- United States

- /

- Insurance

- /

- NYSE:AIG

Will AIG’s Executive Turnover Reveal New Priorities for its North America Strategy? (AIG)

Reviewed by Sasha Jovanovic

- American International Group recently announced several executive changes, including the upcoming retirement of North America Commercial Insurance CEO Don Bailey, the future appointment of Tom Horn as CFO, EMEA, and a board resignation, with leadership transitions taking effect through the end of 2025 and into early 2026.

- These shifts mark a period of significant organizational transition for AIG at both the executive and board level, signaling a realignment of leadership during a time of evolving industry demands and company strategy.

- We’ll now consider how AIG’s new North America leadership structure and key executive transitions may shape its longer-term investment outlook.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

American International Group Investment Narrative Recap

To hold American International Group (AIG) stock, you need to believe in its ability to successfully manage industry and operational risks while capitalizing on expense discipline, digitalization, and global business demand. The recent leadership changes, including new executive appointments and board departures, are not likely to materially alter near-term performance catalysts such as upcoming earnings or stable dividend policy; nonetheless, leadership continuity remains an area investors may want to monitor, especially in the context of evolving risk factors.

Among the various updates, the retirement of Don Bailey, long-time CEO of North America Commercial Insurance, stands out. His transition marks a significant shift for AIG’s largest regional platform and will see a new leadership structure at the start of 2026. Given that North America is a key driver for underwriting improvements and distribution initiatives, any changes to execution or risk management in this area could influence how well AIG handles price competition, loss trends, and premium growth going forward.

Yet, while AIG has achieved strong recent underwriting results, investors should not overlook the growing exposure to catastrophe risk in key portfolios...

Read the full narrative on American International Group (it's free!)

American International Group's narrative projects $31.3 billion revenue and $3.8 billion earnings by 2028. This requires 4.5% yearly revenue growth and a $0.5 billion earnings increase from $3.3 billion today.

Uncover how American International Group's forecasts yield a $88.28 fair value, a 15% upside to its current price.

Exploring Other Perspectives

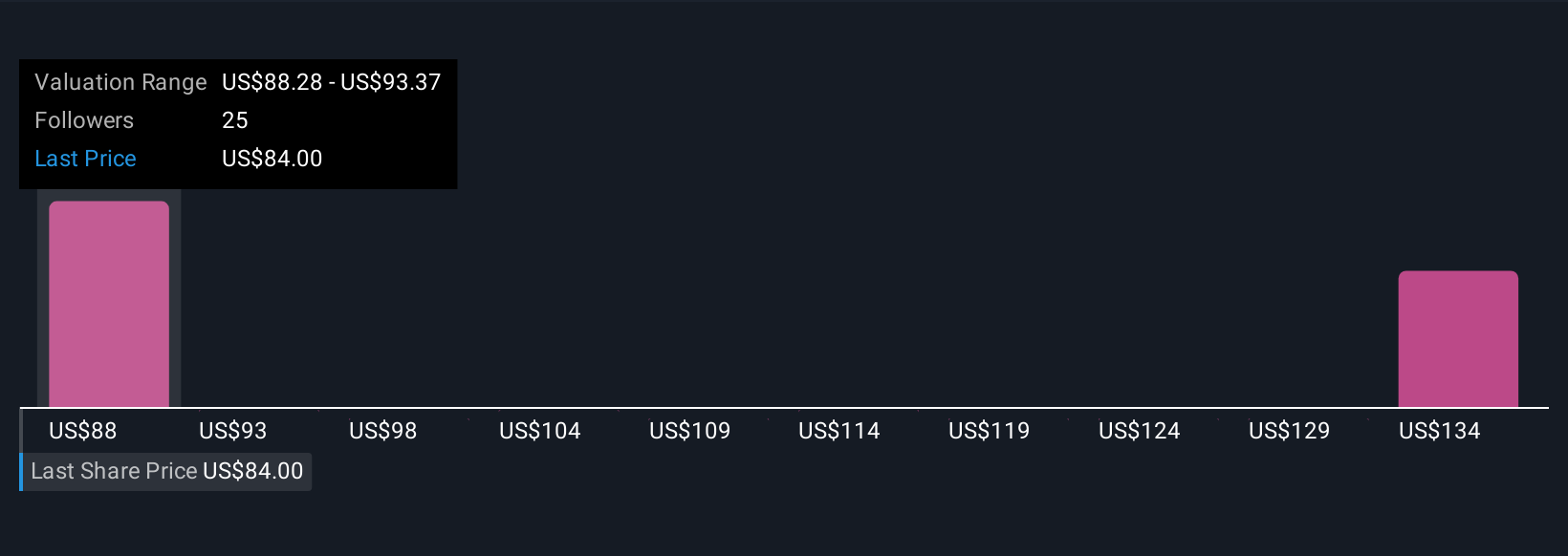

Five members of the Simply Wall St Community estimated AIG’s fair value from US$88.28 up to US$143.65 per share. Their diverse views contrast with ongoing portfolio shifts and highlight how expectations around expense management and risk concentration can lead to sharply different outlooks on AIG’s future.

Explore 5 other fair value estimates on American International Group - why the stock might be worth as much as 87% more than the current price!

Build Your Own American International Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American International Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free American International Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American International Group's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIG

American International Group

Offers insurance products for commercial, institutional, and individual customers in North America and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives