- United States

- /

- Insurance

- /

- NasdaqGS:SAFT

There's A Lot To Like About Safety Insurance Group's (NASDAQ:SAFT) Upcoming US$0.90 Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Safety Insurance Group, Inc. (NASDAQ:SAFT) is about to go ex-dividend in just four days. Investors can purchase shares before the 4th of March in order to be eligible for this dividend, which will be paid on the 15th of March.

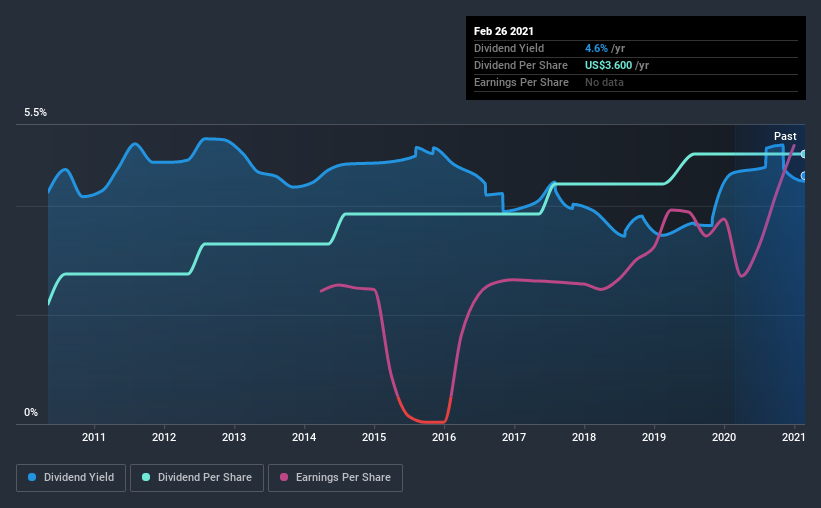

Safety Insurance Group's next dividend payment will be US$0.90 per share. Last year, in total, the company distributed US$3.60 to shareholders. Based on the last year's worth of payments, Safety Insurance Group has a trailing yield of 4.6% on the current stock price of $79.08. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Safety Insurance Group

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Safety Insurance Group paid out a comfortable 39% of its profit last year.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Click here to see how much of its profit Safety Insurance Group paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. That's why it's comforting to see Safety Insurance Group's earnings have been skyrocketing, up 22% per annum for the past five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Since the start of our data, 10 years ago, Safety Insurance Group has lifted its dividend by approximately 8.4% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

Final Takeaway

Should investors buy Safety Insurance Group for the upcoming dividend? Companies like Safety Insurance Group that are growing rapidly and paying out a low fraction of earnings, are usually reinvesting heavily in their business. This is one of the most attractive investment combinations under this analysis, as it can create substantial value for investors over the long run. Safety Insurance Group ticks a lot of boxes for us from a dividend perspective, and we think these characteristics should mark the company as deserving of further attention.

Curious about whether Safety Insurance Group has been able to consistently generate growth? Here's a chart of its historical revenue and earnings growth.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Safety Insurance Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:SAFT

Safety Insurance Group

Provides private passenger and commercial automobile, and homeowner insurance in the United States.

6 star dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives