- United States

- /

- Insurance

- /

- NYSE:AJG

Arthur J. Gallagher (AJG): Assessing Valuation for a Consistent Compounder

Reviewed by Kshitija Bhandaru

See our latest analysis for Arthur J. Gallagher.

Arthur J. Gallagher’s share price has seen some turbulence lately, but with a healthy year-to-date share price return of 9.4% and a solid one-year total shareholder return of 5.65%, the long-term picture remains one of steady value creation and robust multi-year momentum.

If you’re curious about other companies combining steady growth with strong management, this is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares trading just below their analyst price target and valuation metrics sitting near long-term averages, investors might wonder if Arthur J. Gallagher presents a hidden buying opportunity, or if the market has already factored in its next chapter of growth.

Most Popular Narrative: 11% Undervalued

Arthur J. Gallagher's most widely followed valuation narrative assigns a fair value of $339.20 to the stock, about 11% higher than its last close price. The gap reflects optimism around future profitability and organic growth, despite industry headwinds.

Broader adoption of digital tools, enhanced data analytics, and early-stage AI projects within the company's operations are producing measurable efficiency improvements and margin expansion. This is positioning net margins and overall profitability for continued long-term growth.

Want to know the financial engine fueling this optimistic price target? The narrative hinges on aggressive expectations for recurring revenues, margin expansion, and bold advances in operational technology. Discover which ambitious numbers underpin this valuation and how analysts see the next chapter unfolding.

Result: Fair Value of $339.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in property insurance rates and an overreliance on acquisitions could challenge Arthur J. Gallagher’s optimistic growth outlook in the years ahead.

Find out about the key risks to this Arthur J. Gallagher narrative.

Another View: Market Multiples Tell a Different Story

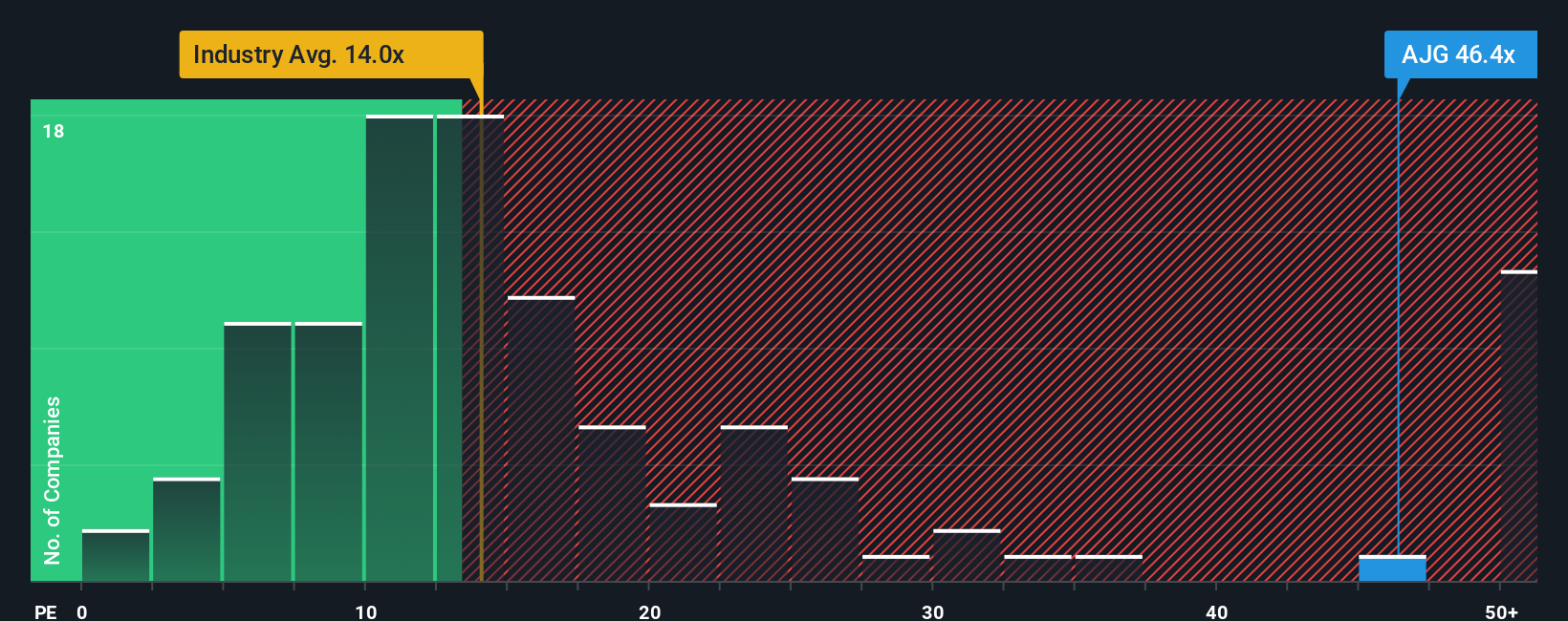

Looking at valuation through the lens of price-to-earnings, Arthur J. Gallagher is trading at 47.1 times earnings, which is more expensive than both its industry peers (52.2x) and the wider US insurance sector (13.9x). The fair ratio stands at 20.5x, suggesting the market could move lower over time. Is the premium deserved, or does it signal potential risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arthur J. Gallagher Narrative

If you see things differently or believe your own insights might reveal a new angle, you’re welcome to dive into the numbers and share your perspective in just a few minutes. Do it your way

A great starting point for your Arthur J. Gallagher research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for a single opportunity. Stay ahead of the market and uncover stocks others overlook by using these exclusive screeners today.

- Capture reliable income streams by targeting these 19 dividend stocks with yields > 3% that consistently deliver yields above the market average.

- Power up your portfolio by tapping into these 33 healthcare AI stocks that are shaping the future of medicine with artificial intelligence breakthroughs.

- Snap up undervalued opportunities before the crowd by reviewing these 898 undervalued stocks based on cash flows primed for potential upside based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives