- United States

- /

- Insurance

- /

- NYSE:BNT

Will Brookfield Wealth Solutions’ (BNT) Japan Expansion Redefine Its Global Insurance Ambitions?

Reviewed by Sasha Jovanovic

- Brookfield Wealth Solutions Ltd. recently completed a three-for-two stock split of its class A exchangeable limited voting shares and announced its first Japan-based reinsurance agreement, with Dai-ichi Frontier Life, effective October 2025.

- This move expands Brookfield Wealth Solutions' presence into Japan, one of the world's largest insurance markets, highlighting its growing international ambitions and operational reach.

- We'll explore how establishing a foothold in Japan could broaden Brookfield Wealth Solutions' investment narrative through international insurance partnerships.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Brookfield Wealth Solutions' Investment Narrative?

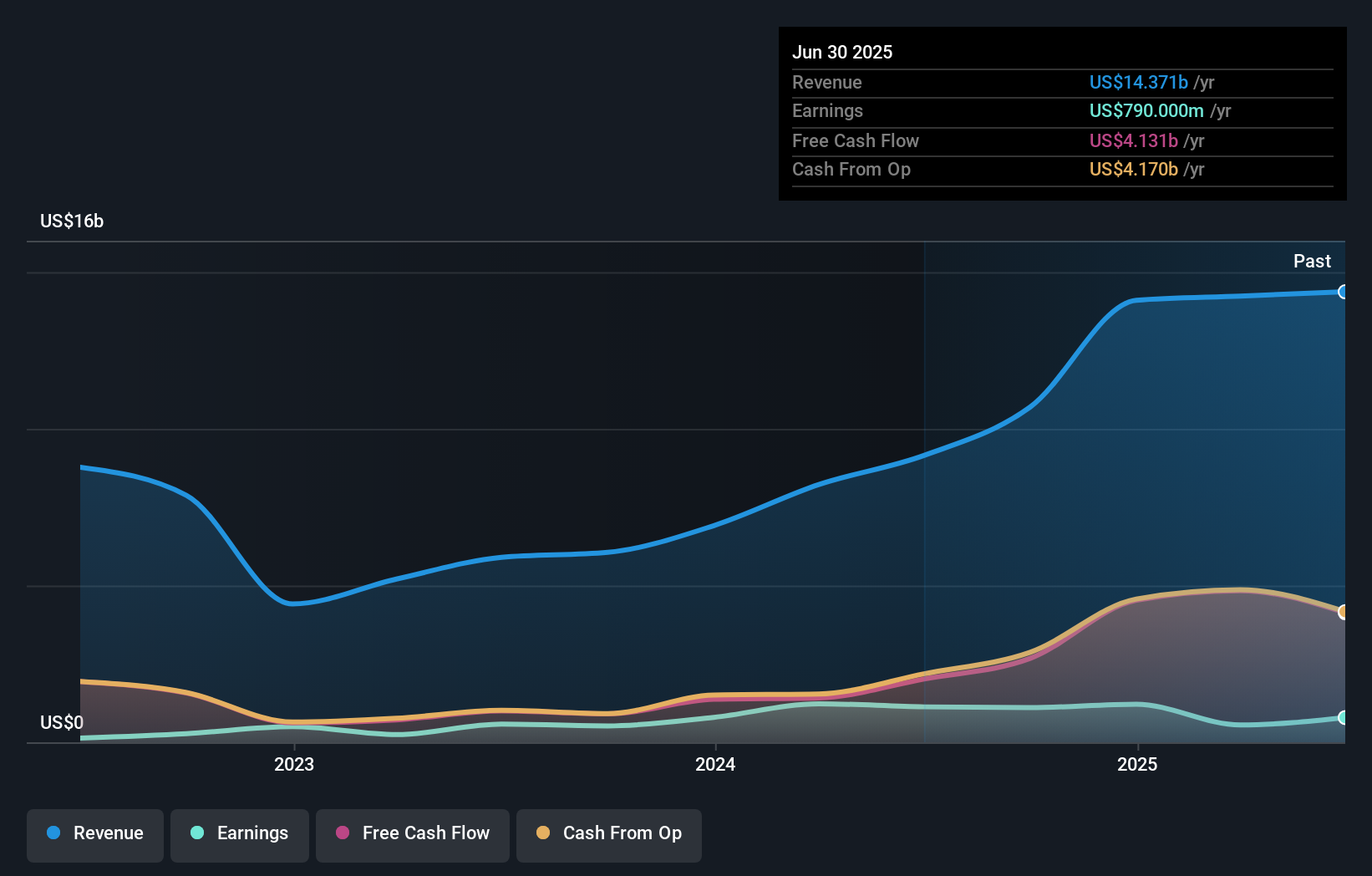

If you’re considering Brookfield Wealth Solutions, the big-picture narrative centers on a business intent on scaling its operations globally, demonstrated by its entry into Japan through a reinsurance agreement with Dai-ichi Frontier Life and the appointment of a local managing director. These recent developments signal an effort to tap into large international insurance markets, which could establish new revenue streams in the medium to long term. However, integrating into such a mature market brings its own set of risks: operational complexity, regulatory hurdles, and an uncertain earnings contribution in the early phase. While the Japan momentum supports management’s growth ambitions and offers a potential offset to recent pressure on profit margins, the short-term catalysts, such as immediate earnings growth or significant margin recovery, may remain unchanged until more deal impacts are visible in reported results. For now, many risks such as relatively high valuation and earnings inconsistency still warrant attention, even as the company’s international exposure grows.

On the other hand, unpredictable earnings trends may matter more than they seem. Brookfield Wealth Solutions' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 4 other fair value estimates on Brookfield Wealth Solutions - why the stock might be worth just $44.89!

Build Your Own Brookfield Wealth Solutions Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Wealth Solutions research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Brookfield Wealth Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Wealth Solutions' overall financial health at a glance.

No Opportunity In Brookfield Wealth Solutions?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Wealth Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BNT

Brookfield Wealth Solutions

Through its subsidiaries, provides retirement services, wealth protection products, and capital solutions to individuals and institutions.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives