- United States

- /

- Insurance

- /

- NYSE:AFL

Aflac (NYSE:AFL) Expands Empathy Partnership Offering Free Digital Legacy Planning Services

Reviewed by Simply Wall St

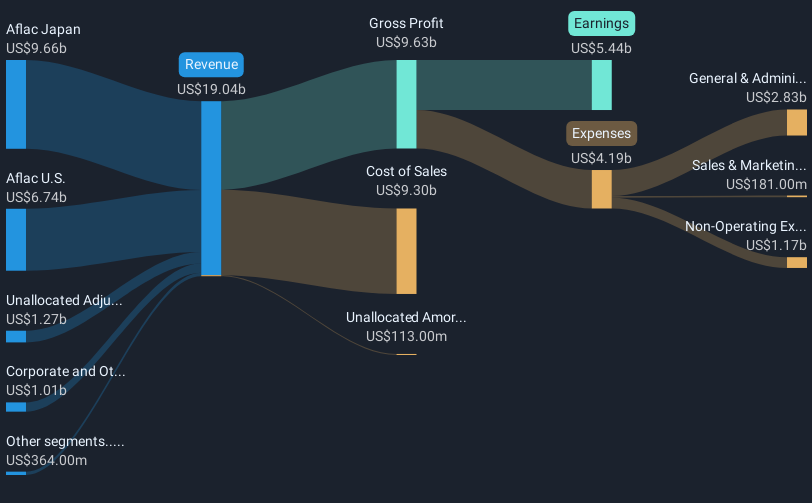

Aflac (NYSE:AFL) is expanding its partnership with Empathy to provide the LifeVault service at no additional cost to certain group term life insurance certificate holders, effective July 1, 2025. During the past month, Aflac's share price moved by 3.8%, an increase that likely adds weight to broader market trends, as the Dow Jones Industrial Average and S&P 500 rose modestly amid other mixed stock activities. Aflac's recent partnership announcement and dividend declaration of $0.58 per share provide a positive backdrop, though the company's first-quarter earnings reported significant declines in net income and earnings per share.

The recent partnership between Aflac and Empathy, along with the dividend declaration, could bolster investor confidence despite the challenges highlighted. Over the past five years, Aflac's total shareholder return was a very large 255.63%, including dividends, underscoring its long-term performance strength. For context, Aflac's stock price has done better than both the US market and Insurance industry over the past year, despite a notable 32.8% decline in earnings, surpassing the broader US market's 8.2% return and the US Insurance industry's 17.1% return. This suggests resilience even amid current headwinds.

In terms of potential business impacts, the partnership aims to enhance Aflac’s product offerings, which might support future revenue and earnings forecasts by addressing segment challenges, particularly in the U.S. dental and vision markets. However, external factors like yen-dollar volatility and commercial real estate uncertainty could still pose risks to revenue and credit quality. Currently, Aflac's share price of US$108.60 is about 2.9% above the analysts' consensus price target of US$105.54, suggesting the market might already be pricing in some of the expected future growth and risks enumerated by analysts.

The valuation report we've compiled suggests that Aflac's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AFL

Aflac

Through its subsidiaries, provides supplemental health and life insurance products.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives