- United States

- /

- Insurance

- /

- NYSE:BNT

Brookfield Wealth Solutions (NYSE:BNT): Evaluating Valuation After Japan Reinsurance Deal and Stock Split

Reviewed by Kshitija Bhandaru

Brookfield Wealth Solutions (NYSE:BNT) just wrapped up a three-for-two stock split and announced a major reinsurance agreement in Japan. These two moves signal a new phase in the company’s strategy and global ambitions.

See our latest analysis for Brookfield Wealth Solutions.

Momentum has been building for Brookfield Wealth Solutions, most recently after news of its Japan expansion and the three-for-two stock split. The stock’s year-to-date share price return stands at 17.04%, and investors who held on for the past year would have seen a total shareholder return of 25.26%. This is no small feat, especially as the company’s international ambitions take shape. Looking to the longer term, the three-year total shareholder return is an impressive 116.28%, underlining how strategic moves and market confidence have both paid off.

If moves like Brookfield’s global push have you curious about what’s next, this is an ideal time to broaden your outlook and discover fast growing stocks with high insider ownership

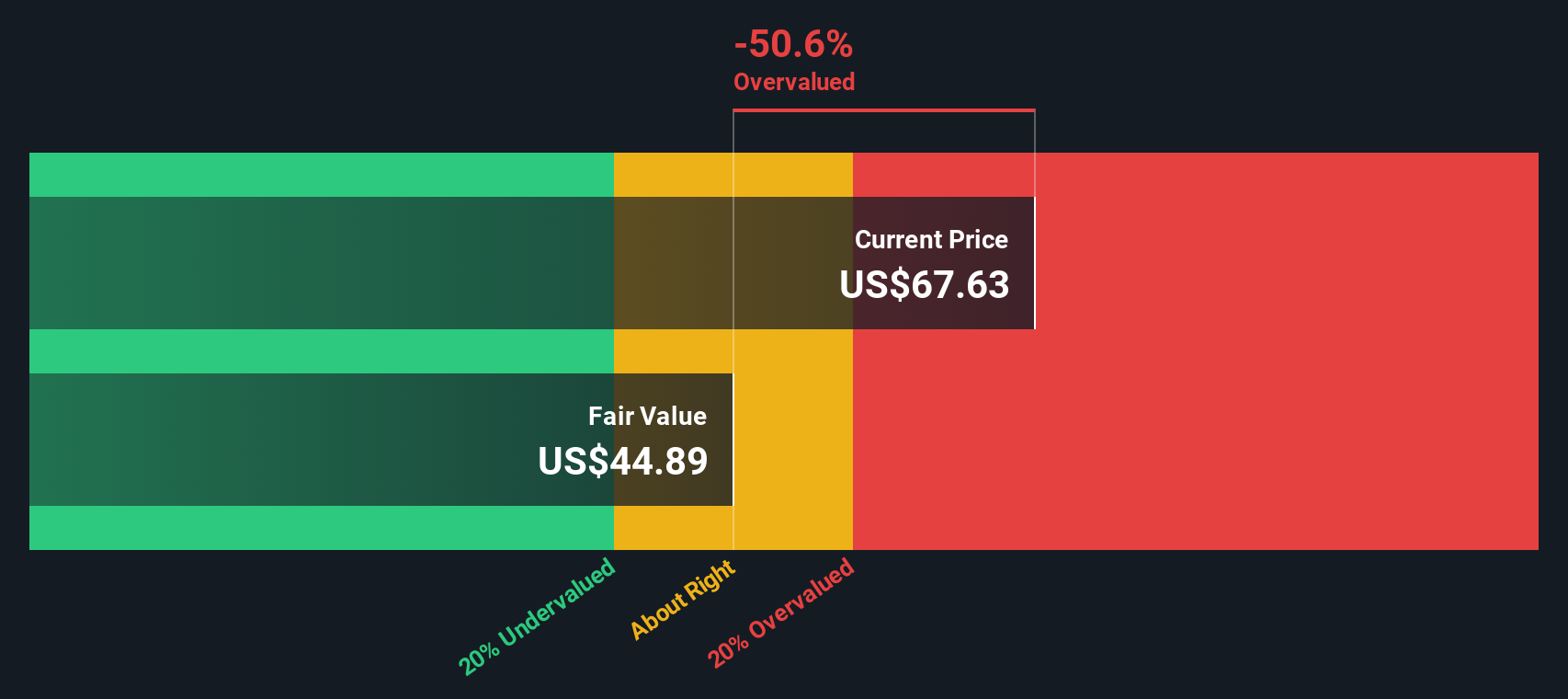

With shares now more accessible after the stock split and international growth accelerating, the real question is whether Brookfield Wealth Solutions remains undervalued, or if the market has already priced in all the future gains.

Price-to-Earnings of 17.3x: Is it justified?

Brookfield Wealth Solutions is trading at a price-to-earnings ratio of 17.3x, which is considerably higher than its industry peers and not justified by recent performance.

The price-to-earnings (P/E) ratio shows what investors are willing to pay per dollar of earnings. For insurance companies, it is a widely used benchmark to gauge whether a stock is expensive or cheap relative to its profit generation.

BNT’s P/E ratio stands well above the industry average of 13.8x and the peer group average of 11.7x. This premium signals that the market has higher expectations for future profit growth. However, BNT’s recent earnings have contracted sharply. While the company’s P/E is below the broader US market (18.5x), the elevated multiple compared to insurance peers may not be fully supported at this time.

Given this context, BNT appears expensive relative to comparable companies in the insurance space, and investors should think carefully about whether its future earnings can justify this valuation.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 17.3x (OVERVALUED)

However, risks such as weaker net income trends or a reversal in international expansion could quickly challenge the current optimism around Brookfield Wealth Solutions.

Find out about the key risks to this Brookfield Wealth Solutions narrative.

Another View: Discounted Cash Flow Model

When looking at Brookfield Wealth Solutions through the SWS DCF model, the picture changes. The DCF model values the company at $42.65 per share, while it currently trades at $44.78. That means BNT might actually be overvalued right now, depending on how you view its future growth.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookfield Wealth Solutions for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookfield Wealth Solutions Narrative

If you have your own take on Brookfield Wealth Solutions or want to dig deeper into the numbers, you can easily put together your own thesis in just a few minutes with Do it your way.

A great starting point for your Brookfield Wealth Solutions research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your potential? The best opportunities often lie beyond the obvious. Make your next move with confidence by filtering for what truly matters.

- Unlock hidden gems by scanning these 895 undervalued stocks based on cash flows for stocks trading beneath their true worth and spot potential bargains before the crowd.

- Secure steady income by exploring these 18 dividend stocks with yields > 3%, featuring companies offering yields above 3%. This can be useful for bolstering your portfolio's resilience.

- Get ahead of cutting-edge technological shifts by targeting these 25 AI penny stocks, where innovation meets strong financial momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Wealth Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BNT

Brookfield Wealth Solutions

Through its subsidiaries, provides retirement services, wealth protection products, and capital solutions to individuals and institutions.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives