- United States

- /

- Insurance

- /

- NYSE:HIG

Hartford Insurance Group (NYSE:HIG) Declares US$375 Preferred Dividend and US$0.52 Common Dividend

Reviewed by Simply Wall St

Hartford Insurance Group (NYSE:HIG) recently announced dividends for both preferred and common stock, reflecting its commitment to shareholder value. The common stock dividend declaration likely played a role in the company's 2% share price increase over the past week, outpacing the broader market's 1% rise. This performance is notable considering the overall market faced downward pressure, with major indexes like the Dow Jones and S&P 500 slipping after reaching record highs. The company's resilience amid this volatility could highlight investor confidence tied to the dividend announcements. Additionally, while other sectors faced challenges, such as significant declines in stocks like Walmart due to weak outlooks, Hartford managed to sustain a positive trajectory. This ability to buck broader market trends suggests supportive fundamentals behind the stock's recent movement, even as broader external pressures influenced the market landscape.

Click here and access our complete analysis report to understand the dynamics of Hartford Insurance Group.

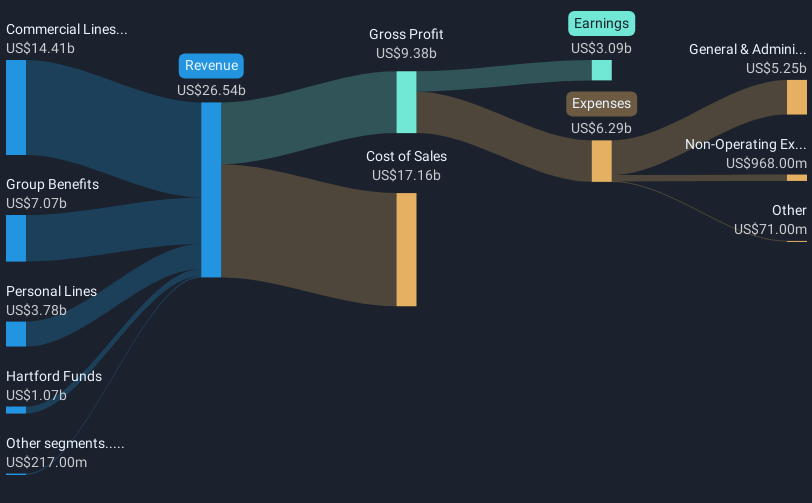

Over the past five years, Hartford Insurance Group has delivered a total shareholder return of 133.01%, reflecting robust performance amidst varied market conditions. A key driver has been steady earnings growth at an average of 10% annually, with recent accelerated growth of 24.4% over the last year. This growth is underpinned by consistent earnings results, with substantial quarterly revenue and net income increases, such as the Q4 2024 revenue of US$6.88 billion and net income of US$853 million. Another constructive factor was the company's shareholder-friendly actions, including the continued buyback plan initiated in July 2022, through which over 35 million shares were repurchased, bolstering share value.

Complementing these metrics, Hartford's dividend strategy has been influential, with an 11% rise in the quarterly common dividend in October 2024. Meanwhile, the recent name change to The Hartford Insurance Group, Inc., may also signal a renewed corporate focus or strategic transformation. Despite lagging behind the US market’s 23.7% return last year, Hartford exceeded the US Insurance industry's 19% return during that period, highlighting its relative strength in the industry.

- See whether Hartford Insurance Group's current market price aligns with its intrinsic value in our detailed report

- Assess the potential risks impacting Hartford Insurance Group's growth trajectory—explore our risk evaluation report.

- Is Hartford Insurance Group part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hartford Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIG

Hartford Insurance Group

Provides insurance and financial services to individual and business customers in the United States, the United Kingdom, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives