- United States

- /

- Capital Markets

- /

- NasdaqGS:ETOR

US Market's Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

The United States market has recently seen a notable upswing, climbing 5.3% in the last week and achieving a 12% increase over the past year, with earnings expected to grow by 14% annually. In this environment, identifying stocks that offer potential for growth and resilience can be key to enhancing your portfolio's performance.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Central Bancompany | 32.38% | 5.41% | 6.60% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Innovex International | 1.49% | 42.69% | 44.34% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

eToro Group (NasdaqGS:ETOR)

Simply Wall St Value Rating: ★★★★★★

Overview: eToro Group Ltd. operates an online social trading platform providing various investment tools for capital markets, with a market cap of approximately $937.27 million.

Operations: eToro Group Ltd. generates revenue primarily through trading activity, which amounts to $12.52 billion.

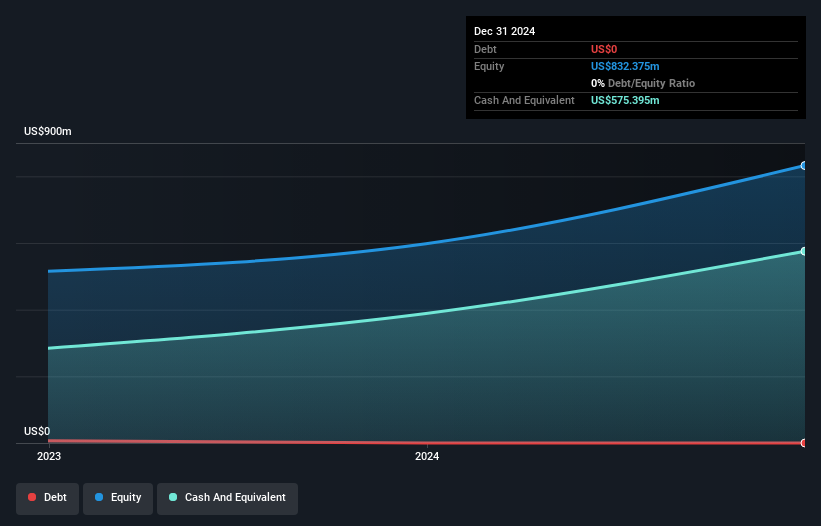

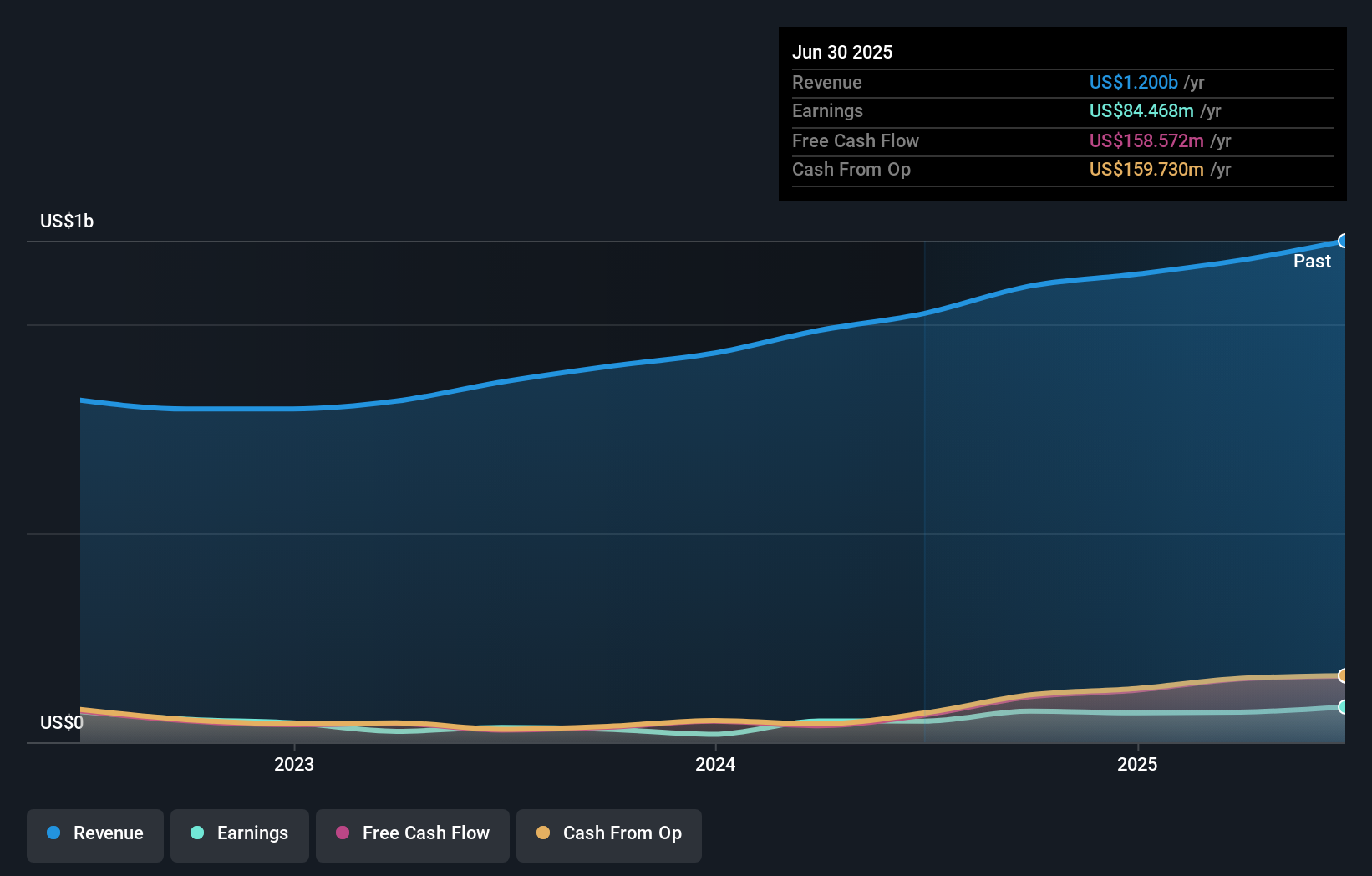

eToro Group, a rapidly growing player in the financial services sector, has made significant strides with its recent IPO raising US$620 million. Over the past year, eToro's earnings skyrocketed by 1160.8%, far surpassing the Capital Markets industry growth of 18.3%. This debt-free company is not only profitable but also boasts high-quality earnings and positive free cash flow of US$265.66 million as of 2024. Recent strategic moves include expanding its crypto offerings and launching a stock lending program in collaboration with BNY, enhancing its global footprint and diversifying revenue streams amidst an evolving market landscape.

- Unlock comprehensive insights into our analysis of eToro Group stock in this health report.

Evaluate eToro Group's historical performance by accessing our past performance report.

Safety Insurance Group (NasdaqGS:SAFT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Safety Insurance Group, Inc. operates in the United States, offering private passenger and commercial automobile and homeowner insurance, with a market cap of approximately $1.21 billion.

Operations: Safety Insurance Group generates revenue primarily from its property and casualty insurance operations, amounting to $1.15 billion.

Safety Insurance Group has been making waves with a notable earnings growth of 41.3% over the past year, outpacing the broader insurance industry's 5.3%. The company is financially robust, boasting more cash than its total debt and a reduced debt-to-equity ratio from 3.9 to 3.5 over five years, indicating prudent financial management. Its interest payments are comfortably covered by EBIT at an impressive 189 times coverage. Despite a historical decline in earnings of 21.7% annually over five years, recent performance suggests potential for continued positive momentum within this under-the-radar player in the insurance sector.

- Navigate through the intricacies of Safety Insurance Group with our comprehensive health report here.

Explore historical data to track Safety Insurance Group's performance over time in our Past section.

SandRidge Energy (NYSE:SD)

Simply Wall St Value Rating: ★★★★★★

Overview: SandRidge Energy, Inc. is involved in the acquisition, development, and production of oil, natural gas, and natural gas liquids primarily in the United States Mid-Continent region with a market capitalization of approximately $382.09 million.

Operations: SandRidge Energy generates revenue of $137.61 million from its activities in acquiring, developing, and producing oil, natural gas, and natural gas liquids.

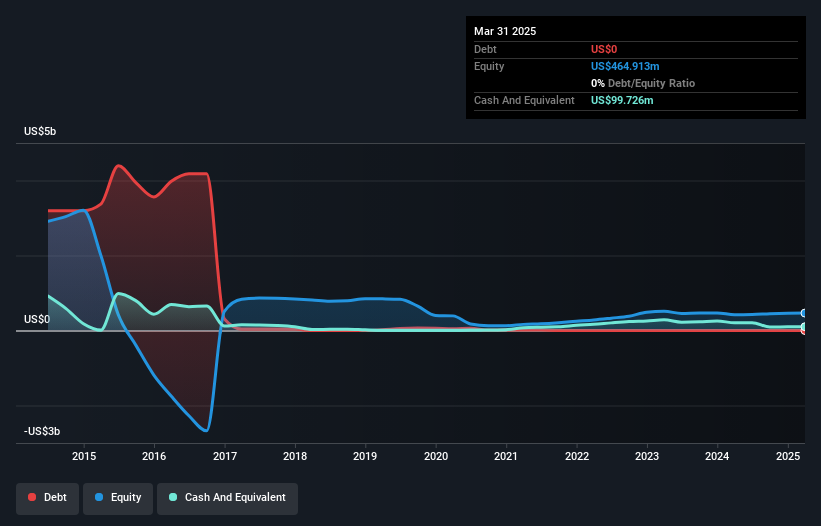

SandRidge Energy, a nimble player in the energy sector, has shown impressive financial health with a debt-free balance sheet and a solid earnings growth of 34.6% over the past year, outpacing the industry average. The company reported first-quarter revenue of US$42.6 million and net income of US$13.05 million, reflecting its competitive edge with a price-to-earnings ratio of 6.1x against the broader market's 17.9x. Despite not being free cash flow positive recently, SandRidge continues to focus on strategic acquisitions and optimizing production to enhance shareholder value while maintaining its dividend payout strategy at $0.11 per share quarterly.

Make It Happen

- Delve into our full catalog of 281 US Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade eToro Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ETOR

eToro Group

Through its subsidiaries, owns and operates an online investment trading platform, which is a social trading platform that offers a wide range of tools for investing in the capital markets.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives