- United States

- /

- Insurance

- /

- NYSE:L

Is It Too Late To Consider Loews After Strong Multi Year Share Price Gains?

Reviewed by Bailey Pemberton

- Wondering if Loews at around $104 a share is still a smart buy or if you have missed the easy money? This breakdown will walk through what the current price really bakes in and where upside or downside could come from.

- Despite a choppy recent week with the stock down about 3.5%, Loews is still up roughly 3.8% over the last month, 24.2% year to date, and 21.9% over the past year, building on multi year gains of 87.2% over 3 years and 143.8% over 5 years.

- Those moves have come as investors have continued to warm to financial and insurance names in a higher for longer interest rate environment, where underwriting discipline and investment income are getting more attention. At the same time, Loews ongoing portfolio shaping and capital allocation decisions have kept the market focused on how much hidden value might still be locked inside the conglomerate structure.

- Yet, on our checks the stock only scores 0 out of 6 for being undervalued, raising the question of whether these returns have already priced in most of the good news. Next, we will walk through different valuation approaches to see what they say about Loews today, then finish by looking at an additional way to think about valuation that goes beyond just the numbers.

Loews scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Loews Excess Returns Analysis

The Excess Returns model looks at how much profit Loews can generate above its cost of equity and then capitalizes those excess profits into an intrinsic value per share.

In this framework, Loews has a Book Value of $88.39 per share and a Stable EPS of $6.20 per share, based on its median return on equity over the past 5 years. With an Average Return on Equity of 8.51% and a Cost of Equity of $5.15 per share, the implied Excess Return is $1.05 per share. The model also uses a Stable Book Value of $72.87 per share, reflecting the company’s typical capital base over time.

Rolling these inputs together, the Excess Returns model produces an intrinsic value of about $100.54 per share. Versus a current share price near $104, Loews appears roughly 3.9% overvalued, which is close enough to describe it as fairly valued rather than stretched.

Result: ABOUT RIGHT

Loews is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Loews Price vs Earnings

For a consistently profitable company like Loews, the price to earnings, or PE, ratio is a useful way to gauge what investors are willing to pay today for each dollar of earnings. It conveniently folds together expectations about future growth and perceived risk into a single number.

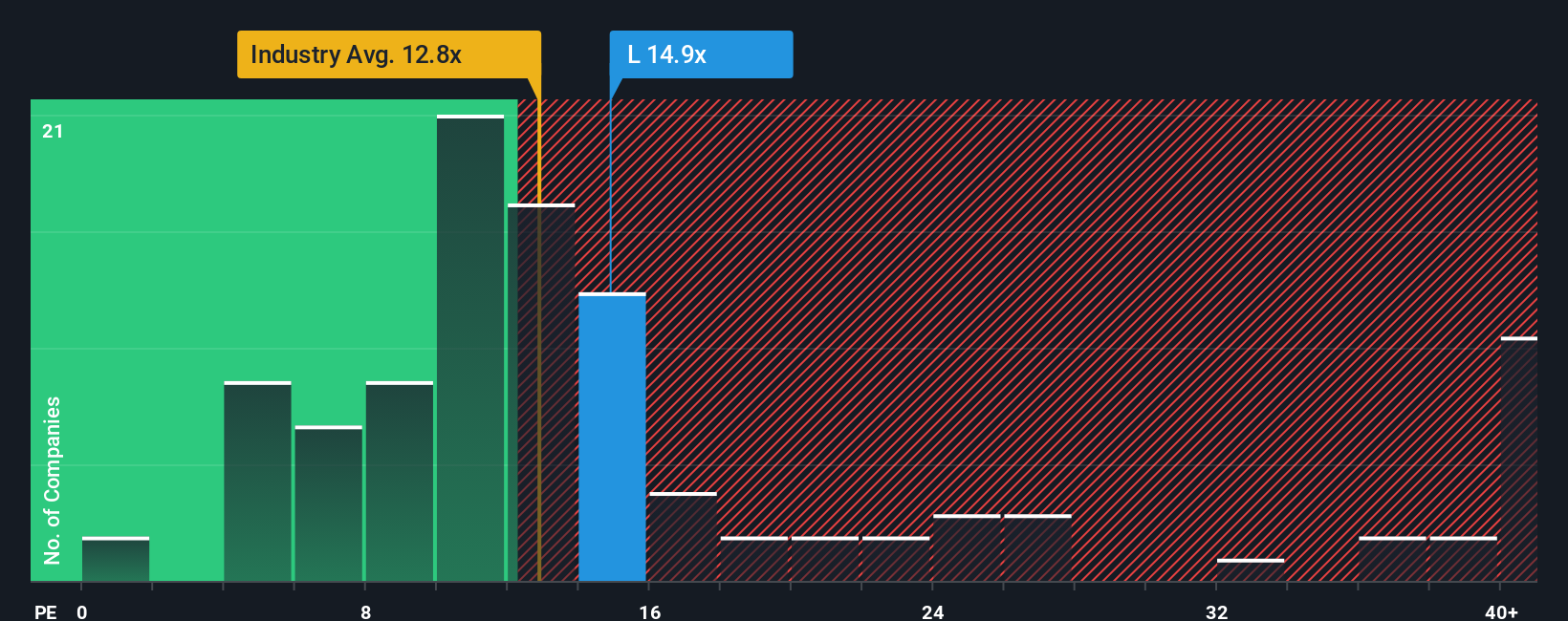

In general, faster growing and lower risk businesses justify higher PE ratios. Slower growth or lumpier earnings typically deserve lower ones. Loews currently trades on a PE of about 14.9x. That sits a bit above both the broader insurance industry average of roughly 12.8x and the peer group average near 13.5x, suggesting the market is already assigning it a modest quality or growth premium.

Simply Wall St goes a step further with its Fair Ratio, a proprietary estimate of what Loews PE should be once you factor in its specific earnings growth outlook, profitability, risk profile, industry, and market cap. This makes it more tailored than a simple comparison with peers or the sector, which can overlook important differences in business mix and balance sheet strength. On this basis, Loews current PE is only slightly above its Fair Ratio, indicating the stock is priced close to what those fundamentals justify.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Loews Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story about Loews future to the numbers you use in your forecast, from revenue growth and profit margins through to your estimate of fair value per share. A Narrative connects three things: what you believe about the business, how that belief translates into a financial forecast, and what that forecast implies as a fair value, so you can see exactly why you think the stock is cheap or expensive. On Simply Wall St, millions of investors build and share these Narratives on the Community page, where the tool makes it easy to compare your Fair Value to the current Price and decide how Loews looks based on your own assumptions. Narratives also update dynamically as new information like earnings or major news arrives, helping your thesis stay current instead of going stale. For example, one investor might see Loews as a slow and steady compounder worth $95 a share, while another might believe its insurance and energy assets justify a value closer to $130.

Do you think there's more to the story for Loews? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:L

Loews

Through its subsidiaries, provides commercial property and casualty insurance in the United States and internationally.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026