- United States

- /

- Insurance

- /

- NasdaqGS:WTW

How Gemini’s Launch and New Hires Could Shape Willis Towers Watson’s (WTW) Innovation Strategy

Reviewed by Simply Wall St

- Earlier this month, Willis Towers Watson announced the launch of Gemini, a digital auto-follow facility backed by A+ rated Lloyd’s syndicates, and unveiled several senior hires in its Insurance Consulting & Technology business.

- These developments underscore the company's focus on technology-driven insurance solutions and talent acquisition as key levers in enhancing client offerings and operational stability.

- We’ll explore how the rollout of Gemini could further strengthen Willis Towers Watson’s investment case through innovation in insurance capacity.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Willis Towers Watson Investment Narrative Recap

To be a shareholder in Willis Towers Watson, you need to believe in the company’s ability to leverage its specialist talent, digital platforms, and global client relationships to defend and expand its market share, despite competitive and margin pressures. The recent senior hires and the launch of Gemini may support key growth catalysts around innovation and client retention, but in the near term, they do not meaningfully alter the company’s most important catalyst, sustained demand for complex risk and advisory solutions, or its principal risk that increasing digital automation could commoditize its services and compress fees.

Among the recent announcements, the launch of Gemini, a digital auto-follow facility offering exclusive, discounted insurance capacity to Willis clients, directly aligns with the company’s push to drive productivity and enhance operational leverage through technology. This product is an example of how WTW seeks to capture incremental demand and defend its advisory margins, even as competition intensifies and the risk of commoditization rises.

Yet, investors should also watch for signs that rivals’ own technology investments could accelerate pricing pressure faster than Willis Towers Watson can adapt, exposing the business to...

Read the full narrative on Willis Towers Watson (it's free!)

Willis Towers Watson is projected to reach $10.9 billion in revenue and $2.5 billion in earnings by 2028. This assumes annual revenue growth of 3.7% and an earnings increase of about $2.36 billion from current earnings of $137 million.

Uncover how Willis Towers Watson's forecasts yield a $364.50 fair value, a 7% upside to its current price.

Exploring Other Perspectives

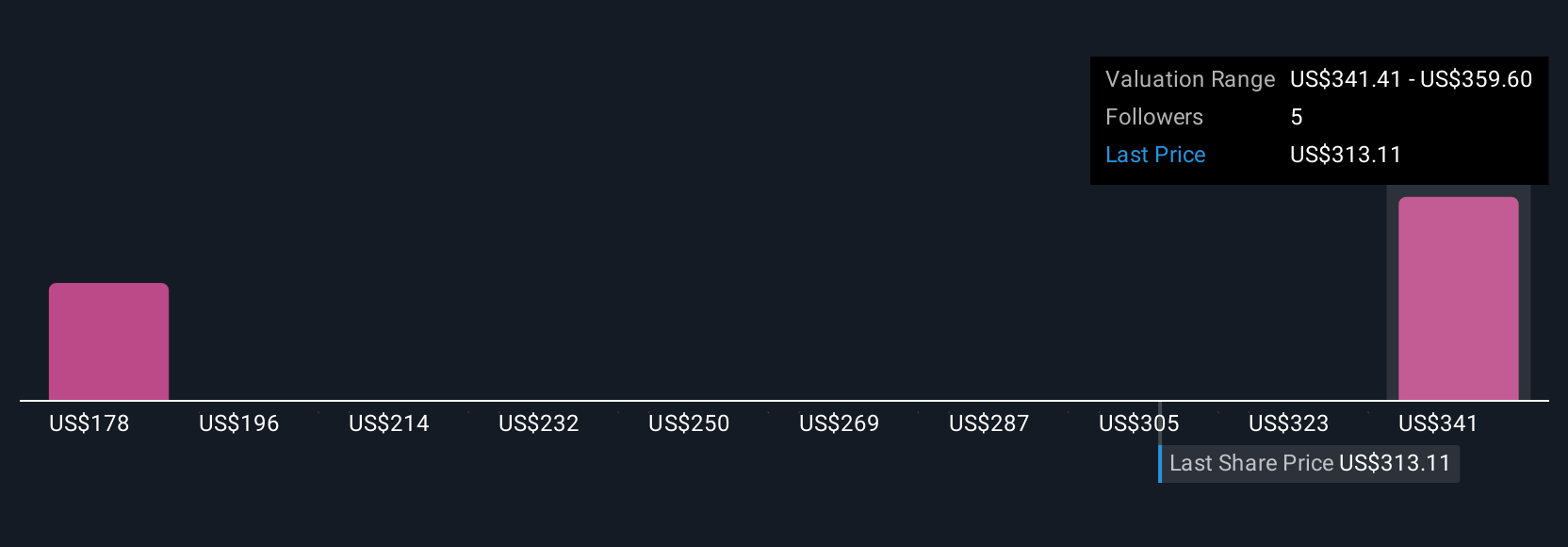

Simply Wall St Community members provide two fair value estimates for WTW ranging from US$364.50 to US$385.54. While views differ, many focus on whether technology-led innovation can truly offset the risk of client fee compression, making it vital to review multiple perspectives.

Explore 2 other fair value estimates on Willis Towers Watson - why the stock might be worth as much as 14% more than the current price!

Build Your Own Willis Towers Watson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Willis Towers Watson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Willis Towers Watson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Willis Towers Watson's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives