- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Willis Towers Watson (WTW) Expands Japanese Team To Enhance Risk & Broking Services

Reviewed by Simply Wall St

Willis Towers Watson (WTW) announced significant changes recently, including the expansion of its Japanese Corporate Risk & Broking team, showcasing its commitment to the Japanese market. Over the last quarter, the company's stock moved 8.51%, which was aligned with generally strong market performance, where indices like the Dow had periods of gains. Key executive appointments and stronger Q2 earnings results may have supported this price rise, aligning with broader market trends expecting positive corporate earnings. Such developments enhanced the company's market positioning, adding to the weight of broader market momentum rather than countering it.

We've identified 3 weaknesses for Willis Towers Watson that you should be aware of.

The recent expansion of Willis Towers Watson's Japanese Corporate Risk & Broking team reflects its focus on strengthening its foothold in international markets. This strategic move aligns with ongoing trends in risk consulting, particularly in regions with complex regulatory and economic environments. As a result, it could potentially contribute to increased demand for the company's services, thereby influencing revenue and earnings forecasts positively. Despite the challenges outlined in the company's narrative, such as margin compression and market volatility, this development might help mitigate some risks by enhancing client retention and expanding market share.

Over the past five years, Willis Towers Watson's total shareholder return was 76.52%, as its stock demonstrated substantial growth, indicating a strong historical performance relative to the broader market. However, when compared to the US insurance industry's return over the past year, the company's performance exceeded the industry's 5.4% return, showcasing a resilience that may have contributed to investor confidence.

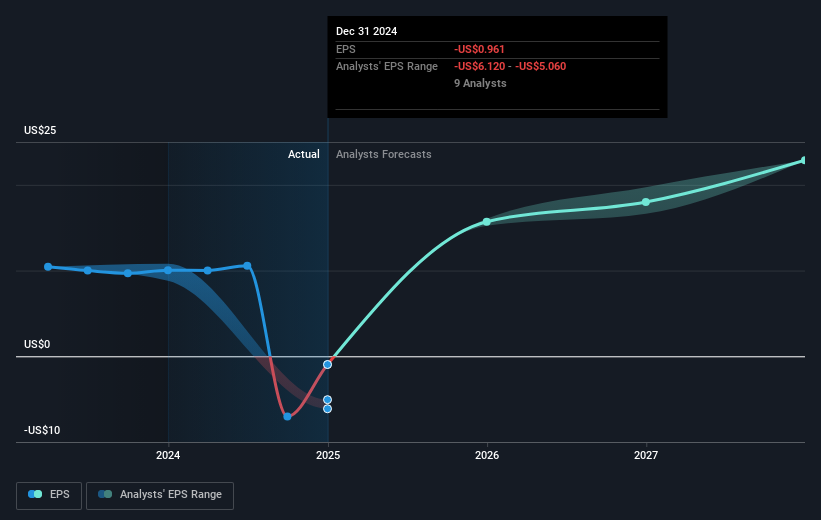

The current share price of US$339.25 shows a modest discount to the consensus price target of US$364.5. This suggests potential upside if analysts' growth forecasts materialize. The 8.51% share price appreciation in the last quarter is a reflection of positive market sentiment, potentially bolstered by key executive appointments and favorable earnings results. The ongoing developments, if executed well, could enhance Willis Towers Watson's market positioning and support its revenue and margin growth objectives in the coming years.

Dive into the specifics of Willis Towers Watson here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives