- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Do These 3 Checks Before Buying Willis Towers Watson Public Limited Company (NASDAQ:WTW) For Its Upcoming Dividend

Readers hoping to buy Willis Towers Watson Public Limited Company (NASDAQ:WTW) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. This means that investors who purchase Willis Towers Watson's shares on or after the 31st of December will not receive the dividend, which will be paid on the 15th of January.

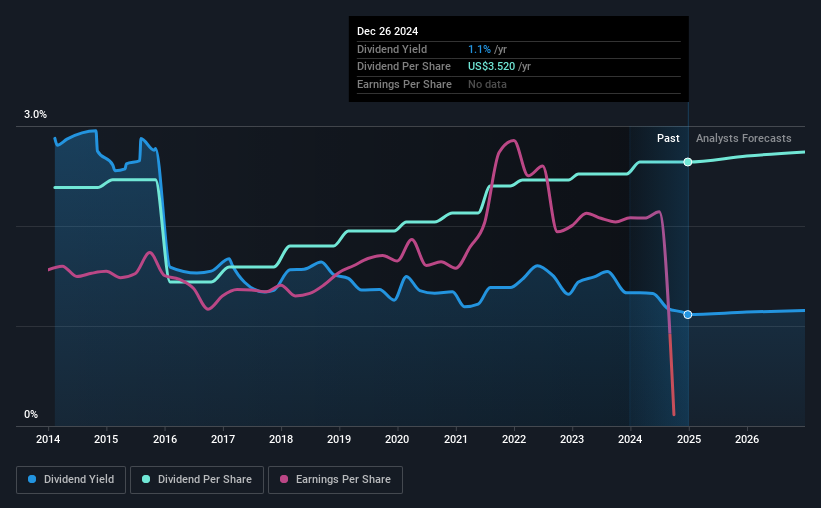

The company's next dividend payment will be US$0.88 per share, and in the last 12 months, the company paid a total of US$3.52 per share. Last year's total dividend payments show that Willis Towers Watson has a trailing yield of 1.1% on the current share price of US$316.03. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Willis Towers Watson can afford its dividend, and if the dividend could grow.

View our latest analysis for Willis Towers Watson

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Willis Towers Watson reported a loss after tax last year, which means it's paying a dividend despite being unprofitable. While this might be a one-off event, this is unlikely to be sustainable in the long term.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Willis Towers Watson reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Since the start of our data, 10 years ago, Willis Towers Watson has lifted its dividend by approximately 1.0% a year on average.

Remember, you can always get a snapshot of Willis Towers Watson's financial health, by checking our visualisation of its financial health, here.

The Bottom Line

Is Willis Towers Watson an attractive dividend stock, or better left on the shelf? It's definitely not great to see that it paid a dividend despite reporting a loss last year. Worse, the general trend in its earnings looks negative in recent times. These characteristics don't generally lead to outstanding dividend performance, and investors may not be happy with the results of owning this stock for its dividend.

Although, if you're still interested in Willis Towers Watson and want to know more, you'll find it very useful to know what risks this stock faces. In terms of investment risks, we've identified 1 warning sign with Willis Towers Watson and understanding them should be part of your investment process.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives