- United States

- /

- Insurance

- /

- NasdaqCM:TIPT

Shareholders May Not Be So Generous With Tiptree Inc.'s (NASDAQ:TIPT) CEO Compensation And Here's Why

CEO Jonathan Ilany has done a decent job of delivering relatively good performance at Tiptree Inc. (NASDAQ:TIPT) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 08 June 2021. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

View our latest analysis for Tiptree

Comparing Tiptree Inc.'s CEO Compensation With the industry

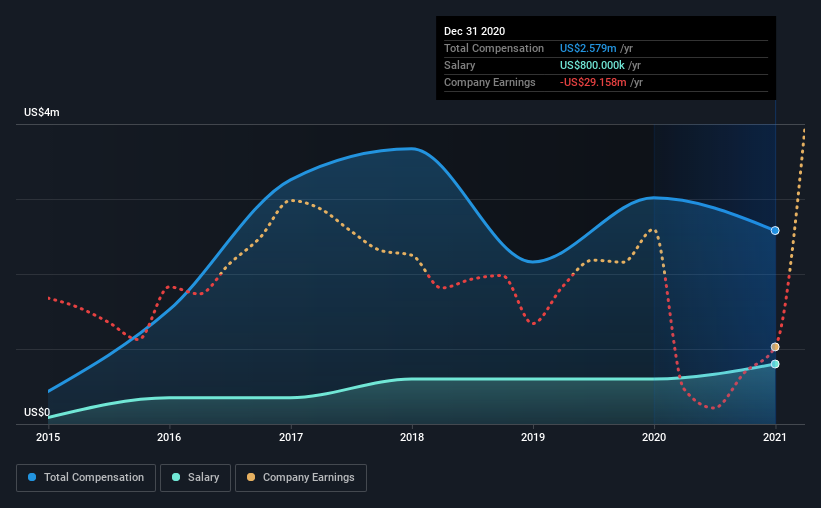

Our data indicates that Tiptree Inc. has a market capitalization of US$352m, and total annual CEO compensation was reported as US$2.6m for the year to December 2020. That's a notable decrease of 14% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$800k.

For comparison, other companies in the same industry with market capitalizations ranging between US$200m and US$800m had a median total CEO compensation of US$1.9m. Hence, we can conclude that Jonathan Ilany is remunerated higher than the industry median. Moreover, Jonathan Ilany also holds US$14m worth of Tiptree stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$800k | US$600k | 31% |

| Other | US$1.8m | US$2.4m | 69% |

| Total Compensation | US$2.6m | US$3.0m | 100% |

Speaking on an industry level, nearly 18% of total compensation represents salary, while the remainder of 82% is other remuneration. Tiptree pays out 31% of remuneration in the form of a salary, significantly higher than the industry average. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Tiptree Inc.'s Growth

Tiptree Inc. has reduced its earnings per share by 6.0% a year over the last three years. It achieved revenue growth of 38% over the last year.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Tiptree Inc. Been A Good Investment?

Boasting a total shareholder return of 73% over three years, Tiptree Inc. has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

The overall company performance has been commendable, however there are still areas for improvement. Until EPS growth picks back up, we think shareholders may find it hard to justify increasing CEO pay given that they are already paid above industry average.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 3 warning signs for Tiptree that investors should think about before committing capital to this stock.

Important note: Tiptree is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Tiptree, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tiptree might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:TIPT

Tiptree

Through its subsidiaries, provides specialty insurance products and related services in the United States and Europe.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026