- United States

- /

- Insurance

- /

- NYSE:AIG

How AIG’s Leadership Transition May Influence Strategy and Investor Outlook (AIG)

Reviewed by Sasha Jovanovic

- American International Group, Inc. recently announced the retirement of Don Bailey, Executive Vice President and CEO of North America Commercial Insurance, effective at year-end due to health reasons, and unveiled a new leadership team for North America, effective January 1, 2026.

- This transition marks a significant shift in AIG's executive ranks, with internal promotions signaling a focus on continuity and operational stability amid leadership changes.

- We'll explore how the new North America leadership structure may shape AIG's investment outlook and ongoing operational transformation.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

American International Group Investment Narrative Recap

To be a shareholder in American International Group (AIG), you need to believe in its ability to balance operational transformation, driven by expense controls and digitalization, with ongoing exposure to industry risks like catastrophe losses and claims inflation. The recent leadership changes, including the retirement of Don Bailey and the appointment of new North America executives, signal continuity but do not have a material impact on the immediate catalyst: successfully executing on cost efficiencies and underwriting standards, while the biggest risk remains volatile catastrophe losses.

The recent appointment of Scott Hallworth as Chief Digital Officer is a relevant development, reinforcing AIG’s broader push toward digital and GenAI transformation. This move aligns directly with AIG’s key catalyst, technology adoption for operational efficiency and better risk selection, supporting its efforts to improve margins and future-proof the business in a competitive insurance sector.

Yet, despite all these operational advances, investors should keep in mind the potential for concentrated risk in AIG’s core segments following the divestitures…

Read the full narrative on American International Group (it's free!)

American International Group's narrative projects $31.3 billion revenue and $3.8 billion earnings by 2028. This requires 4.5% yearly revenue growth and a $0.5 billion earnings increase from $3.3 billion.

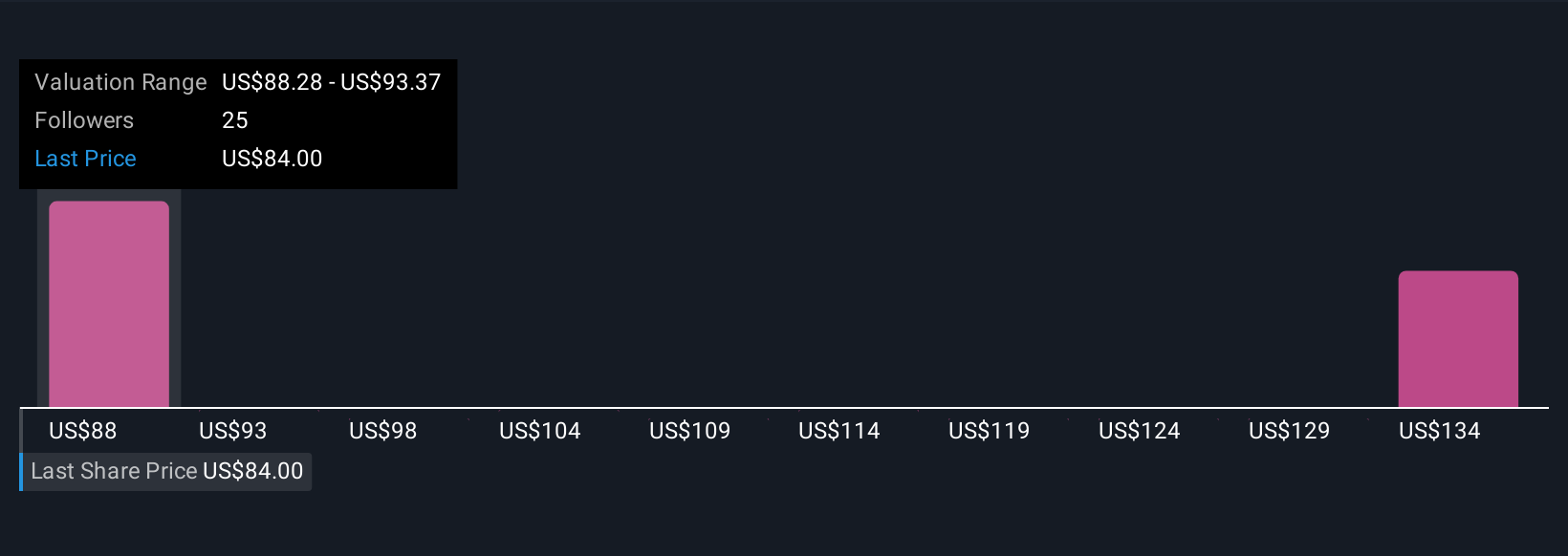

Uncover how American International Group's forecasts yield a $88.28 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community estimate AIG’s fair value between US$88.28 and US$137.96 per share. While opinions spread widely, the company’s divestitures have left it with a more focused but potentially riskier revenue mix, consider how these shifts may shape future results.

Explore 5 other fair value estimates on American International Group - why the stock might be worth just $88.28!

Build Your Own American International Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American International Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free American International Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American International Group's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIG

American International Group

Offers insurance products for commercial, institutional, and individual customers in North America and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives