- United States

- /

- Insurance

- /

- NYSE:AIZ

Assurant (AIZ) Partners With Evident To Revolutionize Rental Equipment Risk Management

Reviewed by Simply Wall St

Assurant (AIZ) has seen a 7% increase in its share price over the last quarter, with several important developments potentially contributing to this movement. The announcement of a partnership with Evident to enhance risk management within the commercial equipment rental industry likely played a role, aiming to provide seamless insurance verification and improved customer protection. Additionally, the company's launch of HOIVerify Origination, a solution designed to streamline insurance verification for mortgages, may have appealed to investors. Amidst a broader market that saw record highs, these initiatives likely supported Assurant’s upward trajectory, enhancing its appeal in a competitive market environment.

Be aware that Assurant is showing 1 possible red flag in our investment analysis.

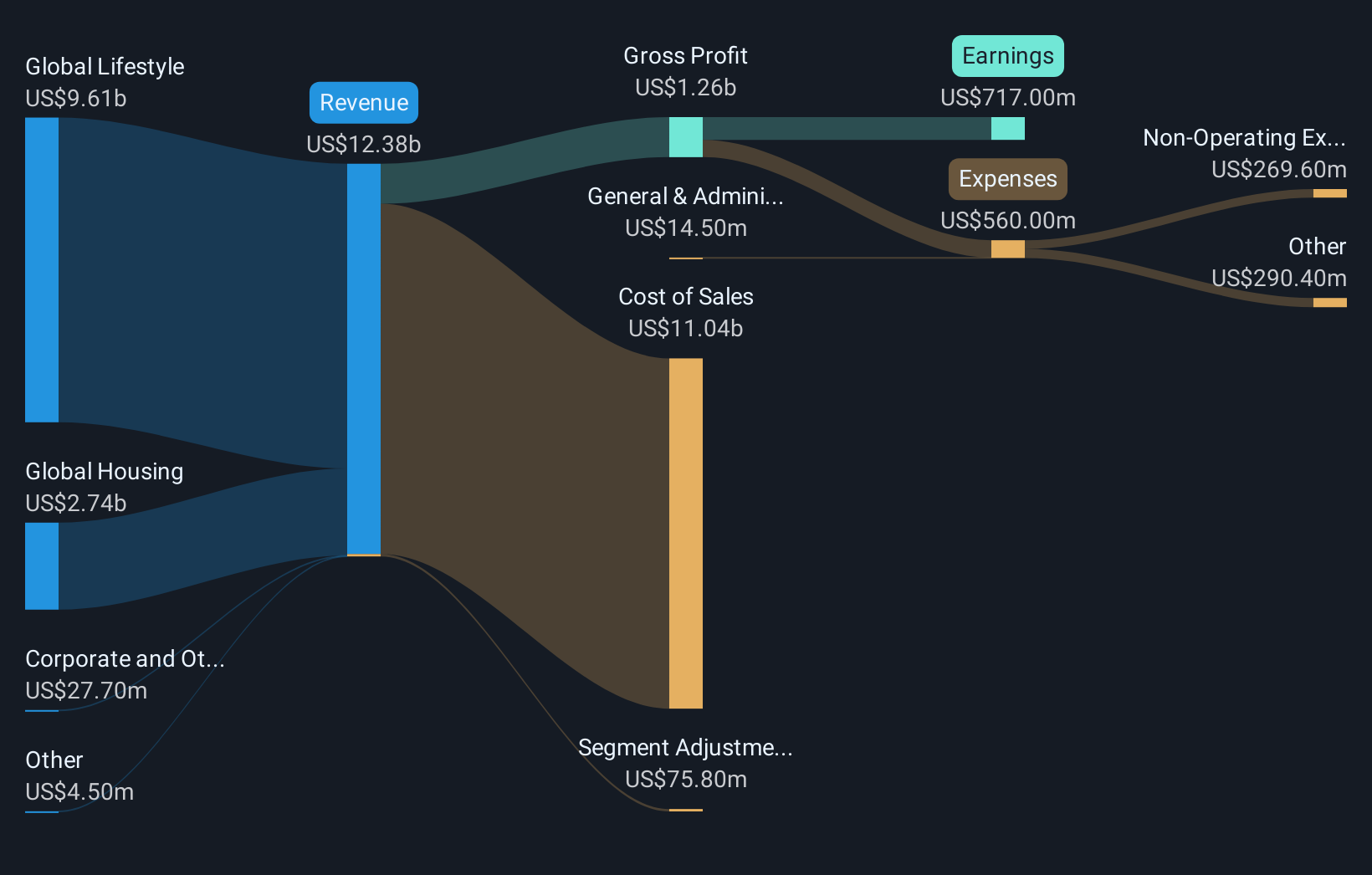

The recent initiatives by Assurant, particularly its partnership with Evident and the launch of HOIVerify Origination, have the potential to reinforce the company's narrative of operational efficiency and market expansion. These moves align with Assurant's focus on low-cost automation and device protection, aiming to sustain growth amidst the proliferation of connected devices. This strategy is crucial as revenue and earnings are anticipated to rise, with earnings expected to reach US$1.2 billion in three years.

Looking at a broader horizon, Assurant's shares have achieved an impressive total return of 96.52% over five years. However, over the past year, the company underperformed the US market, which returned 20.5%. In contrast, Assurant surpassed the US Insurance industry, which returned only 1.3%. These dynamics underscore a mixed performance but highlight the company's resilience in a competitive sector.

Despite the recent 7% quarterly increase in the company's share price, there remains a gap when juxtaposed with the consensus analyst price target of US$241.00. This represents an approximate 10.8% upside potential from its current price of US$211.10. As Assurant integrates these innovations and potentially strengthens its revenue streams, it may better position itself to align more closely with the price target, contingent on market conditions and execution of its strategic initiatives.

The valuation report we've compiled suggests that Assurant's current price could be quite moderate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIZ

Assurant

Provides protection services to connected devices, homes, and automobiles in North America, Latin America, Europe, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)