- United States

- /

- Insurance

- /

- NYSE:LMND

Lemonade (LMND) Is Up 10.3% After Expanding Car Insurance to Indiana Has The Bull Case Changed?

Reviewed by Simply Wall St

- Lemonade recently launched Lemonade Car in Indiana, extending its digital insurance suite to drivers across the state as part of its broader U.S. expansion following a rollout in Colorado.

- The move gives Lemonade access to a market where Hoosiers spend an estimated US$5 billion yearly on car insurance, with existing customers in the state already accounting for hundreds of millions in annual premiums, highlighting the company’s intent to deepen its reach in core segments.

- We’ll explore how expanding Lemonade Car into Indiana impacts the company’s outlook for margin improvement and revenue growth.

Lemonade Investment Narrative Recap

To invest in Lemonade, you need to trust in the company's ability to translate rapid revenue growth and digital innovation into eventual profitability, despite current losses. The Indiana expansion for Lemonade Car broadens the addressable market and could accelerate in-force premium growth, but the immediate impact on short-term margin improvement remains limited, with upfront investment and operational scale-up still the most important near-term catalyst and risk.

Another recent development with strong ties to growth potential is Lemonade’s launch of Buildings and Contents insurance in the UK, which adds revenue diversity and aligns with the company’s strategy to lower reliance on any single market. Both the Indiana car insurance entry and European product launches hinge on successful execution and efficient spend, central to Lemonade’s plans for margin improvement and cash flow strength.

By contrast, it’s just as important to be aware that positive gross loss ratio trends may not immediately translate to stronger earnings if expenses from ongoing expansion continue to weigh on...

Read the full narrative on Lemonade (it's free!)

Lemonade's narrative projects $1.1 billion in revenue and $111.5 million in earnings by 2028. This requires 29.6% yearly revenue growth and a $313.7 million increase in earnings from the current level of -$202.2 million.

Uncover how Lemonade's forecasts yield a $29.77 fair value, a 29% downside to its current price.

Exploring Other Perspectives

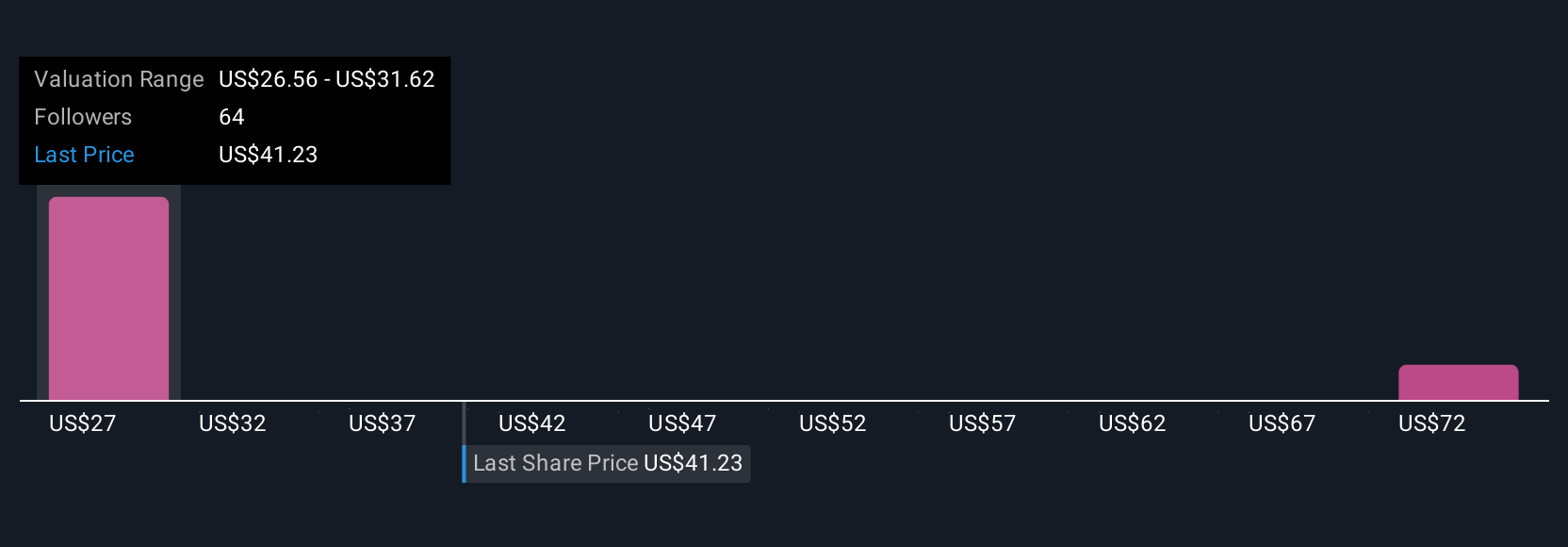

Seven fair value estimates from the Simply Wall St Community cluster between US$26.56 and US$77.14 per share, showing a wide spread in individual views. While many see potential, Lemonade’s heavy growth spending in 2025 remains a key factor you should weigh when reviewing these varied outlooks.

Build Your Own Lemonade Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lemonade research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Lemonade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lemonade's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMND

Lemonade

Provides various insurance products in the United States, Europe, and the United Kingdom.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives