- United States

- /

- Insurance

- /

- NYSE:EG

Everest Group (EG): Examining Valuation Following Recent Share Price Fluctuations

Reviewed by Kshitija Bhandaru

See our latest analysis for Everest Group.

Everest Group’s share price has experienced a bumpy ride this year, dropping 4.6% year-to-date and recently dipping to $346.69. The bigger story, however, is the 1-year total shareholder return of -10%, which stands in contrast to the company’s strong three-year and five-year total returns of 36% and 92% respectively. While momentum has cooled off in the short term, the longer-term track record suggests there may be more to consider for investors who look past recent volatility.

If you’re weighing what else the market has to offer right now, it could be the perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership

The recent pullback in Everest Group shares raises an intriguing question for investors: is the market overlooking hidden value in the stock, or is all future growth already reflected in today’s price?

Most Popular Narrative: 10.3% Undervalued

Everest Group's most popular narrative points to a fair value that is over 10% above the current share price, suggesting overlooked upside potential as the consensus leans higher than where the stock trades today.

Expansion into international and specialty insurance lines, including engineering, renewable energy, marine, and accident business, is leveraging global economic growth and increasing insurance penetration in emerging markets. This diversification is already delivering double-digit premium growth and is expected to provide sustained long-term revenue and earnings growth.

Want to know what really powers this valuation? The narrative centers on outsized future earnings growth, margin expansion, and a bold call on profit multiples that are rarely seen in this sector. Ready to uncover the exact profit forecasts and dramatic changes in margins that justify this target?

Result: Fair Value of $386.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising catastrophe risks and intensifying competition could quickly challenge Everest Group’s margin outlook and disrupt the bullish narrative currently driving valuations.

Find out about the key risks to this Everest Group narrative.

Another View: Looking at Valuation Ratios

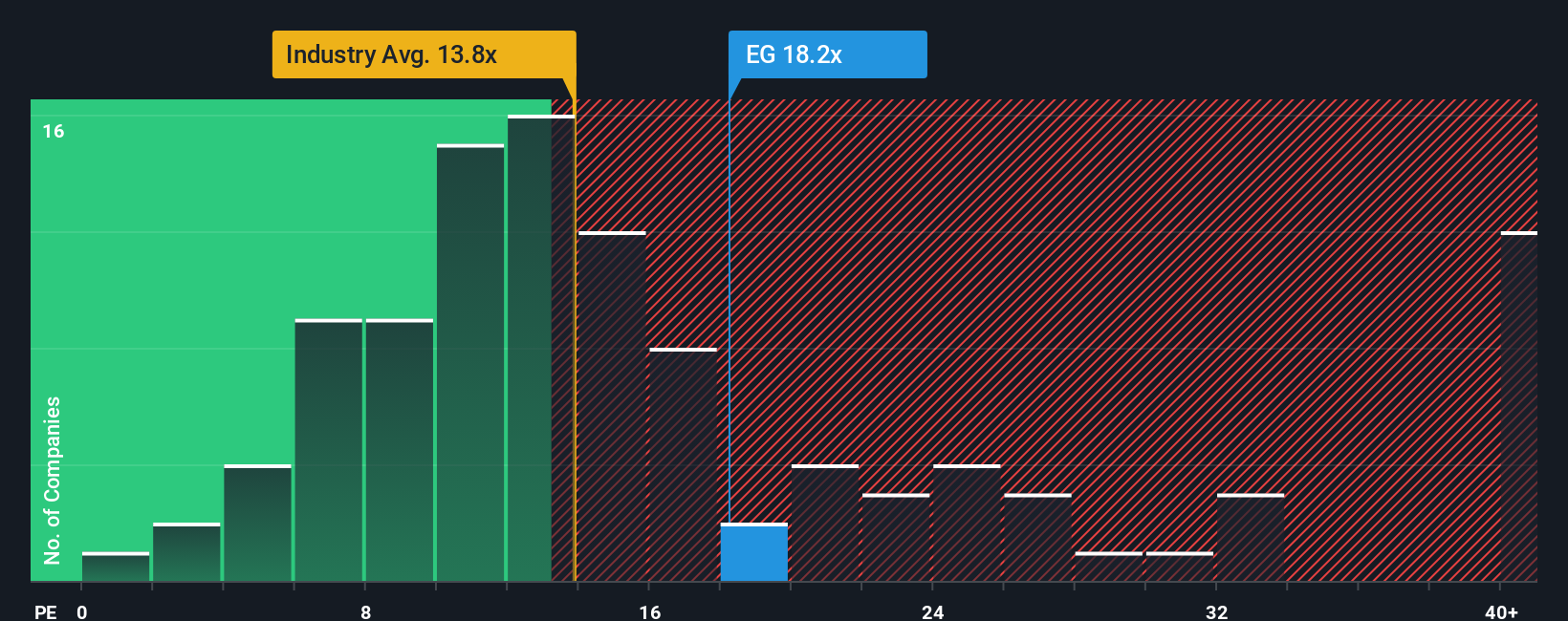

While long-term growth expectations suggest upside for Everest Group, its price-to-earnings ratio of 18.2x is notably higher than both its US insurance peers at 13.8x and the peer average of 13.6x. However, it remains below the fair ratio the market could eventually move towards, at 29.3x. Does this premium signal confidence in Everest’s earnings quality, or does it highlight risk if expectations falter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Everest Group Narrative

If you see the story differently or want to dive into the numbers firsthand, you can craft your own thesis in just a few minutes with Do it your way.

A great starting point for your Everest Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Every smart investor gives themselves an edge by keeping tabs on emerging sectors and hidden gems. Don’t let opportunity pass by. Set your sights on these compelling screens now:

- Maximize your portfolio's growth potential by checking out these 892 undervalued stocks based on cash flows, which is packed with companies trading below their intrinsic worth and positioned for a strong rebound.

- Boost your returns with steady cash flow by tapping into these 19 dividend stocks with yields > 3%, focusing on stocks that consistently reward shareholders with yields above 3%.

- Ride the wave of innovation by targeting these 24 AI penny stocks, featuring AI-driven businesses that are transforming today’s industries and shaping tomorrow’s winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everest Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EG

Everest Group

Through its subsidiaries, provides reinsurance and insurance products in the United States, Europe, and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives