- United States

- /

- Insurance

- /

- NYSE:HCI

HCI Group, Inc. Released Earnings Last Week And Analysts Lifted Their Price Target To US$51.00

Investors in HCI Group, Inc. (NYSE:HCI) had a good week, as its shares rose 4.7% to close at US$44.53 following the release of its annual results. It was an okay report, and revenues came in at US$242m, approximately in line with analyst estimates leading up to the results announcement. Earnings are an important time for investors, as they can track a company's performance, look at what top analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether analysts have changed their earnings models, following these results.

View our latest analysis for HCI Group

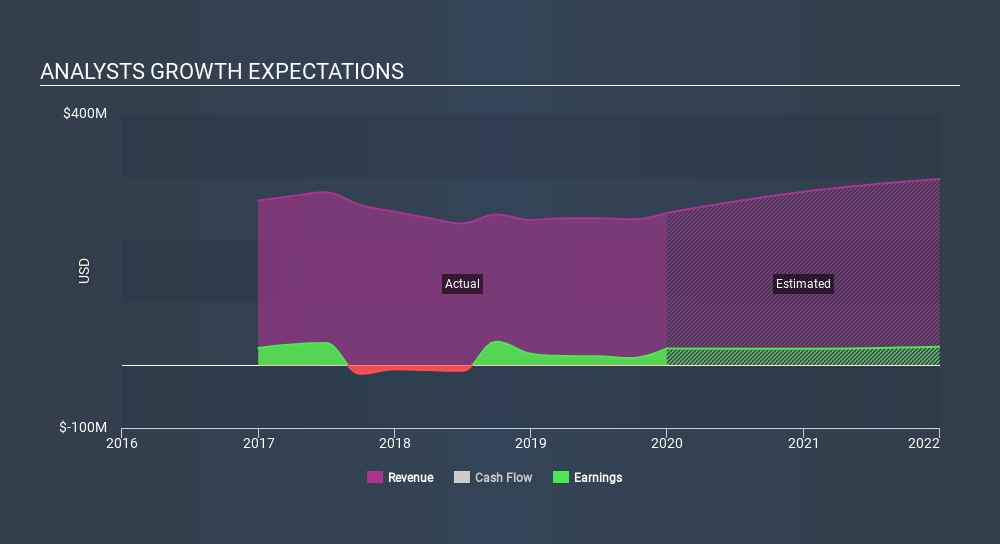

Taking into account the latest results, the latest consensus from HCI Group's twin analysts is for revenues of US$276.2m in 2020, which would reflect a meaningful 14% improvement in sales compared to the last 12 months. Prior to the latest earnings, analysts were forecasting revenues of US$248.4m in 2020, and did not provide an EPS estimate. It looks like there's been a clear increase in optimism around HCI Group, given the decent improvement in revenue estimates after the latest results.

The average analyst price target rose 6.3% to US$51.00, with analysts clearly having become more optimistic about HCI Group's prospects following these results.

It can also be useful to step back and take a broader view of how analyst forecasts compare to HCI Group's performance in recent years. For example, we noticed that HCI Group's rate of growth is expected to accelerate meaningfully, with revenues forecast to grow at 14%, well above its historical decline of 4.4% a year over the past five years. Compare this against analyst estimates for the wider market, which suggest that (in aggregate) market revenues are expected to grow 1.2% next year. Although HCI Group's revenues are expected to improve, it seems that analysts are also expecting it to grow faster than the wider market.

The Bottom Line

The biggest takeaway for us from these new estimates is the bullish forecast for profits next year. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider market. There was also a nice increase in the price target, with analysts feeling that the intrinsic value of the business is improving.

At least one of HCI Group's twin analysts has provided estimates out to 2021, which can be seen for free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:HCI

HCI Group

Engages in the property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses in the United States.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives