- United States

- /

- Insurance

- /

- NasdaqGS:UFCS

United Fire Group (UFCS) Earnings Soar 149.9%, Challenging Valuation Concerns

Reviewed by Simply Wall St

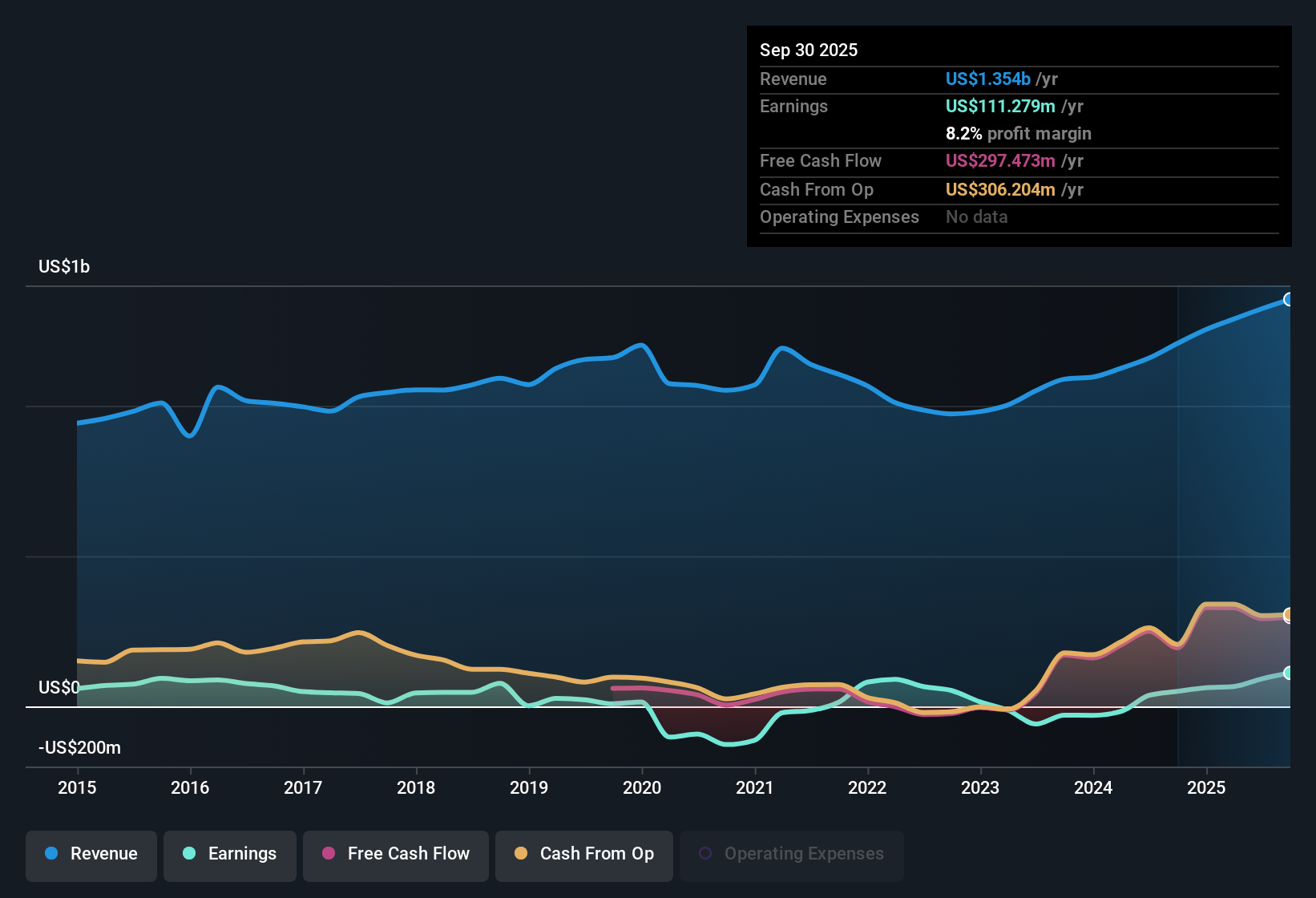

United Fire Group (UFCS) delivered eye-catching results this year, with earnings surging 149.9% from a year ago and outpacing its own five-year annual earnings growth rate of 40.1%. Net profit margins rose to 6.9%, up from last year’s 3.2%. This reflects a solid uptrend in profitability while the company continues to grow earnings at a strong compounded annual pace. Investors now face the prospects of continued growth, high-quality earnings, and improved margins, balanced against valuation concerns and the sustainability of its dividend.

See our full analysis for United Fire Group.Next, we’ll see how these reported numbers hold up against the most widely followed narratives on Simply Wall St, where some perspectives may be confirmed and others put to the test.

See what the community is saying about United Fire Group

Profit Margins Beat Industry Pressures

- Net profit margin has climbed to 6.9%, narrowing the gap with industry peers despite analysts predicting it could shrink to 3.2% over the next three years.

- According to the analysts' consensus view, ongoing climate-related catastrophe risks and higher reinsurance costs still threaten to erode these margins over time.

- Consensus notes rising compliance expenses and lagging technology adoption as long-term headwinds, which could drag on market position and profitability even as recent margin gains outperformed expectations.

- Heightened regulatory demands and investments to bolster reserves are expected to continue putting pressure on expenses and, ultimately, net earnings growth.

Consensus narrative suggests it remains to be seen if robust profit margins can withstand the sector’s long-term competitive and operational challenges. 📊 Read the full United Fire Group Consensus Narrative.

Growth Outlook Runs Just Below Market Pace

- United Fire Group's revenue is forecast to grow at 9.3% per year, lagging behind the broader US market forecast of 10.5% and the analyst estimate of 12.2% annual growth for the next three years.

- The consensus narrative highlights that, while investments in underwriting technology and disciplined risk selection are supporting stable premium growth, moderating rate increases and stiffer competition may limit UFCS’s ability to outgrow inflation in loss trends.

- Consensus emphasizes that recent premium retention and double-digit growth in core lines point to durable expansion, but persistent exposure to catastrophe losses and tightening reinsurance conditions could create volatility in net earnings and limit revenue growth.

- Despite these challenges, United Fire Group's record of stable business production and investment income has helped offset some of the sector’s revenue headwinds.

Valuation Metrics Signal Mixed Messages

- UFCS trades at a P/E ratio of 9.8x, higher than its peer average of 8.9x and beneath the industry average of 13.7x, but the share price of $35.44 remains far above the DCF fair value estimate of $3.37 per share.

- Consensus narrative states analysts have set a price target of $34.00, just 4.1% below the current share price, implying the stock is seen as fairly valued and suggesting muted near-term upside.

- While quality of earnings is considered high and UFCS is assessed as a good value by some metrics, the large gap between market price and DCF fair value underlines ongoing debates about long-term valuation and future growth assumptions.

- Investors are left weighing steady profit momentum against valuation concerns, especially given forecast declines in profit margin and questions around dividend sustainability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for United Fire Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think these figures tell another story? Shape your viewpoint by building a personal narrative in just a few minutes. Do it your way

A great starting point for your United Fire Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite UFCS’s robust profit margins, questions remain about valuation because the stock price far exceeds the discounted cash flow fair value and near-term upside appears limited.

If valuation gaps give you pause, use these 836 undervalued stocks based on cash flows to quickly zero in on companies trading more attractively compared to their underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UFCS

United Fire Group

Provides property and casualty insurance for individuals and businesses in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives