- United States

- /

- Capital Markets

- /

- NasdaqGS:DHIL

Exploring Three Undiscovered Gem Stocks in the United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.2% drop, yet it has shown resilience with an 18% rise over the past year and earnings projected to grow by 14% annually. In this context of fluctuating short-term performance and promising long-term growth, identifying stocks with strong fundamentals and potential for future appreciation can uncover valuable opportunities in an investor's portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Diamond Hill Investment Group (NasdaqGS:DHIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Diamond Hill Investment Group, Inc., operating through its subsidiary Diamond Hill Capital Management, Inc., offers investment advisory and fund administration services in the United States with a market capitalization of $398.02 million.

Operations: Diamond Hill generates revenue primarily from providing investment advisory and related services, amounting to $145.80 million.

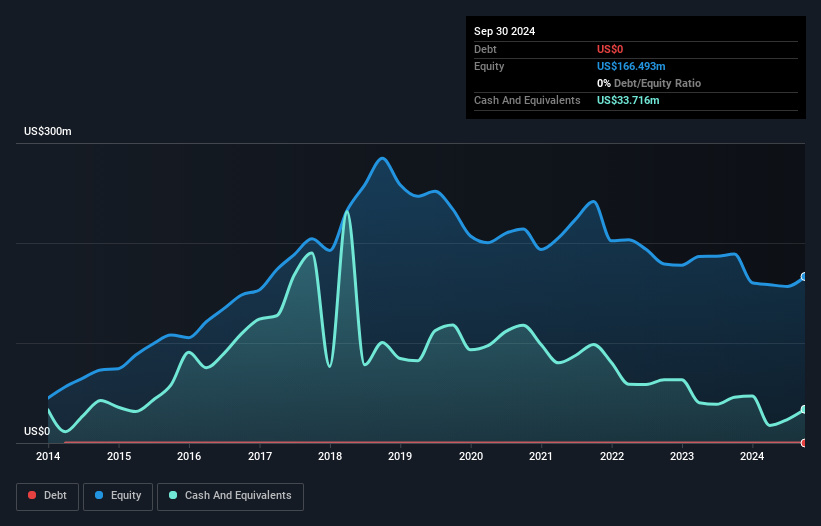

With a market position trading at 48.2% below its estimated fair value, Diamond Hill Investment Group offers an intriguing proposition for those exploring smaller financial entities. Despite a 1.1% annual earnings decline over the past five years, DHIL showcases high-quality earnings and remains debt-free, enhancing its stability in uncertain markets. The company has consistently generated positive free cash flow, with US$48 million noted recently, reflecting robust operational efficiency. While its recent 13.6% earnings growth lags behind the industry average of 16.7%, DHIL's lack of debt positions it well for potential future opportunities within capital markets.

Safety Insurance Group (NasdaqGS:SAFT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Safety Insurance Group, Inc. is a company that offers private passenger and commercial automobile, as well as homeowner insurance in the United States, with a market capitalization of approximately $1.15 billion.

Operations: Safety Insurance Group generates revenue primarily from its property and casualty insurance operations, amounting to $1.09 billion.

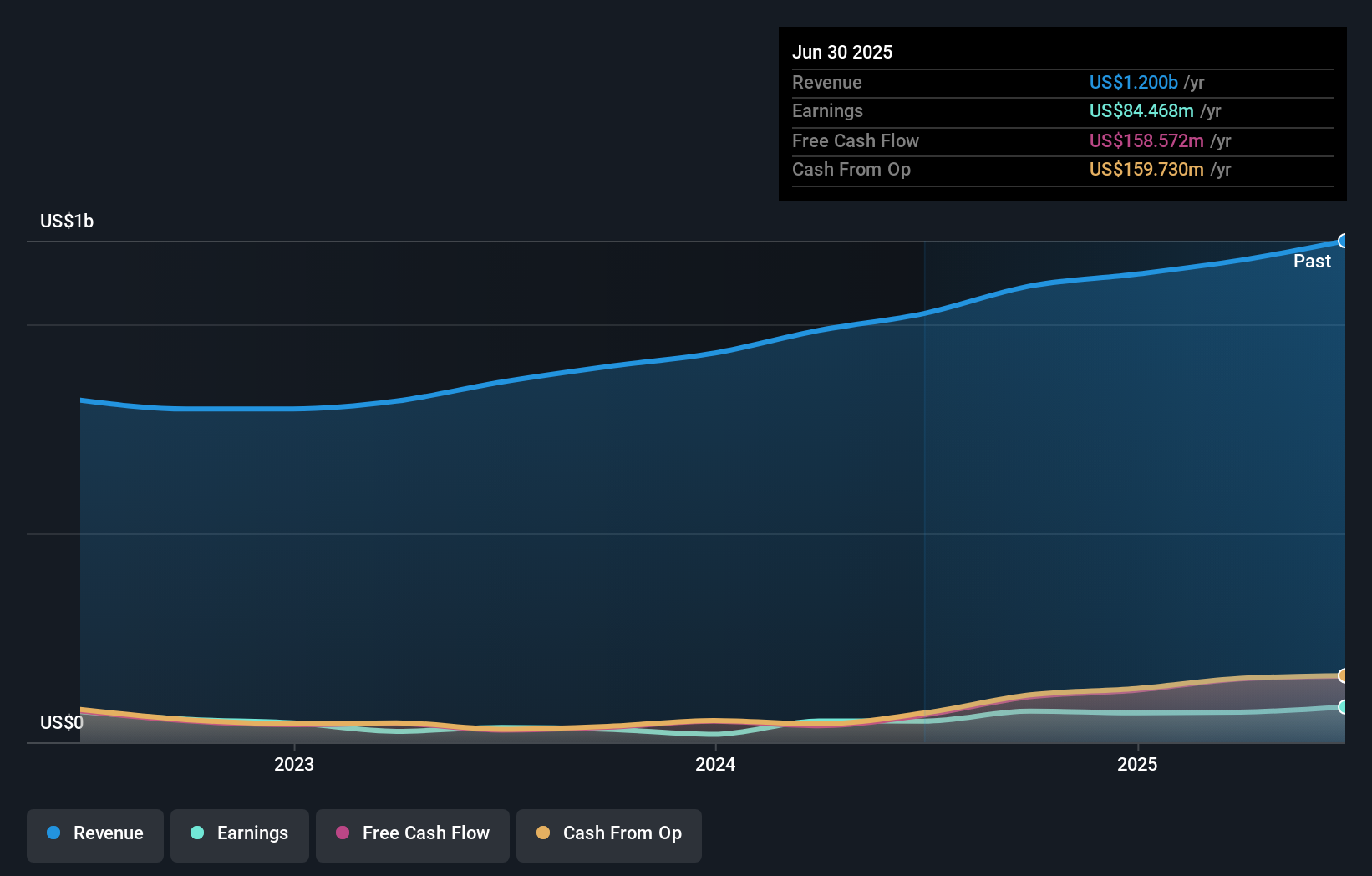

Safety Insurance Group, a small cap player in the insurance sector, has shown impressive earnings growth of 139.6% over the past year, outpacing the industry average of 32.2%. Despite a challenging five-year period with annual earnings declines of 20.8%, its current price-to-earnings ratio stands at 15.5x, offering better value compared to the US market average of 18.1x. The company's debt management appears prudent with more cash on hand than total debt and interest payments comfortably covered by EBIT at a multiple of 189.8x. Recently, it announced a US$0.90 per share dividend payable in March 2025, reflecting confidence in its financial health and future prospects.

Global Indemnity Group (NYSE:GBLI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Global Indemnity Group, LLC operates through its subsidiaries to offer specialty property and casualty insurance and reinsurance products on a global scale, with a market capitalization of approximately $493.31 million.

Operations: The company generates revenue primarily from its Penn-America segment, contributing $545.53 million, and Non-core Operations, adding $103.15 million.

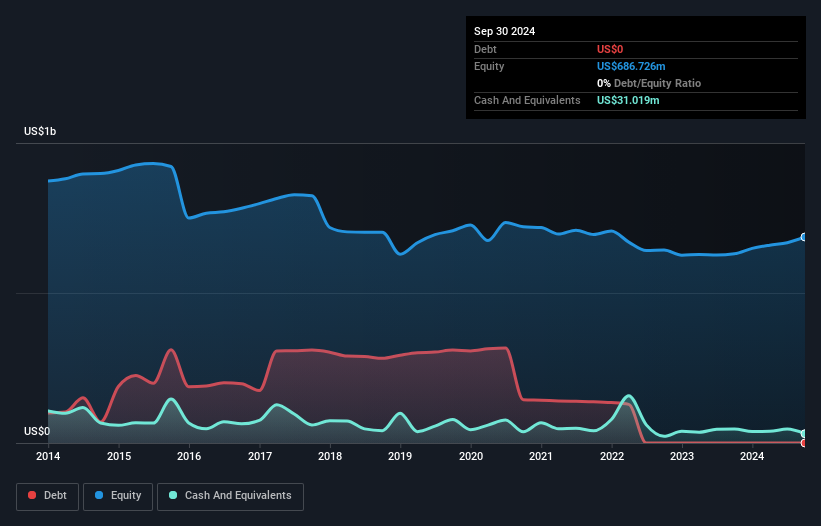

Global Indemnity Group stands out with its strategic reorganization, dubbed 'Project Manifest', aiming to boost operational efficiency and growth by restructuring business divisions and establishing distinct entities for technology and claims services. The company is debt-free, a significant improvement from a debt-to-equity ratio of 43.8% five years ago. It boasts an impressive earnings growth of 85.1% over the past year, far surpassing the insurance industry average of 32.2%. With a price-to-earnings ratio of 12.4x below the US market average, it offers strong value potential despite challenges like an expense ratio at 38%.

Seize The Opportunity

- Investigate our full lineup of 285 US Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DHIL

Diamond Hill Investment Group

Through its subsidiary, Diamond Hill Capital Management, Inc., provides investment advisory and fund administration services in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives