about US$147, showing a wide span of opinions. You can set those views against the recent focus on asset-light, fee-based expansion, which could matter if investment income or credit quality move in ways that challenge today’s earnings mix.

Explore 3 other fair value estimates on MetLife - why the stock might be worth just $91.00!

Build Your Own MetLife Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MetLife research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MetLife research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MetLife's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MET

MetLife

A financial services company, provides insurance, annuities, employee benefits, and asset management services worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026