- United States

- /

- Insurance

- /

- NYSE:ALL

Should Allstate’s (ALL) Leadership Overhaul and Interim CFO Appointment Prompt Investor Reassessment?

Reviewed by Sasha Jovanovic

- The Allstate Corporation recently announced a senior leadership reorganization, with Jess Merten moving from Chief Financial Officer to President of Property-Liability, John Dugenske appointed as interim CFO, and Mario Rizzo promoted to Chief Operating Officer, effective October 1, 2025.

- This significant leadership transition brings experienced executives to critical roles, potentially influencing operational decisions and strategic direction at a pivotal time for the company.

- We'll explore how the appointment of an interim CFO could affect Allstate's investment narrative and future outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Allstate Investment Narrative Recap

To be a shareholder in Allstate, you'd need to believe in its ability to grow in a highly competitive property and casualty insurance market by leveraging technology, expanding digitally enabled products, and driving efficiency. The recent executive reshuffle, with an interim CFO in place, does not materially impact the short-term catalyst of profitable policy growth, but it does bring some uncertainty to leadership stability, currently the biggest risk given persistent challenges from evolving customer needs and regulatory pressures.

Among recent announcements, Allstate’s approval of a quarterly dividend of US$1.00 per share is particularly relevant. This signals management’s ongoing confidence in cash generation despite leadership changes and ongoing catastrophe-related losses, supporting the underlying catalyst of sustained earnings and proactive capital return to shareholders.

In contrast, risks around management transition and the evolving regulatory environment are factors investors should be aware of as they weigh Allstate’s...

Read the full narrative on Allstate (it's free!)

Allstate's narrative projects $76.3 billion revenue and $4.3 billion earnings by 2028. This requires 4.9% yearly revenue growth and a $1.4 billion decrease in earnings from $5.7 billion today.

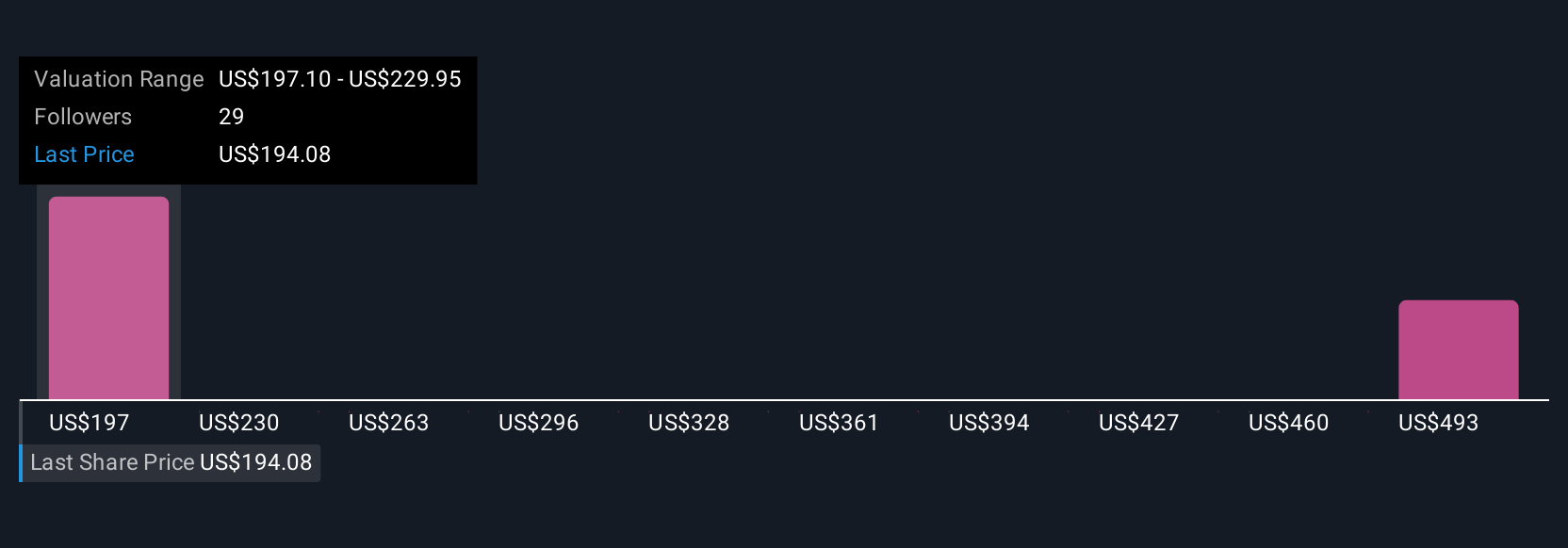

Uncover how Allstate's forecasts yield a $229.68 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community members valued Allstate between US$188 and US$602 per share, reflecting wide differences in growth expectations. While investors remain focused on Allstate’s investment in digital products and stable dividends, the effect of increased regulatory oversight could ultimately shape future results, explore more perspectives inside.

Explore 6 other fair value estimates on Allstate - why the stock might be worth 11% less than the current price!

Build Your Own Allstate Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allstate research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Allstate research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allstate's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALL

Allstate

Provides property and casualty, and other insurance products in the United States and Canada.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives