- United States

- /

- Insurance

- /

- NYSE:FIHL

There Is A Reason Fidelis Insurance Holdings Limited's (NYSE:FIHL) Price Is Undemanding

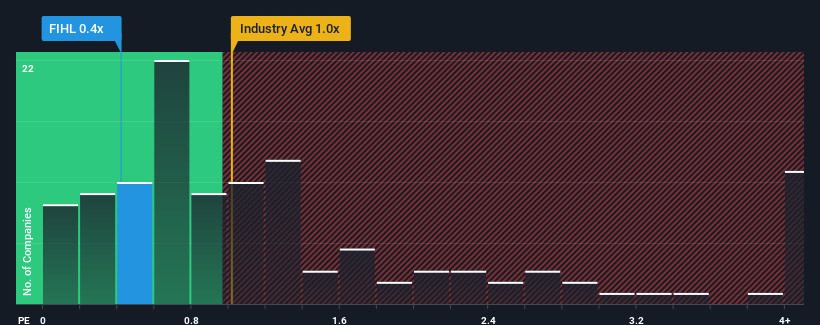

When you see that almost half of the companies in the Insurance industry in the United States have price-to-sales ratios (or "P/S") above 1x, Fidelis Insurance Holdings Limited (NYSE:FIHL) looks to be giving off some buy signals with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Fidelis Insurance Holdings

How Fidelis Insurance Holdings Has Been Performing

Fidelis Insurance Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fidelis Insurance Holdings.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Fidelis Insurance Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 143% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue growth is heading into negative territory, declining 33% over the next year. With the industry predicted to deliver 6.3% growth, that's a disappointing outcome.

With this information, we are not surprised that Fidelis Insurance Holdings is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Fidelis Insurance Holdings' P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that Fidelis Insurance Holdings maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Fidelis Insurance Holdings' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Before you settle on your opinion, we've discovered 2 warning signs for Fidelis Insurance Holdings that you should be aware of.

If you're unsure about the strength of Fidelis Insurance Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FIHL

Fidelis Insurance Holdings

A specialty insurer, provides insurance and reinsurance solutions in Bermuda, the Republic of Ireland, and the United Kingdom.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives