- United States

- /

- Insurance

- /

- NYSE:LMND

Could Lemonade's (LMND) New AI Board Member Signal a Shift in Its Innovation Strategy?

Reviewed by Sasha Jovanovic

- On October 15, 2025, Lemonade announced the appointment of Prashant Ratanchandani, Meta's Vice President of Engineering for AI Products, to its Board of Directors.

- Ratanchandani's deep expertise in artificial intelligence and experience leading major engineering teams at both Meta and Microsoft could accelerate Lemonade's technology-driven transformation.

- We’ll examine how bringing a Meta AI leader to the board could strengthen Lemonade’s emphasis on innovation in its investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Lemonade Investment Narrative Recap

Owning shares of Lemonade means believing in its ability to use AI and technology to transform insurance and achieve profitable growth. While the appointment of Prashant Ratanchandani, a Meta AI leader, to the board underscores Lemonade's tech focus and could boost its innovation narrative, it is unlikely to materially change the biggest short-term catalyst, improving loss ratios and earnings, or address the core risk of ongoing unprofitability in the near term.

The recent launch of Lemonade Car in Indiana highlights the company's push to expand its full suite of products across more US markets. As Lemonade grows geographically and adds experienced voices to its leadership, attention remains fixed on its ability to balance rapid revenue expansion with the need to improve underwriting accuracy and margin discipline.

But even with new expertise on the board, investors should be aware that the risk of sustained net losses...

Read the full narrative on Lemonade (it's free!)

Lemonade's narrative projects $1.8 billion revenue and $201.4 million earnings by 2028. This requires 44.9% yearly revenue growth and a $405.4 million increase in earnings from -$204.0 million.

Uncover how Lemonade's forecasts yield a $46.50 fair value, a 7% downside to its current price.

Exploring Other Perspectives

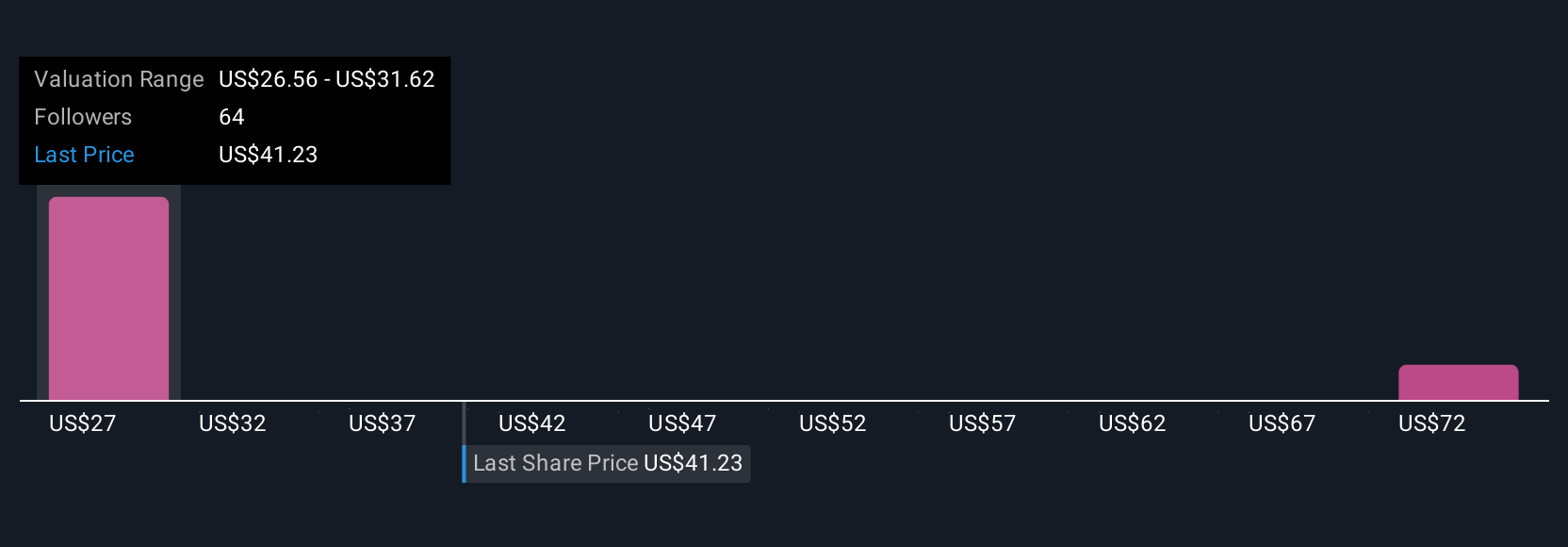

Thirteen private investors in the Simply Wall St Community estimate Lemonade's fair value between US$23.34 and US$77.14 per share. Many focus on Lemonade's projected revenue growth, yet increased competition and regulatory scrutiny could influence whether these outlooks play out as expected; see how others view the company's prospects.

Explore 13 other fair value estimates on Lemonade - why the stock might be worth as much as 55% more than the current price!

Build Your Own Lemonade Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lemonade research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Lemonade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lemonade's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMND

Lemonade

Provides various insurance products in the United States, Europe, and the United Kingdom.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives