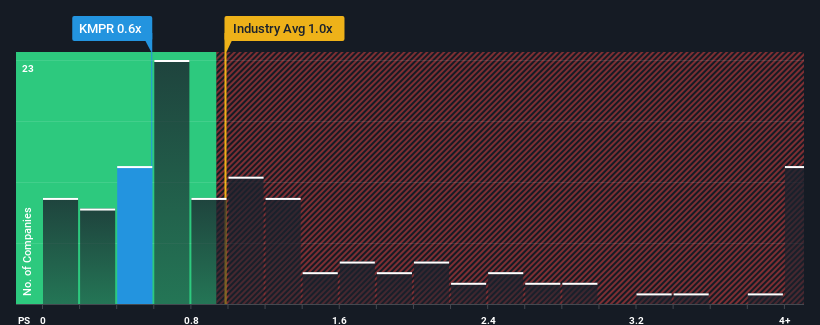

There wouldn't be many who think Kemper Corporation's (NYSE:KMPR) price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S for the Insurance industry in the United States is similar at about 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Kemper

What Does Kemper's P/S Mean For Shareholders?

Kemper hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kemper.How Is Kemper's Revenue Growth Trending?

Kemper's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.9%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 12% during the coming year according to the four analysts following the company. Meanwhile, the broader industry is forecast to expand by 6.4%, which paints a poor picture.

With this in consideration, we think it doesn't make sense that Kemper's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Kemper's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our check of Kemper's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Kemper that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kemper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KMPR

Kemper

An insurance holding company, provides insurance products in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives