- United States

- /

- Insurance

- /

- NYSE:AON

Aon’s Valuation in Focus After Launch of Specialist Claims Solutions and New ARMStrong Partnership

Reviewed by Kshitija Bhandaru

If you have been watching Aon lately, you probably noticed some buzz following the company's introduction of Specialist Claims Solutions, a service intended to help insurers better manage complex claims and cut down on loss ratios. This move, coupled with its exclusive collaboration with ARMStrong Insurance Services to recover more missed opportunities in claims, has sharpened Aon's pitch to insurers. The news might seem like another back-office upgrade at first blush, but operational improvements like this can signal meaningful changes to a company’s bottom line and competitiveness over time.

Zooming out, Aon’s stock has posted modest gains over the past year, up a little over 2%, with relatively flat movement in recent months. While annual revenue and net income growth have been solid, rising 5% and 12% respectively, investors haven’t seen major shifts in the share price lately. Still, Aon's five-year run is impressive, with a 79% total return, hinting at steady long-term momentum even as short-term sentiment remains cautious.

With these latest initiatives in motion, is Aon offering investors a smart entry point, or has the market already priced in the upside from operational gains?

Most Popular Narrative: 14.8% Undervalued

According to the most widely followed narrative, Aon’s current valuation is considered 14.8% below fair value, indicating a notable potential upside for investors based on analyst projections and key business assumptions.

Investment in priority hires and expanding Aon Business Services (ABS) capabilities are creating capacity to fund growth initiatives and drive operational efficiencies, benefiting net margins and earnings. Despite macroeconomic uncertainties, Aon sees increased demand from clients for their risk solutions as they navigate complex trade and economic environments, supporting sustainable revenue growth.

Curious what’s fueling this undervaluation call? The projected fair value hinges on some surprising assumptions around Aon’s future margins, earnings, and how its profit multiple stacks up to the wider insurance market. What bold forecasts are hidden in the details? The numbers behind this narrative challenge conventional expectations and highlight what sets this valuation apart.

Result: Fair Value of $414 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued macroeconomic volatility or rising debt costs could easily challenge these upbeat growth projections and put pressure on Aon's future valuation.

Find out about the key risks to this Aon narrative.Another View: Valuing Aon by Comparison

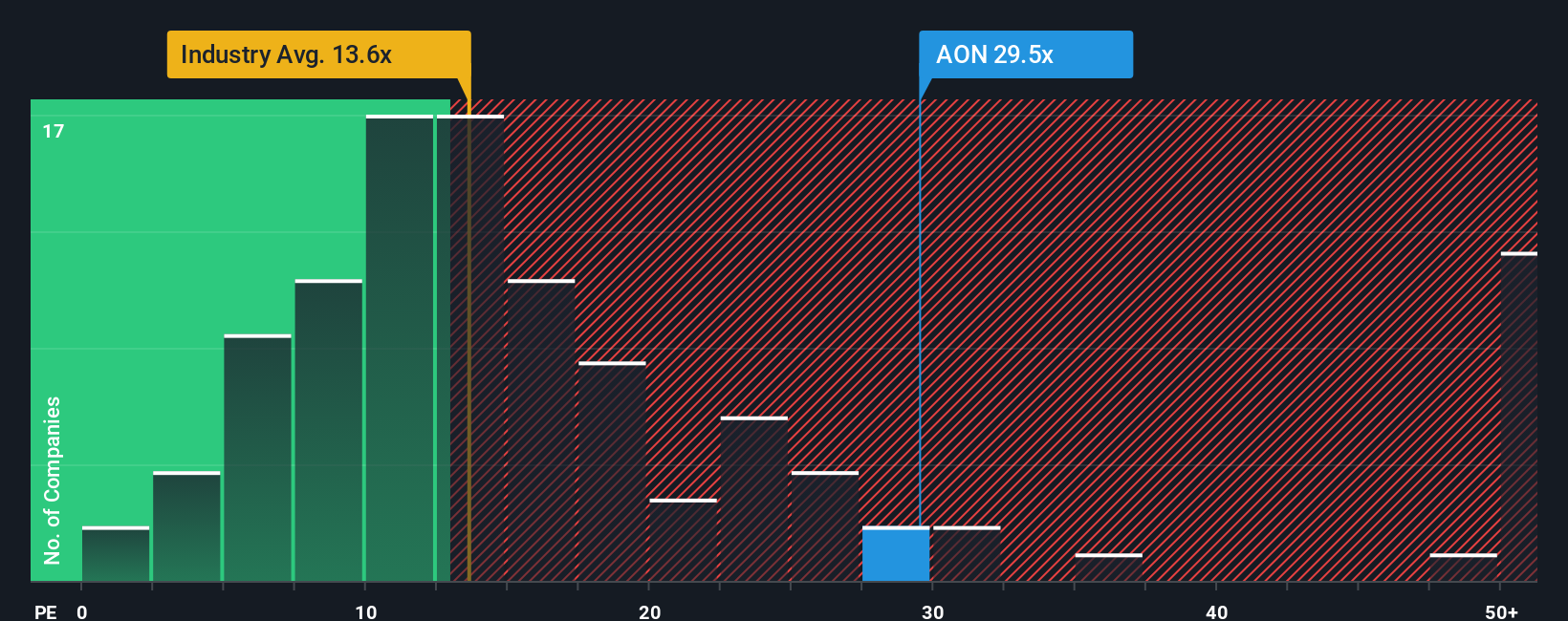

Taking a different approach, some analysts compare Aon's value to the wider US insurance industry and find the shares look expensive using this lens. The question becomes whether growth and quality justify paying a premium, or if enthusiasm is running ahead of reality.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aon Narrative

If you'd rather chart your own course or see the story behind the numbers for yourself, building your own analysis takes just a few minutes. Do it your way.

A great starting point for your Aon research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your opportunities to a single stock when there is a world of powerful, emerging trends at your fingertips. Step ahead of the crowd and uncover investments others might miss by letting Simply Wall Street’s expert tools guide your next move.

- Maximize your yield by targeting high-payout businesses and unlock fresh opportunities in dividend stocks with yields > 3% for reliable cash flow.

- Tap into the future of healthcare innovation by screening for trailblazers in medical AI and biotech with healthcare AI stocks.

- Ride the frontier of digital finance and find pioneers transforming the cryptocurrency landscape using cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AON

Aon

A professional services firm, provides a range of risk and human capital solutions worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives