- United States

- /

- Insurance

- /

- NYSE:ALL

Does the Recent 7.5% Drop Signal an Opportunity in Allstate for 2025?

Reviewed by Bailey Pemberton

Deciding what to do with Allstate stock right now? You are not alone. Whether you have held it through its impressive five-year climb, or are just now eyeing headlines, Allstate’s story has taken a few interesting turns lately. After years of rock-steady gains, up 67.0% over three years and an impressive 146.2% in five, the stock is showing recent bumps in the road. In just the last month, Allstate has slid 6.0%, and in the past week alone, it dipped 7.5%. For long-term holders, it is still up modestly for the year so far at 0.9% and a bit more, 2.4%, over the last year.

These moves partly reflect shifting risk perceptions across insurers as markets digest the impact of heightened natural disaster costs and evolving regulatory conversations. Allstate in particular has drawn analyst attention as it navigates this landscape by focusing on its core strengths and adapting to an environment where pricing power and underwriting discipline are being rewarded.

So how does that translate to the big question: is Allstate stock undervalued or not? By one widely-followed valuation framework, Allstate scores a 5 out of 6, a strong mark that puts it among the more attractive picks in the insurance space right now. But knowing which valuation checks matter most, and discovering an even sharper approach, awaits as we dig into the numbers next.

Approach 1: Allstate Excess Returns Analysis

The Excess Returns valuation model is designed to estimate a company's intrinsic value by evaluating how much return it can generate over and above its cost of equity. This approach focuses on return on invested capital and projected growth, offering insight into whether a business is adding significant value for shareholders beyond basic equity costs.

For Allstate, key indicators used in the model include a Book Value of $83.40 per share, a Stable EPS of $25.44 per share (based on weighted future Return on Equity estimates from 11 analysts), and an Average Return on Equity of 23.01%. The company’s Cost of Equity stands at $7.49 per share, with an impressive Excess Return of $17.95 per share. This indicates robust earnings power. The Stable Book Value is projected at $110.54 per share, according to consensus from 10 analysts.

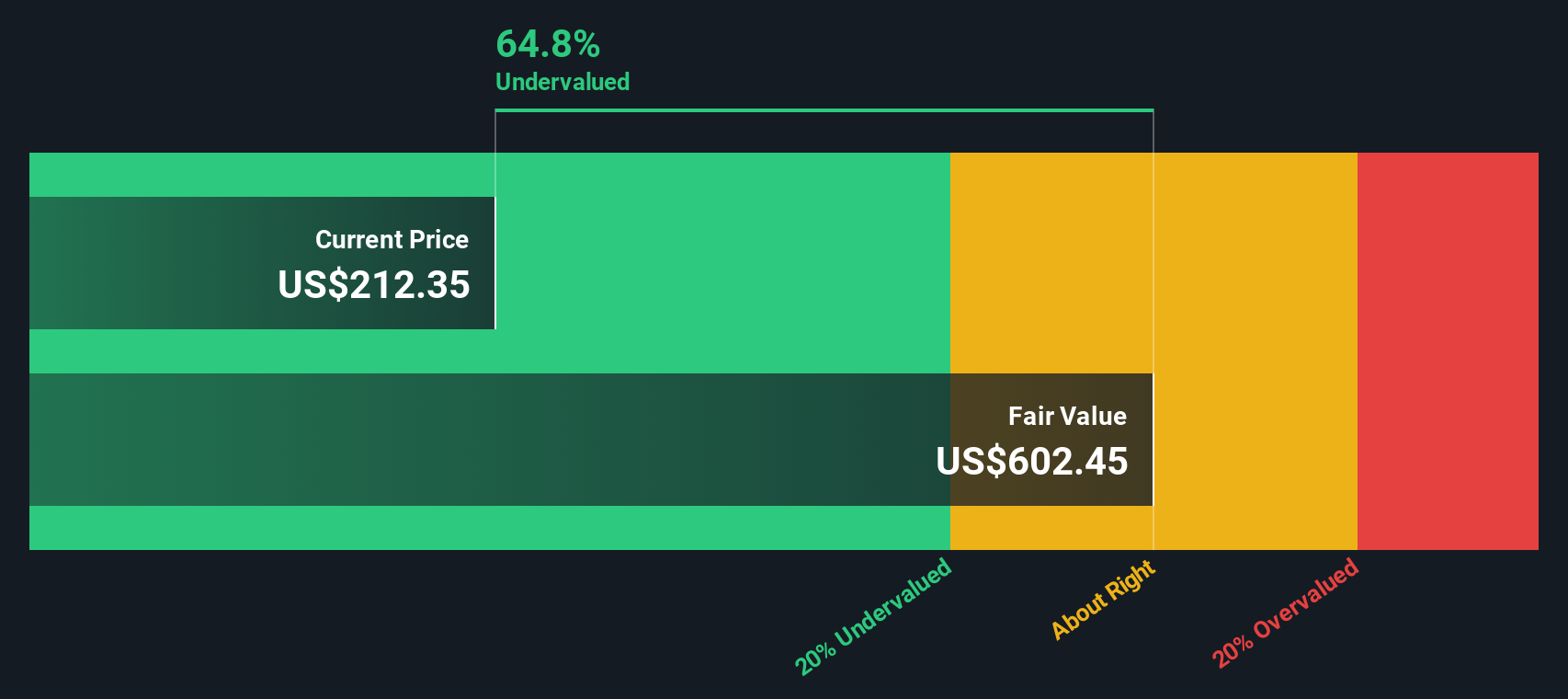

Based on these inputs, the Excess Returns model estimates Allstate’s intrinsic value at $596.15 per share, implying the stock is currently 67.5% undervalued compared to its market price. This sizeable discount signals that investors may be underappreciating the company's future profitability and earnings consistency.

Result: UNDERVALUED

Our Excess Returns analysis suggests Allstate is undervalued by 67.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Allstate Price vs Earnings

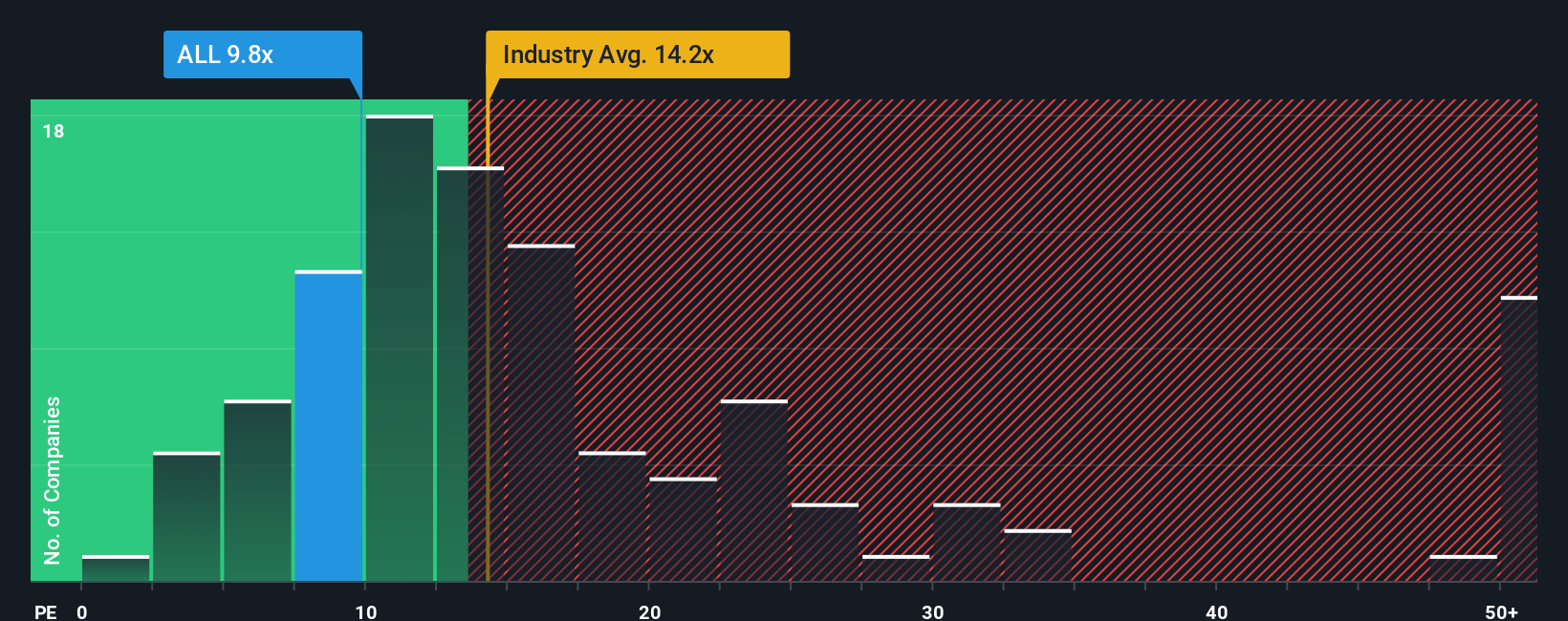

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it directly links a company’s share price to its earnings. For established insurers like Allstate, consistent profitability makes the PE multiple particularly meaningful. It helps investors gauge what they are paying for each dollar of earnings, which is often central to decision-making for mature, stable businesses.

Determining what counts as a “fair” PE often depends on expectations of growth and the level of risk. Higher growth and lower risk typically justify a higher PE since investors are willing to pay more for stronger, steadier earnings trajectories. Conversely, if earnings growth is modest or the outlook riskier, a lower PE is appropriate.

Allstate’s current PE stands at 8.95x, which is well below the insurance industry average of 13.91x and also undercuts the peer group average of 11.96x. However, these benchmarks only tell part of the story. Simply Wall St’s “Fair Ratio” calculates a bespoke PE for Allstate, factoring in its unique blend of earnings growth, profit margins, industry conditions, company size, and risks. In Allstate’s case, the Fair Ratio is 10.66x. This approach is considered more appropriate than using broad peer or industry averages because it tailors expectations to the specific company rather than applying a one-size-fits-all standard.

Given Allstate's actual PE of 8.95x compared to a Fair Ratio of 10.66x, the stock appears attractively valued based on its underlying fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Allstate Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple, dynamic story you create that connects your personal view of Allstate’s future, such as growth drivers, risks, and likely performance, to specific financial forecasts and a fair value estimate. It links the company’s evolving story to hard numbers, so instead of just relying on ratios or models, you build your own forecast and can immediately see the impact on what you think the stock is worth. Narratives are available right now on the Simply Wall St Community page, used by millions of investors, and are incredibly easy to try out.

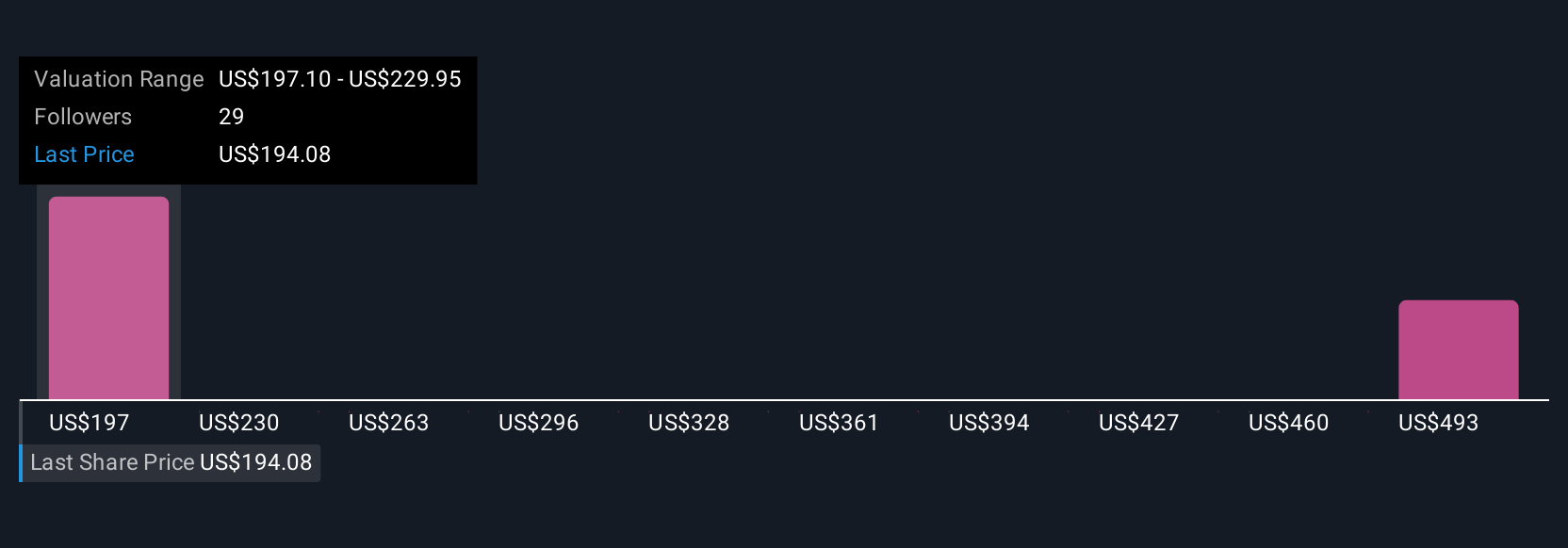

By building a Narrative, you can instantly compare your estimated fair value to the current market price. This helps you decide if Allstate is a buy, hold, or sell based on your view, not just consensus opinion. Narratives are continuously updated as new earnings reports or news emerge, so your perspective always stays relevant. For example, one Allstate Narrative sees the company going digital and expanding profits, justifying a $275 fair value. Another Narrative warns of industry risks and predicts a fair value near $157. This demonstrates how powerful, practical, and personalized this approach can be for your investment decision.

Do you think there's more to the story for Allstate? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALL

Allstate

Provides property and casualty, and other insurance products in the United States and Canada.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives