- United States

- /

- Insurance

- /

- NYSE:AIZ

How Investors May Respond To Assurant (AIZ) Earning Forbes Best Employer Recognition and Strengthening Growth Narrative

Reviewed by Sasha Jovanovic

- Earlier this month, Assurant, Inc. was recognized by Forbes as one of the World’s Best Employers for 2025, marking its first appearance on the list and highlighting its efforts in employee experience and inclusive culture.

- This acknowledgement comes alongside positive analyst evaluations that cite Assurant’s strong fundamental outlook, increased institutional investor interest, and recent technology acquisitions aimed at boosting efficiency and growth potential.

- To explore how recognition as a top global employer could impact Assurant’s growth-oriented investment narrative, we’ll examine the implications for long-term performance.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Assurant Investment Narrative Recap

Assurant appeals to investors who see value in its growth through digital innovation and recurring device protection revenues, but remain mindful of regulatory challenges in lender-placed insurance. The company’s recent recognition by Forbes as one of the World’s Best Employers is unlikely to materially affect its most important short-term catalyst, upcoming earnings performance, or to shift attention away from ongoing regulatory risks in core housing products.

Amid these developments, the recent acquisition of OptoFidelity’s mobile device automation portfolio stands out. This move supports the efficiency and scale of Assurant’s Global Lifestyle segment, directly connecting to growth drivers around device protection, yet it also highlights the importance of adapting to changing technology cycles in the sector.

However, investors should also be aware that ongoing regulatory scrutiny in lender-placed insurance could have...

Read the full narrative on Assurant (it's free!)

Assurant's outlook projects $14.2 billion in revenue and $1.2 billion in earnings by 2028. This assumes a 4.9% annual revenue growth rate and a $483 million increase in earnings from the current $717 million level.

Uncover how Assurant's forecasts yield a $243.50 fair value, a 11% upside to its current price.

Exploring Other Perspectives

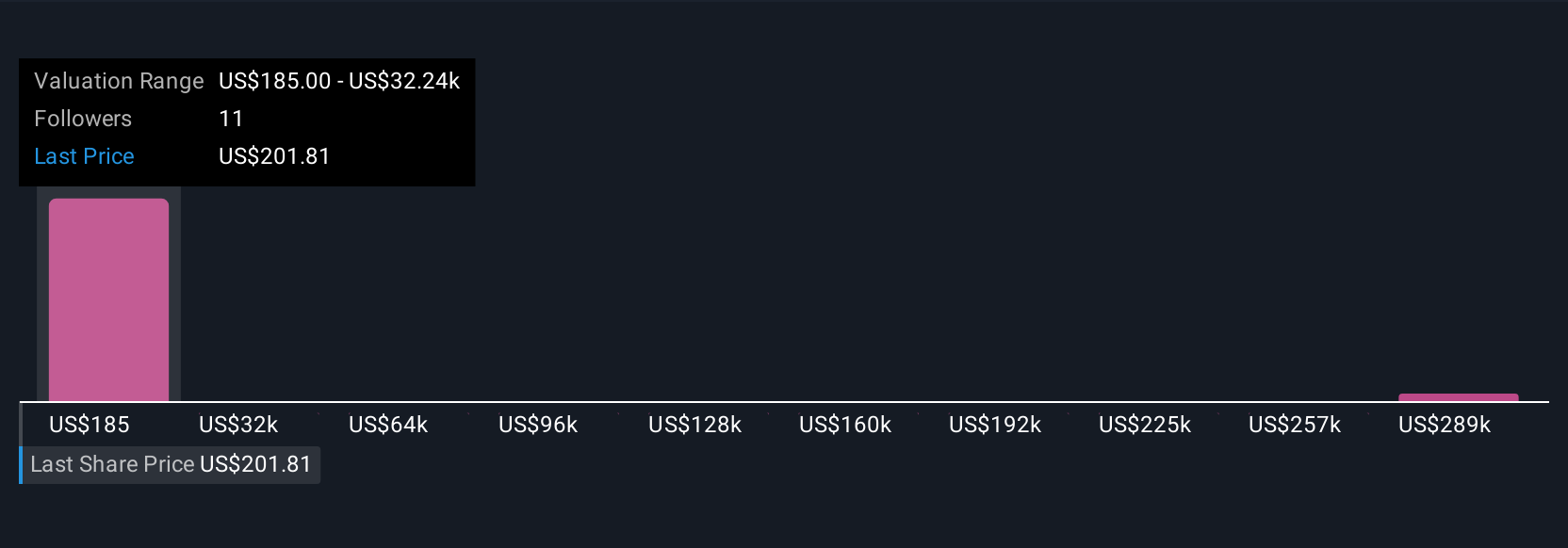

Simply Wall St Community members provided four fair value estimates for Assurant, ranging from US$185 to over US$320,700 per share. Such diverging outlooks reflect how risks like increased regulation in housing insurance may shape performance differently depending on your view, explore these perspectives to inform your assessment.

Explore 4 other fair value estimates on Assurant - why the stock might be worth 16% less than the current price!

Build Your Own Assurant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Assurant research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Assurant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Assurant's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIZ

Assurant

Provides protection services to connected devices, homes, and automobiles in North America, Latin America, Europe, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives